Day trading involves so many focuses and skill sets that it can be overwhelming at times to stay efficient and focused. Whether you are a beginner or a seasoned veteran, these 10 basic rules can help keep you on track for smarter day trading.

1) Do Your Homework

Preparation is the key. First and foremost, have an effective trading methodology in place. This can often times be a work in progress since true students of the markets will always be adjusting, improving and calibrating parts of a trading system.

Secondly, have a morning routine that incorporates devising a watch list of tradable stocks to monitor complete with trend, support and resistance data and trade trigger signals. Keep a news feed handy for your watch list stocks to understand the reasoning for any large gaps up or down.

2) Have a Plan

Each stock on your watch list should have a trading plan in place in the event a trade signal triggers. Your plan should include the triggers, targets and stops along with position sizing ahead of time.

Triggers can form from any combination of indicators. For example, a buy signal on a stock may trigger if the stock holds above the $115 price level for three consecutive 5-minute candle closes making higher lows and followed by a 5-minute stochastic cross up, with a stop-loss under the $114.30 support level for a target of $117.10 to $117.50 level. Stops can be indicator-based, price-based or a combination of both.

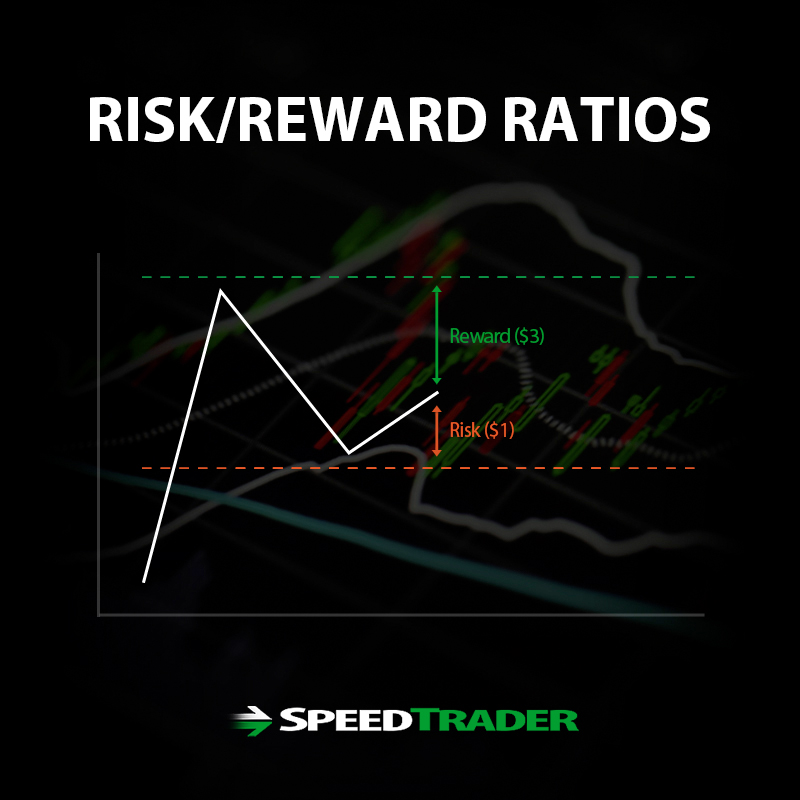

3) Focus on Positive Risk/Reward Ratio

Ideally, you want to maintain a 3:1 positive risk/reward ratio. This means you risk $1 for every $3 you plan to make. To assess proper risk/reward, you should be well aware of the support and resistance price levels. Generally, trades should be entered close to support price levels with resistance three times further away so that stop losses are small compared to trade targets.

4) Pay Attention to Broader Markets

As they say, a rising tide lifts all boats. This applies just as well to the stock markets. Most widely traded stock have a .70 beta meaning that the general market accounts for 70% of the daily price moves. When broader markets rise, most stocks tend to follow and vice versa. Many seasoned traders prefer to use lead indicator like the Standard & Poor’s 500 (S&P 500) index futures also known as the e-minis for an edge. As the term “futures” implies, these are a lead indicator for the broader markets. The S&P 500 ETF (NYSEARCA: SPY) also tracks the futures and is most easily accessible on any platform. If the SPY is trading down negative 2%, then you may want to limit holding long positions as they will very likely show weakness.

5) Never Go “ALL-IN”

The worst culprit of account blow-ups is going “ALL-IN” on a single trade or position. Usually, this involves maxing out the margin as well. Leverage cuts both ways, but in reality, it cuts much worse when you are on the wrong side of a position. Diversification among positions helps to spread the risk. Your watch list helps serve this purpose.

