What is a Direct Access Broker?

A direct access broker is a specialized brokerage that allows the user to directly route their orders to specific electronic communication networks ( ECN), market makers and exchanges. The broker provides advanced trading platforms that focus on optimizing speed; access and execution. Theses brokers cater to active traders who value fast access to liquidity and precision executions.

Differences from Conventional Online Brokers

Conventional online brokers usually direct customer trade orders to centralized trading desk that routes to the firm’s own market makers or other pre-determined liquidity providers through pre-negotiated order flow arrangements. The platforms tend to have a higher concentration on research and fundamental analysis functions over execution. These brokers cater to self directed investors and retail swing traders.

What to Look For When Choosing One

There are three aspects to consider when choosing a direct access broker: pricing, platform and routing.

Pricing: Most direct access brokers offer a sliding scale per-share pricing model. This means you pay only for the shares you trade. The more volume you trade, the deeper your discount can be. Typical rates start at $0.005 per share (SpeedTrader offers rates as low as $0.009 per share). This allows for economical and effective scaling into an out of positions, as opposed to paying a flat rate per trade commission with conventional online brokers. Since most direct access brokers are smaller firms, they can work with their clients to negotiate even steeper discounts with larger trading volume. For active traders that trade large size trades, many direct access brokers will also offer a discounted per-trade fee, which may be more economical for traders who tend to place block trades.

Trading Platforms: Direct access brokers offer highly specialized trading platforms either developed in-house or licensed through third parties or a combination of platforms. Direct access platforms have a multitude of features including hot keys, programmable routing modules, programmable scanners and algorithm capabilities. Many brokers also have algorithmic routing that will search out the best routes on behalf of the user.

Routes: Access to more routes ensures access to more liquidity. Having liquidity when it’s needed is top priority for active traders. A direct access trader can target specific ECNs, exchanges and access dark pools to snatch liquidity immediately, while the conventional online broker trader is limited to the liquidity supplied by the broker’s preferred liquidity providers. The difference in trade fills can be substantial especially in volatile markets and stocks. Many ECNs also allow for hidden or reserve orders, which allow the trader to hide or cloak the true size of the order. This can be invaluable to traders who want desire to hide their transparency and minimize market impact. It’s important to note how many different routes are provided by the direct access broker. The best direct access brokers will offer access to at least 8 different routes.

Role of Trading Software

The trading software/platform is the essential tool that allows the users full control of their trading activity. These are usually downloaded from the broker site and installed as standalone programs. However, many direct access brokers also provide browser based platforms as well as mobile platforms for added convenience. The user has the flexibility to arrange his workspace, program hot-keys, set-up preferred routing, charts and scanners as needed. The trading software usually has a monthly fee but can be waived when a minimum monthly volume or commission level is reached.

Who Should Use Direct Access Brokers?

Direct access brokers cater to a very specialized user base. Active traders who are well versed in order routing, liquidity and precision fills benefit the most. High volume algorithmic traders benefit from the speedy executions and access to various liquidity providers, including dark pools, ECNs, exchanges and broker-dealer networks.

