Like any technical industry, the world of day trading is full of jargon. While this jargon seems completely normal to experienced traders, it can leave new traders confused. Understanding terminology shouldn’t be the difficult part of trading, so make sure you are familiar with these common terms and acronyms!

52-week high/low – When a stock hits a yearly high or low

After Hours – Trading done after the market closes

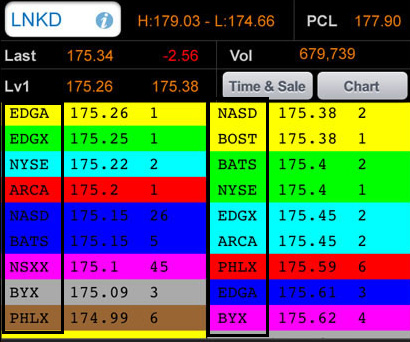

Ask – The price a seller is willing to sell for. (The lowest ask price is most commonly referenced)

Bid – The price a buyer is willing to buy for. (The highest bid price is most commonly referenced)

Breakouts – When a stock “breaks out” above it’s previous resistance level

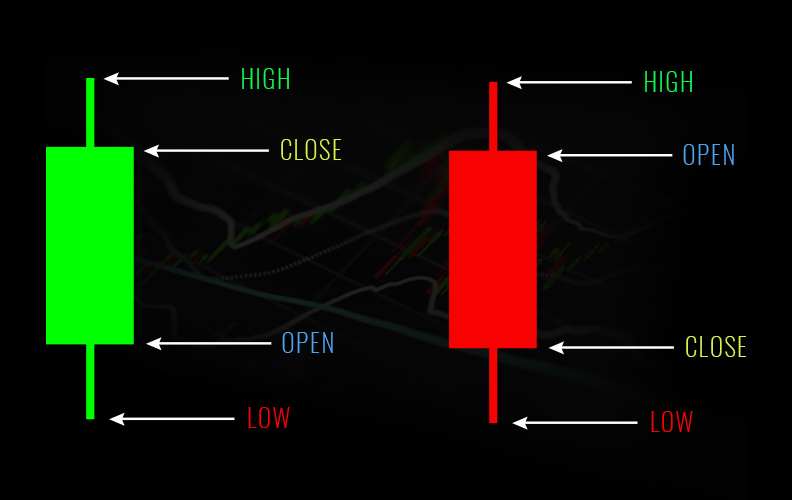

Candlesticks – A type of chart where each candle represents the high, low, open & close for a given period

Covering – Buying back the shares that were sold short

ETF – An exchange traded fund comprised of a set of equities

Earnings Reports (E/R) – A company’s quarterly/annual report of their financials

Filing – A document filed with the SEC regarding company updates

Float – The amount of shares available for public trading

Fundamental Analysis – Analyzing a company & its industry (financials, filings, sector, etc.)

Gap Up/Down – When a stock opens above or below its previous closing price

Going Long – Buying a stock with intentions of selling at a higher price

High/Low of Day (HOD/LOD) – A stock’s highest or lowest price for the day

Hard-to-borrow – A stock that is not readily available to short. Brokers will often charge an additional fee to those trying to short hard to borrow stocks.

Liquidity – The ease with which a stock can be bought or sold without drastically affecting the stock’s price

Low Float – A stock with a low amount of publicly traded shares, often times experiencing higher volatility

Market makers – The firms responsible for facilitating buy & sell orders and maintaining liquidity in the markets.

Market Cap – The total dollar value of a company based on the stock’s price and outstanding shares.

Outstanding Shares – The total amount of shares issued, including both the float and institutional ownership

Pre-Market – Trading done before the market opens

Profits & Losses (P&L) – A portfolio’s gains/losses for a given period

Pattern Day Trader Rule (PDT) – An SEC rule limiting traders with under $25,000 in their accounts to a maximum of four day trades in five days.

PR – A press release issued by a company

Red-to-Green & Green-to-Red – When a stock goes from being up on the day to down on the day (or vice versa)

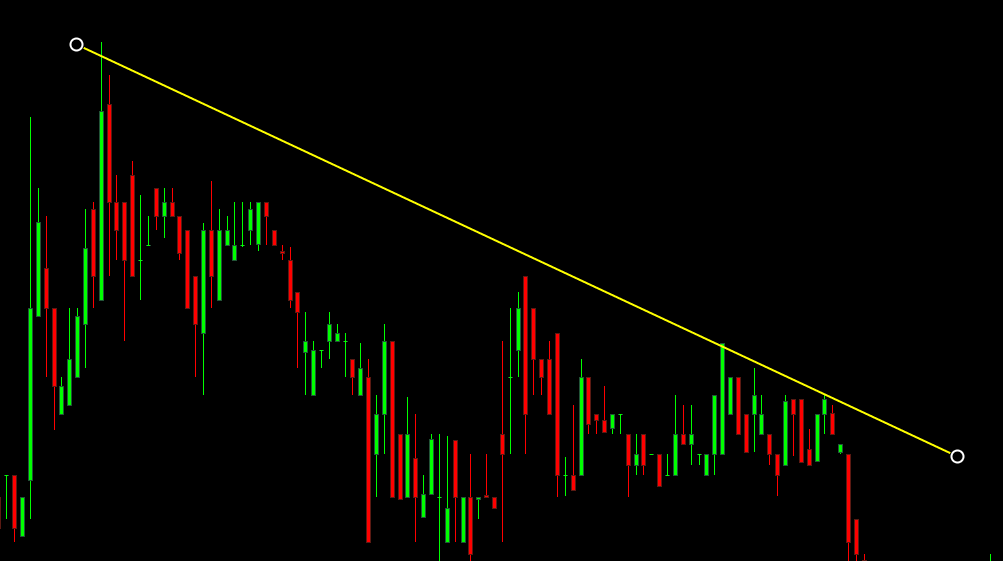

Resistance – A price level at which sellers repeatedly overpower buyers, making it difficult for the stock to increase in price.

Risk/Reward – How much money you plan to risk on a trade compared to how much you expect to gain

Scalp – Taking advantage of very small price changes

Short Selling – Selling shares of a stock that you do not own in hopes of buying the shares back at a lower price (the opposite of going long)

Spread – The price difference between the bid and the ask

Support – A price level at which buyers repeatedly overwhelm sellers, making it difficult for the stock to drop lower in price.

Technical Analysis – Analyzing a stock’s historical price action (using charts and technical indicators) to predict future movement.

Trend – The general direction of a stock’s price movement. A stock can be in an uptrend or downtrend.

Volume – The amount of shares a stock trades for a given time period