As traders, we are often focused on finding good setups and placing trades accordingly. Many traders don’t put too much thought into what happens after they press the “Buy” or “Sell” button. That said, order routing can have an impact on your executions speed, fills, and overall profitability.

What Happens After You Place a Buy/Sell Order?

Marketable orders are meant to execute immediately in the form of a market order or a limit order where a set limit price is specified. Traditionally, when you place a marketable buy or sell order online, it is immediately sent out to various destinations in an effort to match and fill the order.

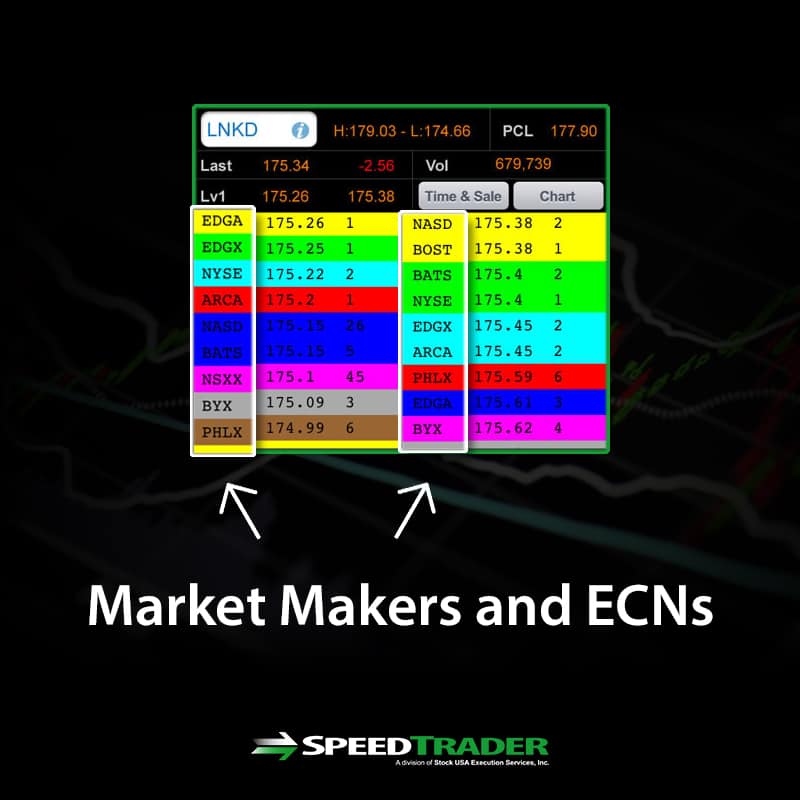

Market makers are broker-dealers that commit their own capital to fill customer orders. Discount and Full-service brokers will direct client orders to their own market makers or outsource to specific market makers under pre-arranged order flow agreements. Stock exchanges have order books that will automatically match up orders through a specialist or market maker. Alternative trading systems (ATS) are composed of various electronic communication networks (ECNs) and dark pools that provide an order book for market participants to compete for fills.

Routing Options

Most beginner and intermediate traders tend to use the default simple electronic routing through their brokers. Every broker has an internal default routing system, which may include preferential order flow agreements with various market makers. The order flow deals may potentially limit liquidity and increase costs, so it’s best you are aware of them.

While using the standard routing that is determined by the brokerage’s platform is sufficient for swing traders and passive investor, it is recommended you get acclimated to manual routing if you are using a direct access online broker. Direct access routing puts you in control to get the best and quickest liquidity as well as earn potential commission rebates.

Types of Routes

There are three types of routes for a buy and sell order. All routes display their best bid and ask/offer through level 1 quotes. All exchanges are required to comply with the National Best Bid Offer (NBBO) also known as the “inside” price. When you look at a stock quote, you will see a last price, bid and ask (also known as offer) with a share size indicating how many shares are available.

National Best Bid Offer (NBBO)

For example, if you’re looking at a stock, the level 1 NBBO quote may appear like this:

Last Trade: $118.10 Quote: $118.08/500 x $118.10/1,000

This inside bid is $118.08 for 500 shares and inside offer is $118.10 for 1,000 shares.

If you want to immediately buy shares of this stock, you can purchase up to 1,000 shares at the ask/offer for $118.10. If you already own shares and wish to sell them, you can immediately sell up to 500 shares at $118.08 on the bid.