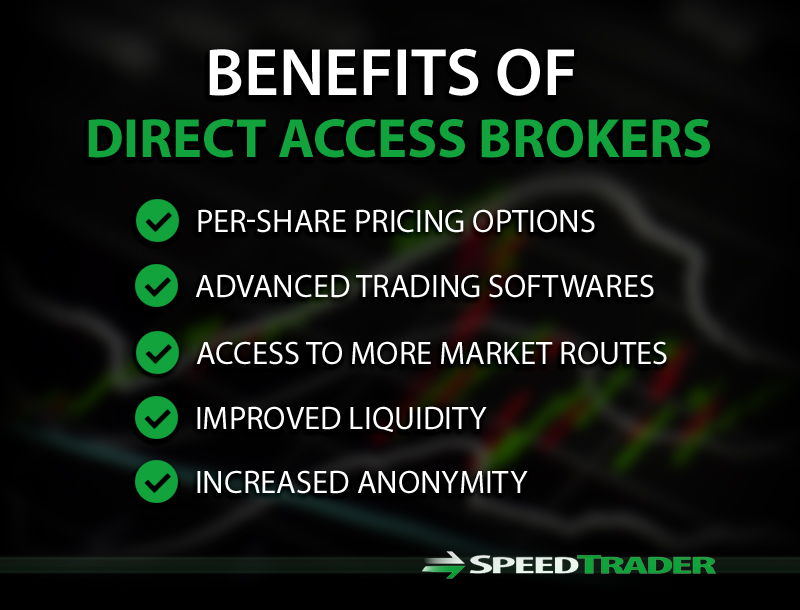

Benefits of Direct Access Brokers

There are many benefits using a direct access broker, especially for active traders. The quickest path between two points is a straight line. This sums up direct access trading in a nutshell.

- Direct access brokers have superior speed of execution.

- Direct access brokers pass the rebates back to the users when they provide liquidity, whereas conventional online brokers may keep these.

- Since the orders are routed directly to liquidity providers, there are no middlemen that can delay the fills or limit liquidity. Centralized trading desks can often trade against your order to provide liquidity. For example, you Buy 5,000 Shares of XYZ, the broker will lend you the 5,000 shares short and then attempt to cover it back in the market at a lower price. This is legal but doesn’t sit well with many traders.

Example of Liquidity

It is often said that liquidity overrides price. This is true especially when prices move quickly due to volatility or thinner market trading climates. Liquidity provides the means to turn a paper profit into cash profits.

For example: Let’s say two traders are Long 2000 shares of XYZ at 26.10.

- Trader A is using a direct access broker

- Trader B is using a conventional online broker

They both want to sell their position, as XYZ is climbing showing a 26.29 x 26.30 bid/ask.

Trader A routes his order directly to Sell 2,000 shares of XYZ through EDGEX at 26.29 and gets filled immediately.

Trader B places his order to Sell 2,000 shares at 26.29 Limit but the stock peaks out at 26.30 and the bids evaporate back to 26.21 x 26.25 quickly. Meanwhile, his order 2000 share Limit Sell order is stuck at 26.29.

The stock upticks back to 26.27 x 26.28. Trader B cancels his old limit order and places a new limit order to sell at 26.27 on the bid. As soon as he confirms the trade, the bids evaporate again back down to 26.22 x 26.27 bid/ask.

Trader B can’t help but feel frustrated that his orders are just not hitting liquidity at the desired price. As XYZ downticks to 26.17 x 26.21, Trader B panics and places a Sell 2,000 share Market Order of XYZ. This further causes the bids to drop as he gets filled at 26.15 for 2,000 shares. Trader B feels a bit relieved as it downticks to 26.10 x 26.12 before surging back to 26.22 x 26.25.

What Trader B doesn’t realize is that by placing his full size order on level 2, the bids back off as the algorithms sense a desperate seller. By constantly lowering his Sell Limit price; he inadvertently (and sloppily) creates a market impact causing the bids to evaporate until he finally throws in the towel with a Market Order. The algorithms can spot this like a wounded animal and will work to panic out the participants. As soon as the panic sellers are gone, they mark the price back up.

Trader B was at a disadvantage in many ways. First he was not able to place a reserve or hidden order to cloak his size when the stock was down ticking. Secondly, he was only able to access the liquidity that his broker provided, which was limited at the time. Remember, markets are not static. The supply and demand is always dynamic. Lastly, his execution attempts were slow because of the limited access to only the online broker’s liquidity providers. In the end, the difference was $0.14 in profits ($280) between Trader A and Trader B. This type of action is a common occurrence in the age of electronic trading. Liquidity overrides price. Access to liquidity is one of the most important benefits of direct access trading.