Becoming a better day trader requires that you not only focus on textbook knowledge, but also on yourself. As a day trader, you are the driver of your own success. Often times, traders tend to focus solely on the market and forget that their own behaviors may be holding them back. This is why it is so important to put some focus on trading psychology.

Trading psychology is centered around understanding the mind of a day trader. As we’ll mention over and over again, you cannot control the market but you can control how you react to it. Studying trading psychology allows you to analyze your behavioral patterns and change them for the better. A focus on trading psychology is the ultimate compliment to basic market research. For example, after taking a big loss, you may find yourself asking, “Was it because the market acted oddly or because my stressful day affected my trading?”

When you begin to understand your strengths and weaknesses, you begin to become more self-aware. This self-awareness is a priceless resource for a day trader.

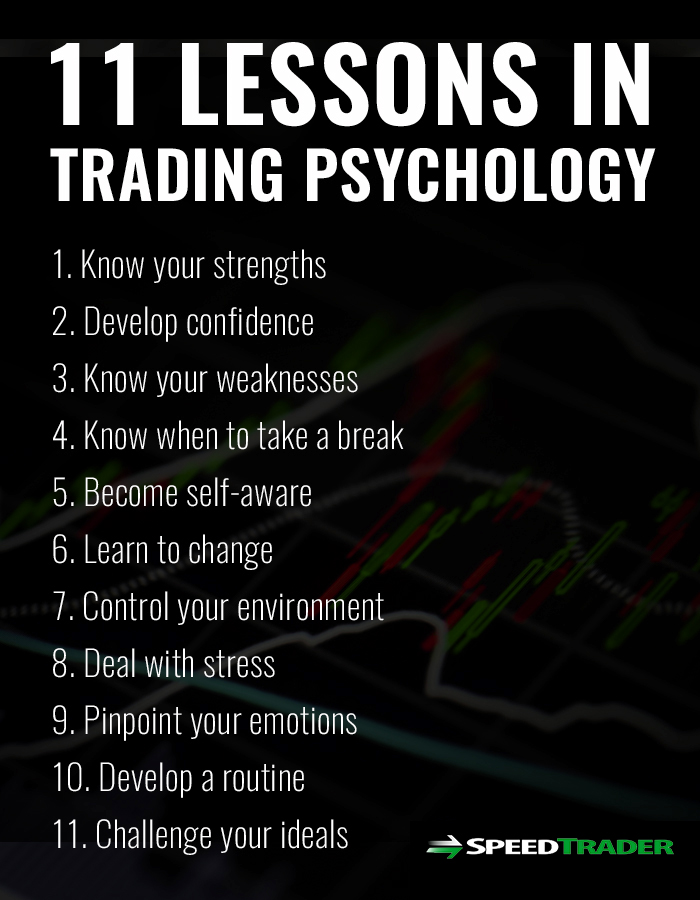

So, let’s get to the good stuff. Here are a few trading psychology lessons that may help you improve your trading.

Know Your Strengths – Knowing your strengths is a crucial part of trading. It’s important to focus on what you are good at so that you may focus your attention in that area. Focus on what times of day you trade best during, the setups you’re most successful with, etc.

Develop Confidence – Developing confidence not only removes some of the stress from trading, but it also allows you to become more competent. If you always feel like you are going to fail, you may create a self-fulfilling situation. Find your niche and give yourself credit when credit is due.

Know Your Weaknesses – Knowing your weaknesses is just as important as knowing your strengths. This trait is what keeps you out of trouble and allows you to preserve your capital. You wouldn’t enter a marathon if you’ve been lounging around on the couch for the past couple of months; this would lead to calamity. The same logic applies to trading. Don’t put yourself in a position that you are not equipped for. If you tend to perform poorly with short selling, avoid it. If you always lose money when trading biotechs, avoid them. Don’t waste energy in areas that you will not excel in.

Know when you need to take a break – Day trading can be stressful at times. As day traders, we have the tendency to always want to be a part of the action. If you take a big loss, you want to get back in the game and recoup your lost capital. If you take a big gain, you want to claim more profits. It’s okay to take a break every now and then. This gives you time to refresh and come back to the market with a better mind state.

Become self aware – The ultimate goal of all of these lessons in trading psychology is to help you become more self-aware. If you are not self-aware, you cannot make the changes necessary to improve. Self-awareness can be a tricky thing. Everyone has a lot of blind spots when it comes to self-evaluation; your goal is to pinpoint them. That being said, consistent introspection and unbiased self-analysis can help you find areas to improve upon.

Learn to change – Often times, changing requires that you leave your comfort zone. That being said, if you want different results, you have to make changes. While change may seem simple, it’s actually a skill that can be developed. Get comfortable with change and learn when it’s necessary to change what you are doing. This will give you the agility necessary to constantly improve as a day trader.

Control your environment – Both physical and mental cues within your environment can have a profound effect on your trading. Focus on finding the ideal environment to trade in. This environment will vary for traders. Some traders can deal with the chaos of watching 10 screens while blasting music, while others require a more serene environment with a more narrow focus. Focus on your physical surroundings and your mind state.

Deal with stress – Trading under stressful conditions is a recipe for disaster. It would be naïve to assume that you could completely eliminate stress from day trading. While you may not be able to eliminate stress, you can find better ways to deal with it. Maybe you need to take a peaceful walk during the mid-market lull. Maybe you need to stop trading for the day when your losses exceed a certain number. The main point is that you should find away to deal with stress so you can avoid trading under less than ideal conditions.

Pinpoint your emotions – We talked about becoming self-aware. A big part of this process is understanding the emotions that trigger your actions. You can’t diagnose an issue until you pinpoint its origin. For example, let’s say you stop out of a move early even though your initial hypothesis ended up being correct in the long run. What caused this? Did you make this decision out of fear? Did you buy too many shares? Did you lack the self-confidence to follow through with your plan? Figure out the emotion that triggered your behavior and look for a way to combat this emotion in the future.

Develop a routine – The markets are chaotic enough as-is. The last thing you want to do is increase this chaos with your own disorganization. Develop a routine and stick to it. The repetitiveness of this routine will create a sense of stability and increase your organization. It will also create a baseline for you to make future comparisons to. For example, let’s say you usually create watch lists for an hour the night before the trading day, wake up, go on a run, have a cup of coffee and start trading. If you have an off day, you can see if you strayed from your routine. Maybe you skipped your run for the day and became more stressed as you were trading. Focus on creating and refining a routine that allows you to trade in the best conditions possible.

Challenge your ideals – As we’ve discussed above, we’re all blind to some of our own behaviors. Every now and then, it’s important to challenge some of your own ideals and seek improvement. This isn’t to say that you should try to fix what isn’t broken. Instead, you should focus on finding areas of weakness that you were not previously aware of.

Conclusion

There is no “one-size-fits-all” program for trading psychology. Every trader is different; therefore every trader will need to take different approaches. What works for one trader may not work for another. Weaknesses of some are strengths of others and vice versa. That being said, the end goal is the same for everyone: be aware of your own behaviors so that you can improve them in the future.