Regardless of your trading style, it can be helpful to understand why a stock is moving in a certain way. Even if you are a technical trader who is solely focused on charts, knowing the reason why a stock is breaking out can provide some insight into how the move should be handled. For example, a stock running on a paid promotion may make a good short in the future, whereas a stock running on earnings may not.

For the sake of this article, we’re not interested in determining why a stock fluctuates within its normal range. Instead, we are focused on abnormal moves in which a stock becomes more volatile. Stocks can make big moves for a variety of reasons, and sometimes it can be difficult to determine the exact reason behind a move. That being said, here are a few common reasons for stock breakouts and breakdowns:

Technical Breakout (Multiple Timeframe) – A breakout occurs when a stock “breaks out” of its previous trading range. This can occur on any timeframe, meaning a stock can break out of its daily, weekly, monthly, or yearly range. Regardless of your trading style, it’s important to be conscious of breakout points on multiple timeframes. A price that may seem insignificant on a 5-minute chart may be a major pivot point on a daily chart. Understanding these breakout points can help you better assess the move, allowing you to determine where future resistance may be.

Press Releases – Company news can often trigger higher than average volatility in a stock. For day traders, the realistic implications of the news is not nearly as important as the market’s response to the news.

Earnings – Earnings reports shine light on the progress of a company for the past quarter (or year). This is when investors get to see just how well the company did. At this point, investors and traders may change their opinion on a stock, thus generating more volatility.

Analysts & Influencers – When a reputable source shares his/her views on a stock, it can hold enough influence to trigger buying/selling behavior. This may come in the form of an article/presentation or even something as simple as a tweet.

We currently have a large position in APPLE. We believe the company to be extremely undervalued. Spoke to Tim Cook today. More to come.

— Carl Icahn (@Carl_C_Icahn) August 13, 2013

Social Media – Social media messages have the power to influence a stock’s price action. Sometimes this is due to a single, influential individual and sometimes it’s attributed to a larger group sharing (and spreading) a similar sentiment towards a stock.

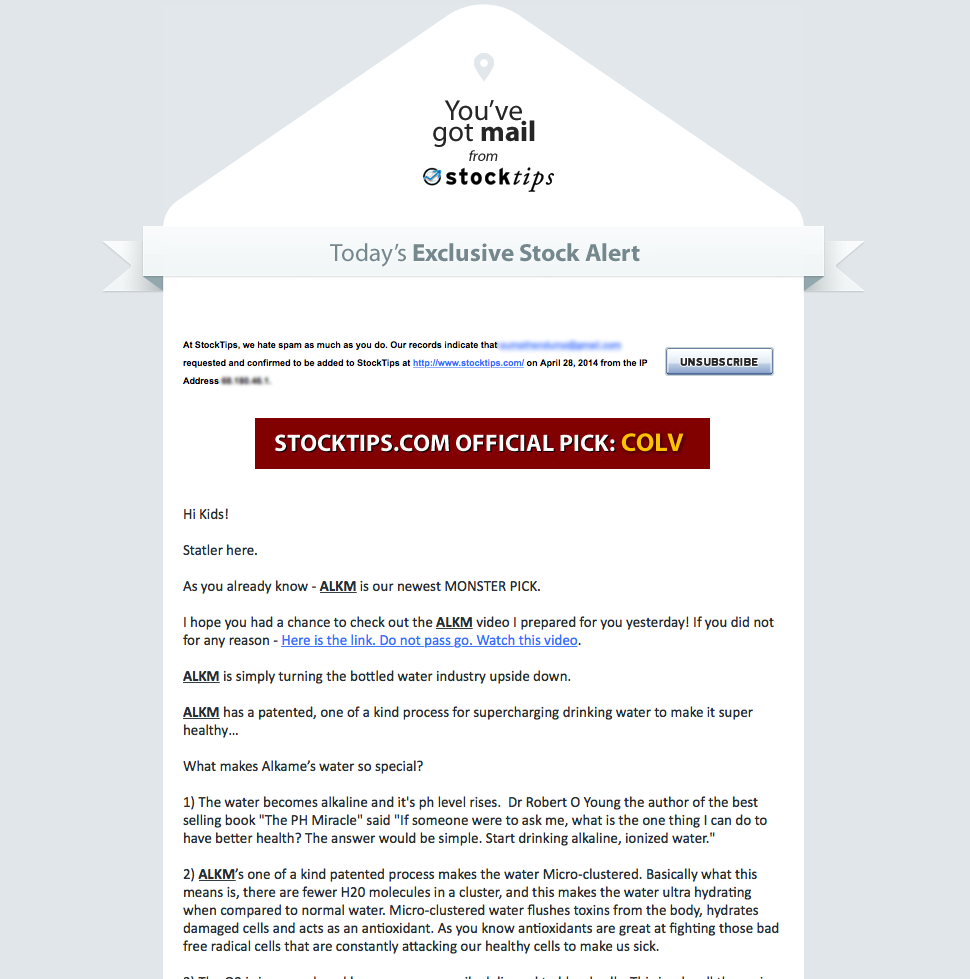

Promotions – Certain companies pay for the promotion of their stock. Unlike traditional advertising, the company is promoting their stock, as opposed to their product or service. These promotions can be online or through the mail.

Short Squeeze – When too many shorts get stuck in their positions, a short squeeze may be triggered as they all rush to cover their positions. This squeeze results in more buying activity that can push a stock’s price upwards.

SEC Filings – A company’s SEC filings can provide some insight into their current standing. While some of these filings (such as earnings reports) are followed by press releases, some are not.

Larger Indexes – Most stocks follow the stock indexes to some degree. If the market is up considerably on the day, traders and investors may be more bullish, allowing more stocks to run. Contrarily, if the broader markets are down on the day, market sentiment may be negative, causing more stocks to drop in price.

Sector Moves – Stocks within certain sectors may experience similar price movement. Sometimes these moves are justified and other times they are not. Regardless of the validity of the move, day traders can focus on the end result (price action). For example, the recent Ebola scare caused a variety of different companies to run. Similarly, events in Ferguson and talks of police corruption caused many body camera and non-lethal weapon stocks to run.

In Conclusion

Sometimes, it can be difficult to determine why a stock is moving with 100% certainty. That being said, you can do a quick assessment and get some answers that may be helpful in aiding your trading process. Keep in mind that understanding why a stock is moving is only one part of your trading plan. You still need to assess your risk, choose entry/exit points, and manage the trade.