If you’ve been around trading long enough I’m sure you’ve heard the phrase, “90% of all traders fail”, thrown around at least once. While it’s difficult to prove that this is pure fact, it has nonetheless gained enough traction such that it is generally accepted by a fair amount of people in the community. Below, I will share my thoughts on why I feel traders struggle and some tricks to help you become part of the elite group of profitable traders.

For the purpose of this blog, I will focus more on the intangibles as I feel points such as, ‘not having a plan’, ‘not sticking to your plan’, or ‘not being adequately prepared’ have been touched up on enough times already by many others.

So What Causes Traders to Fail?

Focus Too Much on the Technical Aspect Instead of the Psychological Aspect

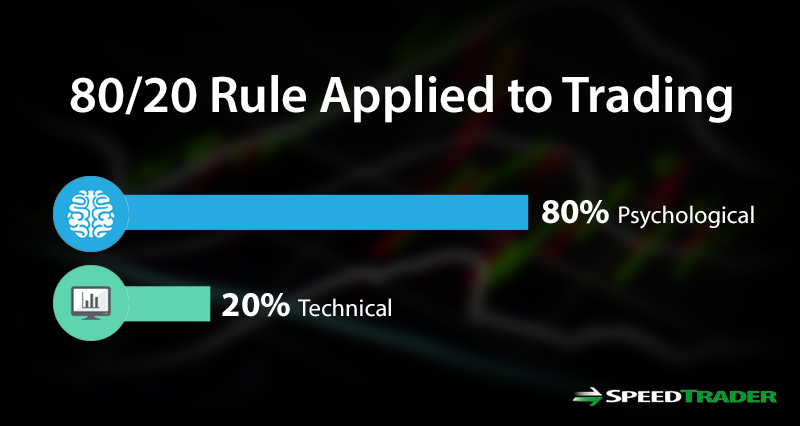

I’ve always been a proponent of the belief that trading is mostly psychological rather than technical. I’m sure you’ve heard of the 80/20 rule. I feel that it applies here as well with 80% of trading being psychological and only 20% being technical. If trading were as simple as memorizing chart patterns and learning some fancy indicators, you would think that more than 10% of people that attempt it would succeed, wouldn’t you? Memorizing formulas is something that you can get away with on a college math exam, but not in trading where emotions are constantly involved in every decision we make. As a result, having a very strong psyche is absolutely mandatory. Anyone can study very hard and learn what a head and shoulders pattern is or what MACD is, but very few actually end up developing the proper mindset to succeed in this game.

Having Unrealistic Expectations

I’ve seen it time and time again. Lots of new traders enter the game thinking that things will be easy or that they will get rich quick. If you’ve been trading long enough to survive past the first year or so, you will know that trading is anything but easy and that there’s a lot of blood, sweat, and tears that you have to put in to finally reach the top. If you think trading is an easy, get-rich-quick scheme, you’re setting yourself up for some serious disappointment.

Allowing Ego or Stubbornness to Get in the Way

As human beings, we know how hard it is to admit when we’re wrong about something. We have built in defense mechanisms that kick in when we’re put in compromising situations, such as making excuses or blaming our faults on some other external factors. If this is a habit of yours, be prepared to drastically overhaul the way you approach this, because failure to do so will almost certainly result in a very short trading career. As traders, we will often have to split second decisions to take losses in order to prevent them from ballooning into catastrophic ‘blow-ups’. In order to do this, you have to be able to set your ego aside and swallow your pride, which is something that, unfortunately, most people have trouble with.

So What Are Some Tricks That Ensure That I Succeed at Trading?