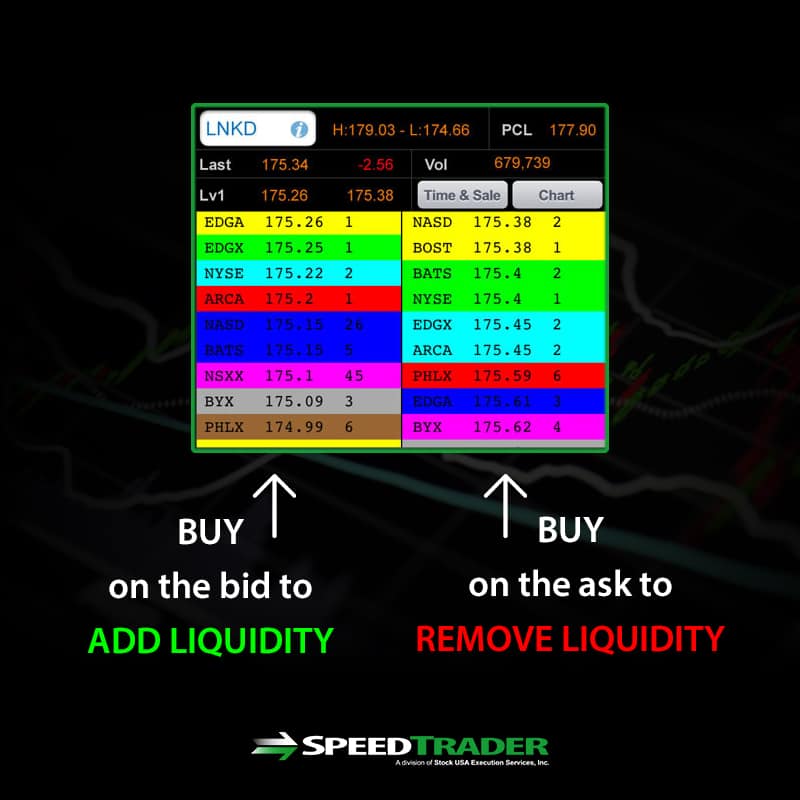

Liquidity Taker or Provider

Either of these trades where you buy at the ask/offer or sell at the bid is considered taking liquidity. However, if you are more patient and willing to wait for a better price by placing a limit order to buy at $118, then you are providing liquidity to other sellers. Vice versa, if you are long and place a limit sell order at $118.25, then you are a liquidity provider to the buyers. When you place a limit trade order outside of the NBBO, then you become a liquidity provider. When you place a limit or market order that fills at the NBBO also know as the “inside” bid/ask, then you are in essence taking liquidity out of the market.

Electronic Communications Networks (ECNs)

Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. The purpose is to cut out the middleman (market makers and specialists) and let the buyers and sellers deal between themselves, a true natural market. Some of the most popular ECNs have become actual exchanges like Archipelago NYSE (ARCA), BATS, EDGE, INET/ISLD. ECNs can only be effective when there are enough participants to provide a seamless market with liquidity.

Direct access brokers allow the user to target a specific ECN. This is very useful when using level 2 screens; a quote feed that provides stock price data for outside bid/asks. If you see that ARCA is offering 5,000 shares, a direct order to ARCA ensures an immediate fill as opposed to being routed to a market maker, which may not be able to provide the same liquidity at the same price. The market itself may move away from the desired price after ARCA gets taken out which will increase the cost to attain the desired position.

ECN Pass-Through Fees and Rebates

For this reason, most ECNs will charge a pass-through fee for taking liquidity while providing a rebate for providing liquidity. The more liquidity flows through an ECN, the more popular it becomes and remains. ECNs profit off the difference between the pass-through fee and the rebate. For example, ARCA may charge a pass through fee of $0.004 per share and rebate of $0.002 per share. ARCA keeps the $0.002 per share difference as profit. These fees are in addition to the brokerage commissions. Check with your broker to get the actual fees.