Remember that win percentage may be important, but that can all go over the window if you are reckless with the position sizing. As a general rule, larger position sizes should be accompanied with shorter holding periods and tighter stops.

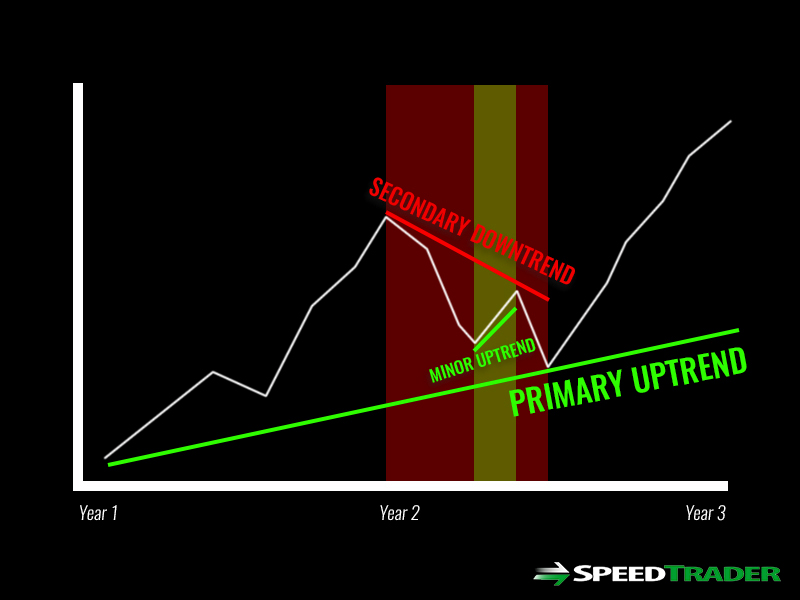

6) Focus on Trends and Avoid Speculation

Be conscious of your thoughts and actions throughout the trading day. While trading countertrend reversions can result in quick profits, you have to be disciplined enough to take profits or stop-losses in a nimble manner.

As the adage that the ‘trend is your friend’ applies in the market, be aware when you are fighting it. There is really no such thing as a stock being ‘up too much’. The key is not to let your own opinion blind you to what is actually happening with the underlying stock. Always be aware of the existing trend and the remaining upside compared to the downside.

7) Cut Losses

Capital preservation should be your top priority when trading. When in doubt, get out of the trade. Your ‘bankroll’ is the most important factor, which is responsible for your buying power, which is the lifeblood of a trader. Set daily maximum stop-loss amounts and stick to them religiously. Live to fight another day should be a core theme every morning going into the trading day. Markets are dynamic and the tradability can change from day to day. The only way to assure longevity is to make sure to cut losses diligently when the premises for the trade start to erode.

8) Know that Trade Ideas are Hypotheses Not Predictions or Bets

Only pull the trigger when you have all your ducks lined up with a solid, unbiased reason for the trade. As renowned mutual fund manager Peter Lynch states, “Know what you own and why you own it. ” You should be intimately familiar from a technical and fundamental aspect of your positions, especially swing positions. The trade idea is a hypothesis and the trade itself is simply an experiment. Let the data do the talking and react accordingly. It is perfectly normal to be wrong and take stops. Don’t let pride, ego or fear of missing out on a larger move prevent you from reacting to the reality of the trade.

9) Find and Develop Your Niche

The longer you trade, the more clarity you will find as to what types of trades or positions work well for your style and temperament. Don’t try to be a master of all types of trades. Focus on what you’re best at. Some traders are better suited towards scalping, which involved precision round trip trades with very little tolerance of risk. Some traders will feel more comfortable with swing trading. They don’t want to rush trades or micro-manage positions intra-day and prefer to give the trade more time to play out.

It’s important to find out what niche of trading products the most consistent gains for you. Once you find it, make sure to continue to be disciplined and work on adjusting or calibrating the methods to ensure they remain robust moving forward. This is always a work in progress. Don’t let the cliché “Jack of all, master of none” apply to you. Never spread yourself too thin.

10) Learn From Experience

Day trading is unlike any other endeavor. Whereas most jobs and training programs are structured with parameters and rules you are obligated to follow, day trading virtually has none. The reality is that you must set the parameters and stick to them. With every error or mistake, take the time to learn from the experience. Some days, the market may be very tight with untradeable ranges that get no follow through. The very next day could be a robust trending market that provides excellent entries and exits on large oscillations. You become a seasoned trader though experience. Learn from every trade and always continue to improve your trading methods and strategy.