Keeping a Trading Journal/Log

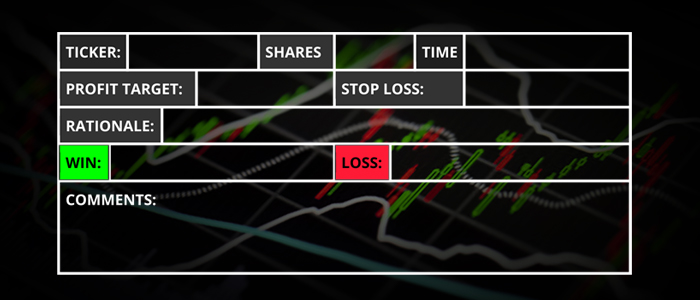

If you’re already doing this, good on you! You’re either already a consistent trader or you’re on your way there. Ever since I started doing this about 2 years ago, I realized I was a fool for not doing so from the start of my trading career. Keeping a daily trading journal or log is crucial to recognizing patterns, both positive and negative, in your trading and will help you clearly see what is working and what isn’t. Keeping a trading log has allowed me to eliminate tons of bad habits and, as a result, probably saved me thousands upon thousands of dollars.

Log your daily profit/loss along with some notes as to why you made or loss money that day. You can add some other metrics such as average gain on profitable days, average loss on unprofitable days to help you determine, for example, if you’re selling your winners too early and letting your losers amplify uncontrollably. I can’t stress this enough, keep a trading journal. Every top trader I know does this, and you should too.

Building Positive Trading Habits in your Life Outside of Trading

Like I mentioned above, I feel that the psychological aspect of trading greatly outweighs the technical aspect. Therefore, I believe that we should focus developing these intangibles to help aid us in our journey to the top of the trading pinnacle. As we know, some of the psychological skills we need to possess are, but not limited to: strong discipline, open-mindedness, systematicness, and decisiveness. The best way to develop these skills is to do it in our everyday lives, when we’re not trading. Yes, that’s right, you can get better at trading, even you’re not trading or doing anything trading related.

Are you the type of person that tells yourself that you will go on a diet and will resist the temptation to cheat and splurge on double cheeseburgers and chocolate milkshakes or are you the person that adheres to your plan and will do whatever it takes to achieve your goal? Are you the type of person that takes charge and plans what you are your buddies are going to do, or you the type of person that just takes a backseat and waits for someone else to do it? Are you the type of person that is willing to try some new ethnic food even if it has a funny name that isn’t so appetizing?

You get the idea, if you’re a discipline, open-minded, systemic, and decisive person in real life, chances are when it comes to trading, the same mindsets will carry over and you will have a huge advantage over the people that don’t have it.

Maintain a Balance in Your Life with Trading and Non-Trading Activities

This point goes along with the point I just made above. I often see people spending their nights and weekends doing nothing but trading-related activities, which is fine. If you’re new and trying to absorb the myriad of information in the trading world, by all means, you should definitely do that. But in the long run, I feel that in order to develop that proper mindset that is optimal for trading we need to achieve a balance in our life by doing things that make you happy, which in turn will allow you to bring a more positive mindset when you’re actually in front of the screen ready to fire off those profitable trades in the morning.

Convergence of balance and harmony is a recurring theme and pattern that we see everywhere. For example, in biology and ecology we see this with homeostasis, and in economics we see this with equilibrium, so, logically, we should not deviate from what is natural. For me personally, after the market closes, I spend a few minutes to do my technical analysis for the next day and then I shut off everything trading related and do other things like exercise, go outside for some fresh air, spend some time with a few friends, or some other hobby. I also don’t do anything market related on the weekends aside from Sunday night. Since I’ve been doing activities that are stimulating or refreshing for my mind and in general make me happy and enjoy my life to the fullest extent, this helps me maintain a healthy and positive attitude that I can carry over into the start of my trading week on Monday.

I hope these points shed a light about my approach to trading and how some of the things I do can help you work towards your goal of becoming part of the group of consistently profitable traders. Cheers!

About Madaz

Madaz is a full-time trader with over 5 years of trading experience, having ventured in the world of trading right when he graduated from college at the age of 22. He finally decided to leave his job as a structural engineer behind 2 years ago and made the leap into full time trading and has never looked back since. He mainly focuses on the scalping approach to day trading and trades all types of stocks from small caps to large caps and ETFs. He also makes free educational videos including examples of his live trades on his YouTube channel, www.youtube.com/madaztrader.

For more information on Madaz, follow him on twitter @madaznfootballr and his blog at http://madazmoney.blogspot.com