What Is An Efficient Day Trader?

Efficiency can be defined as accomplishing tasks with the least amount of time and energy (i.e. working smarter, not harder). In day trading, efficiency means less wasted trades, less unnecessary risk while generating more consistent gains.

An efficient trader is frugal with the number of trades and only takes positions when the set-ups are triggered while presenting an attractive risk to reward ratio. An efficient trader is a disciplined trader that is able to keep drawdowns to a minimum due to any lack of hesitancy taking stop-losses, while having the prudence to trade strong set-up triggers. Efficient traders focus executing the right set-up at the right time. They go “all-in” and over leverage on any single trade. They shun impulse trades and methodically plan out every single trade prior to execution. Efficient traders spend most of their time and energy in the preparation phase including filtering for watch list stocks, analyzing charts and devising game plans. During the day, they track and monitor their watch list ready to react when opportunity presents itself. They focus on the trade, not the money.

The Relevance of Efficiency: Mindset

It is important for every trader to focus being efficient. Efficiency results in less slippage costs, less losses and most importantly less mental strain and tension. Trading is a mental game. While profits and losses appear to be the most tangible factors in trading, the role of a trader’s mindset is often overlooked. A trader’s psyche dictates how they will react in every situation. It is the mindset that needs to be preserved at all times, because it is the mindset that will control performance. Making too many trades is exhausting and can fog the clarity that an efficient trader must possess to make immediate and effective judgements.

The 80/20 Performance Rule

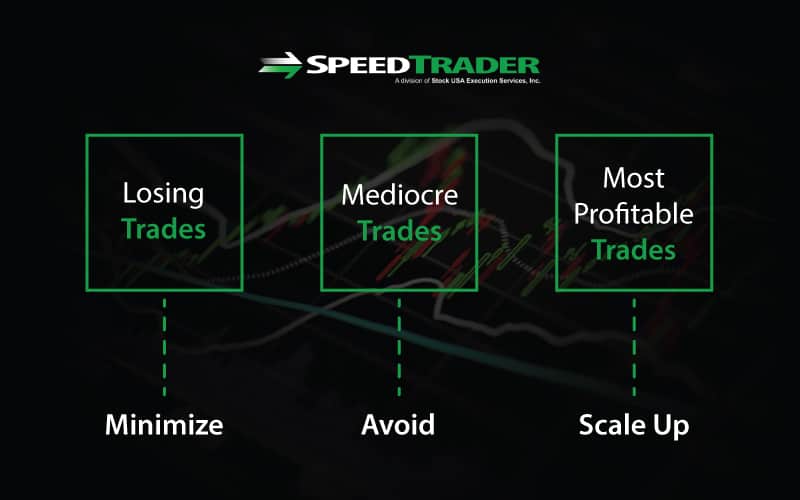

Just like in business, traders can expect 80% of their profits are derived from 20% of the trade types. Focus should be locked on those 20% set-ups, stocks and situations. Focusing on the process and not the results is how profits become consistent. If the right stocks are traded with the right set-ups with the right timing, then profits will take care of themselves. Here are five tips to help your become a more efficient trader.

Tip #1: Less Is More

This is the essence of efficiency. Less effort spent to attain more results (quality over quantity). However, you should be very careful taking this too literally and mistaking laziness for efficiency. While the number of trades should be less, the effort put into the preparation should be more. Trade less but research more. Don’t try to catch every move and most importantly don’t kick yourself for not taking a trade. That is one of the biggest downfalls of weak traders when they get upset for a trade they didn’t even take. It’s a complete waste of time and a sign of weakness. Focus on improving efficiency by being selective in making trades.

Tip #2: Have a Morning Preparation Routine

A solid morning preparation routine includes gathering a solid watch list of tradeable stocks. Each stock on the watch list should have the trend, support/resistance price levels, potential pattern set-ups and their triggers at the ready. Just having this information beforehand will put you ahead of the majority of traders in the stock. This is akin to a master chef prepping his ingredients before cooking the meal. Focus on just a few of your watch list stocks so that you focus is not spread too thin.

Tip #3: Create An Active Watch List and a General Watch List

It’s too easy to end up with 20 stocks on a watch list. The key is to filter and filter potential candidates down to just a handful of stocks. Having fewer stocks to monitor means more focus is possible. Have an active watch list and a general watch list. The active watch list is composed of stocks to trade that day. They can be transferred to the general watch list when the action has dried up but may still be worth tracking for future set-ups. The active watch list commands immediate attention while the general watch list contains viable stocks that need time to form pattern set-ups. The key is to narrow your focus and don’t dilute your efforts. One trade that generates a $1000 profit is more efficient than 10 trades generating $100 profit each.

Tip #4: Avoid Indicator Overload

While technical indicators are useful in spotting patterns and triggers, having too many technical indicators can backfire. Try to narrow down your technical indicators to just having enough so they provide converging signals. For example, having more than a single momentum indicator like stochastic, RSI and MACD on a chart is overkill. This is just as bad as having five or more moving average on a single chart.

Too many indicators can dilute the mindset and cause decision fatigue. Be frugal and select only the most accurate indicators for tracking price action, momentum and targets. The indicators that pass the mustard and make it onto your charts should be time-tested and personally observed to determine if it fits your style. Be mindful that every indicator should help you in the split second decision-making process that is trading. If your indicators cover up your chart so that the candlesticks are no longer visible, it means you have too many indicators. K.I.S.S. applies here (keep it simple stupid).

Tip #5: Learn Your Strengths

Every trader has strengths. Unfortunately, their weaknesses override them at the worst times. Kowing what strengths you possess as a trader is critical. Analyze your best trades to see what worked and how your mindset prevailed. When it comes to determining strengths, be objective.

Are you a stronger scalper or swing trader? Do you prefer to short-sell or buy long? Do you like to get in and get out of positions quickly or hold positions longer? How do you react to losing positions? Do you have the discipline to wait for the trigger before reacting? Are discipline and assertiveness strengths for you? How many losing trades does it take before you start to double up the sizing? What patterns do you find the most success with? With these questions you can narrow down where your strengths may lie.

If you have more success with short-selling stocks, then stick to more short selling and cut down on long-side trades. Do you find more success with stocks under $20 or higher? The goal here is to narrow down the criteria in order to map your trading persona. For example, you might be a scalper that performs best in the first hour of the trading day short-selling stocks under $20 on descending triangle patterns. From there, you want to specialize in meeting those criteria with your trades and scaling up the sizing when they trigger. Always make sure you are within your comfort zone with sizing.

Tip #6: Learn Your Weaknesses

Just as you mapped out your strengths, you will want to also map out your weaknesses. Naturally, your weaknesses will include factors that are not part of your strengths. Ask the same questions and the answers will lie with what you didn’t select to be your strengths. For example, you may determine that your weaknesses are swing trading, playing long stocks above $20 and breakout patterns in the afternoons.

When you can determine your weaknesses in an objective and clinical manner, you have identified what not to do. Being aware of this will maintain the distance between being confident and going on tilt. Try to eliminate or minimize your weaknesses to cut down on waste. Also, make sure that you examine waste in your expenses as a trader. Do you subscribe to too many news alert or chatroom services? Do you pay too much in commissions? Do you spend too much time watching the screens causing you to make impulse trades? Take notes and work on trimming down the waste as you re-build your efficiency as a trader.