A trader takes on many roles throughout the day. The role of a trader is to sift through large amounts of data to identify a high probability trade, devise a game plan, execute, monitor and manage the trade. The preparation process is the most critical part.

Technology has made accessing and analyzing the data easier and quicker than ever. Today’s trading platforms are powerful tools that can streamline and shorten the preparation process seamlessly, once a routine is established. The most important part of preparation is finding tradable stocks.

What Makes a Tradable Stock?

A tradable stock needs liquidity/volume, volatility/momentum and follow through. Fundamental catalysts that result in a significant gap up or down often draw more attention thereby increasing the tradability of a stock. Even stocks that are not usually tradable can become tradable when reacting to a fundamental catalyst including earnings reports, government/regulatory ruling, FDA approval, merger speculation and insider activity. Prudent traders should compile a watch list of these stocks as part of a morning preparation routine in addition to intra-day scanning for active stocks. The following are five ways to find tradable stocks.

The Watch List

Like a master chef that creates a delectable meal with fresh, high quality ingredients, a prudent trader should also collect fresh high quality tradable stocks in the morning and throughout the day. Creating a watch list of tradable stocks should be a priority for any trader. Here are five ways to find stocks that are tradable. Note that these are just tips on finding stock candidates. You will still have to filter and be selective in finding the handful of tradable stocks that you can apply a solid and effective trading strategy/methodology to. Remember, never to blindly follow or chase stock candidates based on another trader or a scanner. Always do your research and devise a plan ahead of time.

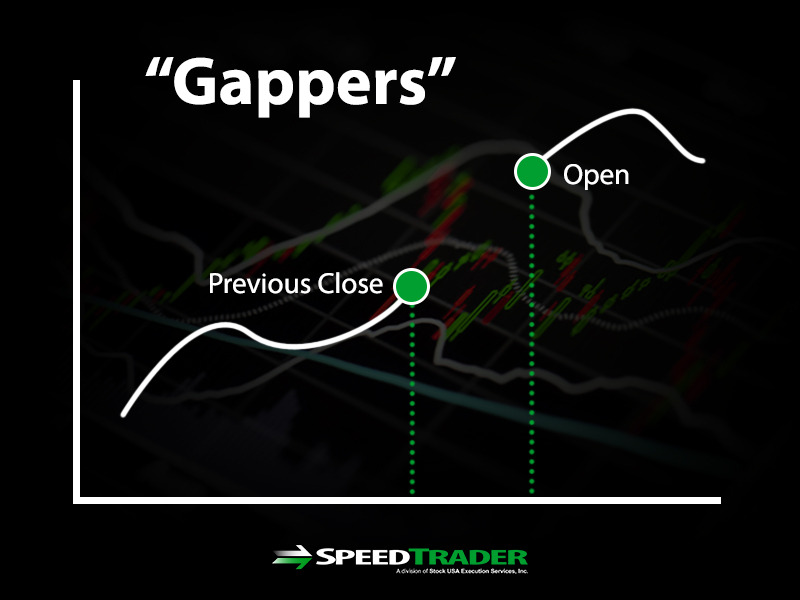

1) Pre-Market Gappers

News Related Gappers

Stocks that gap up or down significantly on news tend to draw the most volume and attention among traders. Be aware that stocks tend to gap normally in correlation to the S&P 500 futures. These are different situations from news catalyst related gappers. The latter are the ones to focus on. Stocks that are gapping up or down at least 5% with volume of at least 50,000 shares in the pre-market should be on the watch list. It is important to have a solid trading methodology that helps prepare you ahead of time. Preparation should always include multiple time frame analysis of price support/resistance levels before the open and then dynamic levels during market hours. Familiarize yourself with the behavior of the stock before making any trades. An updating list of gapper stocks can be found on most trading platforms.

