Frequently Asked Questions

Account Opening

How do I open a trading account?

Please visit our Open an Account page and fill out the online application or choose to fill out the form offline.

Do you accept foreign clients?

Please contact us regarding policies for accepting accounts in the following countries: Australia, Austria, Belgium, Denmark, EEA (European Economic Area), Germany, Hong Kong, Italy, Japan, Luxembourg, Netherlands, New Zealand, Singapore, Spain, Sweden and the United Kingdom.

How will I know when my trading account has been approved?

Do you offer a practice online trading account?

Yes. You can request a free, virtual practice account with virtual buying power. You can then download our online trading software and login using your credentials. Just email us at [email protected] or call us at 845-531-2487 to get started. -line-

Is there a minimum requirement to open an account?

The minimum for the SpeedTrader Pro platform is $10,000 and $2500 for the Active Web platform. A MINIMUM DEPOSIT OF $30,000 IS REQUIRED FOR US AND FOREIGN CLIENTS TO DAY TRADE. SPEEDTRADER ACCEPTS APPLICATIONS FOR MARGIN AND OPTION ACCOUNTS ONLY. NO CASH ACCOUNTS ACCEPTED – Accounts that fall below the required minimum will be subject to certain restrictions, and additional funds may be required. SpeedTrader does not currently offer debit card and/or checking accounts.

Commissions

Can I change commission plans?

If I am on a per-share rate (Plan B) how much will the commission be to buy 100 shares?

Trading Software

Do you offer a free trial of the DAS Trader trading software and platform?

Yes, click DAS Trader Demo or the “Try Demo” button on the upper right-hand side of this page and complete the form. We will email you instructions for a 14-Day free trial of the SpeedTrader Pro/DAS Trader platform. Be check your spam filter.

Is it problematic to change software plans or data plans?

What can I trade with your firm?

What can I trade with your firm online?

Are there any share limitations?

Can I enter a GTC Order?

Good Til Cancelled Orders (GTC): It is the client’s responsibility to review all open orders daily, especially GTC (good till cancelled) orders. The order management system does not have the capability, at this time, to send the orders as GTC. Orders entered as GTC on the software are actually system held as DAY or DAY+ orders that are saved by the system each night and then replaced each morning. You should know that certain routes do accept GTC orders: those orders are sent as Day+. If you believe you had an order that for some reason is not showing on your software or have any other issues or problems with any order(s) you must contact SpeedTrader immediately. You are responsible for the daily review of your open orders. Any issues caused by your failure, as a client, to conduct this review and/or to contact SpeedTrader, in a timely manner (within 10 calendar days) of discovery to resolve any discrepancies will be solely the client’s responsibility. Also please note that you alone are responsible for any orders placed in your account or through your user and the resulting executions from those orders. GTC orders that remain on the software for more than one day cannot be reduced or increased, in the event of a corporate action; such as for ordinary dividends. It is the client’s responsibility to monitor GTC orders and act accordingly, in the event, a corporate action has been announced. The software company is in the process of re-coding and testing the system to allow GTC orders. Clients will be notified in advance of any changes

Can I Trade Master Limited Partnership (MLP) stocks with SpeedTrader?

Short Requests

How can I check if a stock is shortable?

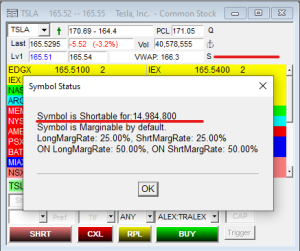

On the SpeedTrader Pro/DAS Trader trading platform, look at the top right corner of the Level 2 Trading Montage. If there is an “S” directly under the anchor, the stock is shortable. Click on the “S” area and the following pop up will appear.

How can I request a short that is not on the trading software?

Security and Protection

Is my online trading account insured?

For accounts at Axos Clearing – Axos Clearing’s policy with Lloyd’s of London (www.lloyds.com) provides additional account coverage up to $99.5 million. With the combination of SIPC coverage and Lloyd’s of London insurance, accounts held by Axos Clearing are protected up to a total of $100 million per client, including up to $1.15 million for cash balances with an aggregate limit of $100 million.

Funding and Banking

How do I fund my trading account?

How do I transfer my account from another broker?

Stock Certificates

Can I deposit stock certificates?

Currently we do not accept deposit of stock certificates. You may however, ACAT transfer stock certificates, for listed stocks only, from another broker/dealer. For more information or instructions, please contact [email protected] or call customer service at 845-531-2487.

Do you accept Restricted Stock Certificates?

Restricted securities are accepted for publicly traded companies on a case by case exception basis only. All restricted securities must be eligible to be sold under Rule 144. For more information or to request a review and/or exception, please contact [email protected] or call customer service at 845-531-2487.

Ready to Get Started?

Start your application and fund an account today!