Smart Routes

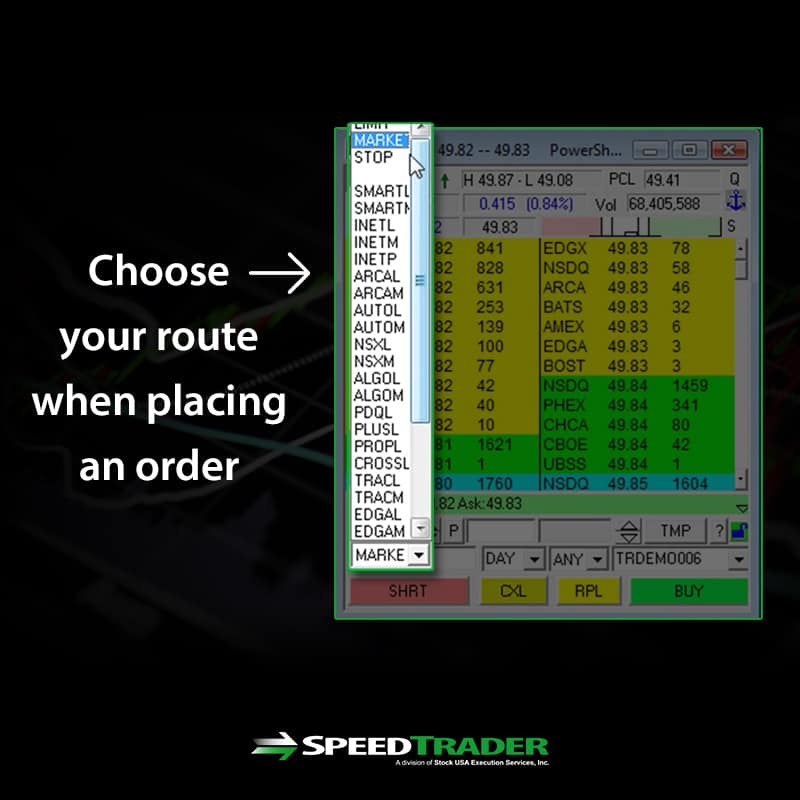

Many online brokers incorporate their own smart routing algorithms. These programs will automatically scan the various pre-determined ECNs for the best price and liquidity and spread out the order until filled. Some direct access brokers go one step further and allow the users to select a preference of routes in the preferred order for their smart routing. This allows for the best liquidity situation but may take a bit longer due to the extra time to scan the ECNs. The time difference may not be noticeable in terms of an extra second or two, but high frequency trading ( HFT) programs operate in single digit milliseconds. Compared to the HFTs, even a single second is an eternity.

Market Makers

Market makers are licensed dealers that are registered and regulated by the exchanges. They are required to put up firm capital and provide both bids and offers in the stocks they make a market in. Market makers will fill client orders against their own inventory or go out in the market and trade against the pending orders. They are some of the heaviest implementers of high frequency trading programs and backed by literally unlimited leverage and the ability to legally naked short sell. They are privy to order flow information. For example, if Fidelity wants to sell 1,000,000 shares of Netflix, Inc. (NASDAQ: NFLX), they would work the order through various market makers, who are then privy to the information. Market makers may front-run orders since they are taking the risk on both sides. For this reason, traders should be very careful routing directly to market makers as they serve the interests of their clients and the firm.

Choosing Your Routes and Why It Matters

By using a direct-access online broker, you have the freedom to select your own routes. The significance of this can be witnessed by placing limit orders directly to the market maker and an ECN, especially during thinner trading periods during the day. The following are reasons why direct-access routing is superior for most traders.

Better Price Executions and Better Fills

When trying to fill an order for several thousand shares of a mid-cap stock, you may notice the difference when trying to fill with a market maker as opposed to an ECN. Rarely do market makers show the true size of the prices they are quoting, whereas ECNs may show a more accurate display of size.

If you want to buy 5,000 shares of a stock at $17.37, where a market maker is only showing 100 shares compared to ARCA with 10,000 shares. The ability to route your order directly to ARCA may be the difference of attaining the full 5,000 shares at $17.37 compared to only receiving 1,000 shares at $17.37 as the market maker sensing the demand quickly decides to raise his offer price to $17.42. Ultimately, you may get filled for the 5,000 shares at an average cost of $17.40 compared to $17.37 through the direct routing to an ECN. This is a $150 difference that comes right out of the pocket of a trader that is forced to route through a market maker compared to a direct-access trader that has the ability to route directly to the ECN of their choosing.

Speed

By going the direct route, there is no middleman and fills (for certain order types) are immediate. This can be quicker than smart routing and almost always quicker than going through a market maker. The time difference may only be seconds, but keep in mind that it takes 300 milliseconds to blink your eyes. High frequency trading programs can attain an order fill in several milliseconds. When thinking in terms of milliseconds, a few seconds is truly an eternity. Why does this matter? Up to 70% of the market trading volume is all composed to algorithm trading programs. This means the competition is very heavy for liquidity. Speed is the only thing that can assure attaining liquidity. Any speed delay means you will miss the liquidity at your desired price level, which ends up costing you more for the trade.

Rebates

As mentioned earlier, ECNs offer rebates for providing liquidity. This is done by buying on the bid and selling on the ask/offer price. The risk is that you may not get filled when providing liquidity compared to taking liquidity buying on the ask and selling on the bid price. Rebates help to drive down commission costs. Check with your broker for the up-to-date pass-through and rebate fees.