2) Intra-Day Scanners

2) Intra-Day Scanners

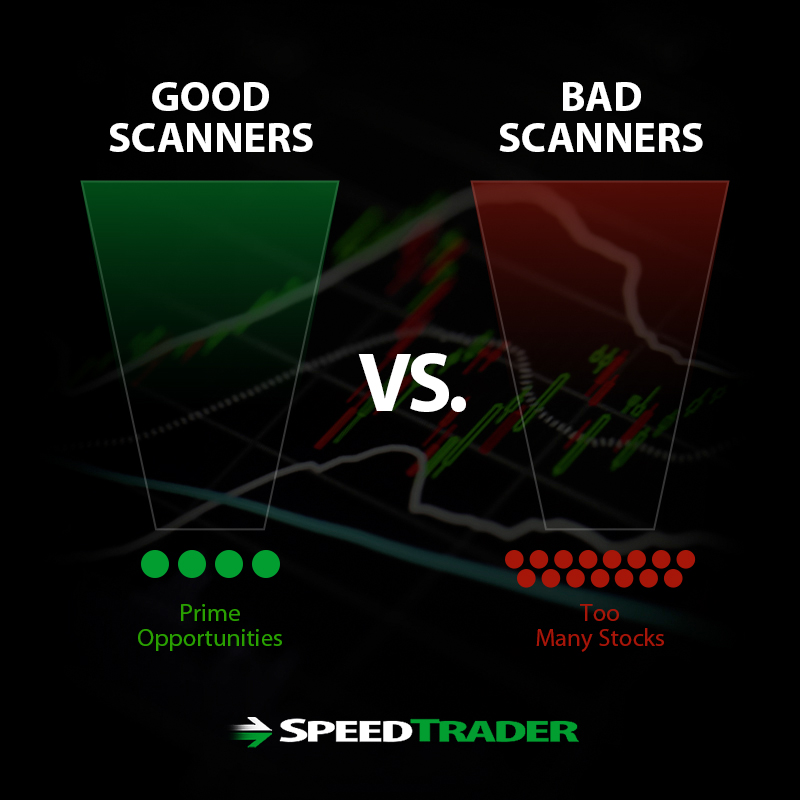

After the market opens for trading, it’s always a good idea to watch for stocks hitting new highs and lows to consider adding to the watch list. Generally, you should wait at least 15 minutes to let things settle down a bit, then scan for stocks that are holding highs or lows on the day with good volume. Intra-day scanners are a double edge sword for the trader.

Don’t Chase or Spread Yourself Too Thin

While it generates potential trade ideas, it’s important not to spread yourself too thin chasing anything that pops up. The purpose is to filter down to a handful of key stocks to add to the watch list. Once the watch list is set, you should carefully monitor them for potential trades based on a solid methodology complete with trade triggers, support/resistance price levels, momentum readings and a correlating lead indicator such as the S&P 500 or peer stock/sector. Most trading platforms have scanners as well as an updating new high/low scan (ie: High/low hitlist) as well as most active stocks.

Twitter/StockTwits

Social media sites like Stocktwits and Twitter have become so popular that they do have a market impact on share prices. For this reason, it is prudent to keep a stream open for your watch list stocks to observe sentiment, news and traders. There are many talented traders on these streams that may offer trade alerts on their own positions. The ones with a large number of followers (above 10,000) may have a material impact on share price movements depending on volume and liquidity. Be very careful not to get sucked into a pump and dump situation if they are pitching penny stocks. These can be very illiquid.

Cash Tag and Key Word Search

Once you set-up an account to Twitter and/or Stocktwits, you can create your own streaming feed based on your watch list stocks, follow specific traders and keyword searches. To stream information on a watch list stock, you can simply enter a cash tag $ and the stock symbol in the search function to get a stream to all conversations related to that particular stock. For example, $AAPL would stream all news and conversations in regards to Apple Computers, Inc. (NASDAQ: AAPL). Stocktwits updates the stream automatically, while Twitter requires a manual refresh. However, you can set-up on TweetDeck to stream your Twitter feed automatically as well.

A Grain of Salt

It is important to take any opinions with a grain of salt. Anyone can state an opinion on the internet. Often times, the sentiment may be too tilted to one side. A prudent trader knows that he is playing the reaction to and not the actual news when trading. You can find some very skilled traders on these sites with large followings. Be careful not to blindly following any single person. Always remember this is just for idea generation only. Always ask yourself what their motivation is for posting trades. Always confirm with your own methodology and trust no one completely on the internet.

4) News feed/Press Releases

News feeds like PR newswire, Dow Jones, Reuters and Bloomberg are all credible sources when they are releasing press releases directly from the company. This is public information, although most of the news may not have a material impact. Earnings reports tend to provide the most material share price movement. Always distinguish between a rumor and actual news. Rumors of acquisitions, mergers and regulatory actions have an initial impact on share prices but can revert quickly. Most trading platforms provide news feeds, sometimes for a fee. Third-party sites such as Briefing.com, Flyonthewall.com and Benzinga Pro provide a condensed summary of significant tradable news items often at a discount to the major news feeds.

5) End of Day Pattern Scan

Stocks may take several days to set-up a technical formation like a cup and handle, triangles, head and shoulders and flag patterns. These may have no news catalysts to explain the movement as it is purely technical. Most platform scanners can be set to run end of day scans as well. Some sites provide technical pattern scans for a small monthly fee while others provide similar scans for free. You can also use your trading platform to run, save, and update these scans based on your criteria. As with any scanner, make sure you have an effective strategy/methodology in hand before making any trades.