Importance of Money Management

Money management is the make or break skill set that will impact a trader’s longevity the most. No matter how technically skilled a trader may be, poor money management can cause all kinds of unforced errors resulting in account blow-ups. Money management entails managing risk and leverage. The leverage part is where the danger is the greatest. Even if a trader has an 80% win rate, poor money management on the 20% can wipe out the account. Whereas a trader with a 60% win rate can still remain very profitable with strong money management skills. Proper money management is always a work in progress that is determined by experience, discipline, prudence, preparation and emotional control. Here are 7 money management tips for day trading.

Tip 1: Have a Max Dollar Stop-Loss

This takes discipline to administer. If possible, having the trading platform trigger the max daily stop is often the best way to administer. Every day trader should be paranoid and know that there is always that one lurking trade that is capable of setting off a series of events to push him into blowing out his account. Usually, it’s an anomaly or exceptional stock move that forms, which sucks the trader in on the wrong side. If the trader doesn’t accept the anomaly, it can and will often swallow him gradually at first and then trap him.

The max dollar amount should range between two to three times the average daily profits, if the trader maintains an 80% win/loss ratio. If the accuracy rate drops, then the max loss should drop as well. This type of ratio puts special attention on the accuracy rate. This works well for precision scalpers.

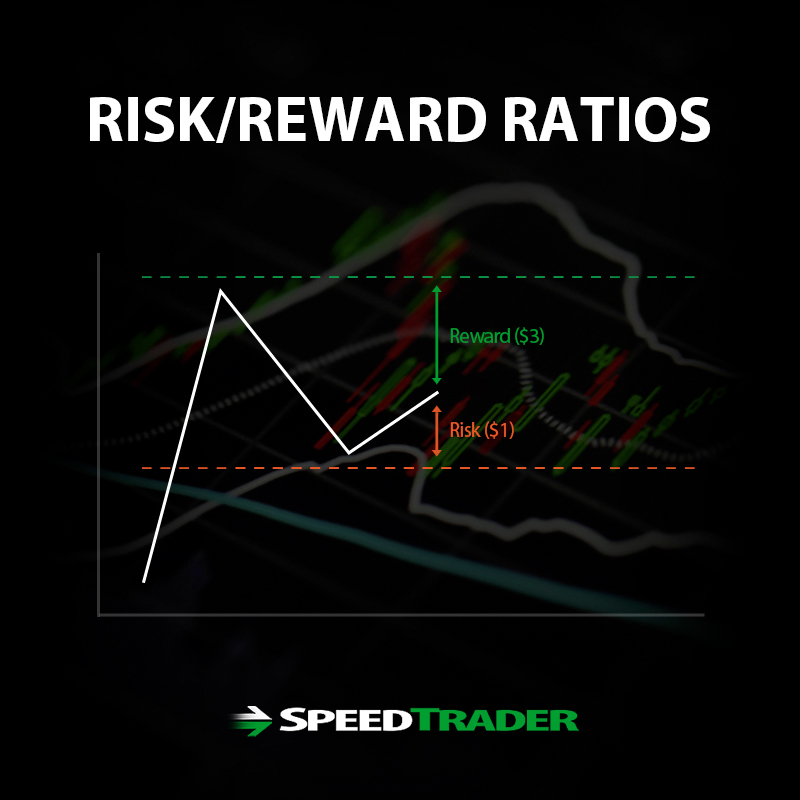

Tip 2: Find Trades with Solid Risk/Reward Ratio

Prior to pulling the trigger on a trade set-up, measure the potential profit versus the stop-loss on the trade. Typically, this is the risk/reward ratio where the potential loss is compared to the potential profit. The conventional thinking is to always have at LEAST a 2 to 1 ratio of reward to risk (ideally, closer to 3:1 or higher). However, there is another factor that makes perhaps the most material impact on the ratio. That is probability.

What is the probability that the reward will hit before the stop-loss is hit? If the upside is equal to the stop-loss, but the probability for hitting the upside first is above 80%, then the trade may be valid for a precision scalper with discipline. However, if the discipline to take the smaller profit is not administered, can you take a stop-loss? This is where a trader can get hurt. The best way to raise probability is by decreasing the profit target, while filtering stronger pattern set-ups. If the odds for a + 0.20 price move is above 80%, then an equal – 0.20 stop-loss makes sense on this 1 for 1 risk/reward trade. Measuring the probability of a target being hit relies on the strength of the underlying pattern and timing the entry and exits properly.

Tip 3: Don’t Average Down

There is a difference between scaling into a position that was pre-meditated and averaging down on a loss that wasn’t planned for. This tip applies to the latter. Every trader should know the distinction between the two. Averaging down from a position of weakness without a plan is a surefire way to blow out an account. In these situations, a trader averages down out of desperation and hope. The problem is two-fold.

First, if by a miracle, the trade works out and the trader walks away with a profit, it sets a dangerous precedent that when in danger, he should just double down. This is a road to ruin eventually. Secondly, if the trade doesn’t come back, then the result can be massive losses and possibly forced liquidation margin calls. Traders should first consider taking the stop-loss rather than averaging down in most cases. Use stop losses to buy time and take the tension load off your shoulders. Only then can you consider a more precise re-entry or reversal trade or just move onto another stock.

Tip 4: Take Breaks

A trader’s psychology stamina is important in remaining flexible and the ability to make good timely judgments and reactions. To stay fresh, it is a good idea to segment the trading within the day and take regular breaks away from the screen. When you stare at a screen all day every day, the mind doesn’t stop working or being influenced. The psychological approach to trading can rely on the physical. This means to physically break the connection, get up from your chair and walk away for a solid break anywhere from 10 minute to several hours. This is the only way to replenish the mental fuel gauge.

You may also find that taking breaks from trading for longer periods of time can help give you the “refresh” you need. Taking breaks, especially after a big loss or win, can help you clear your mind and come back to trading at your best.

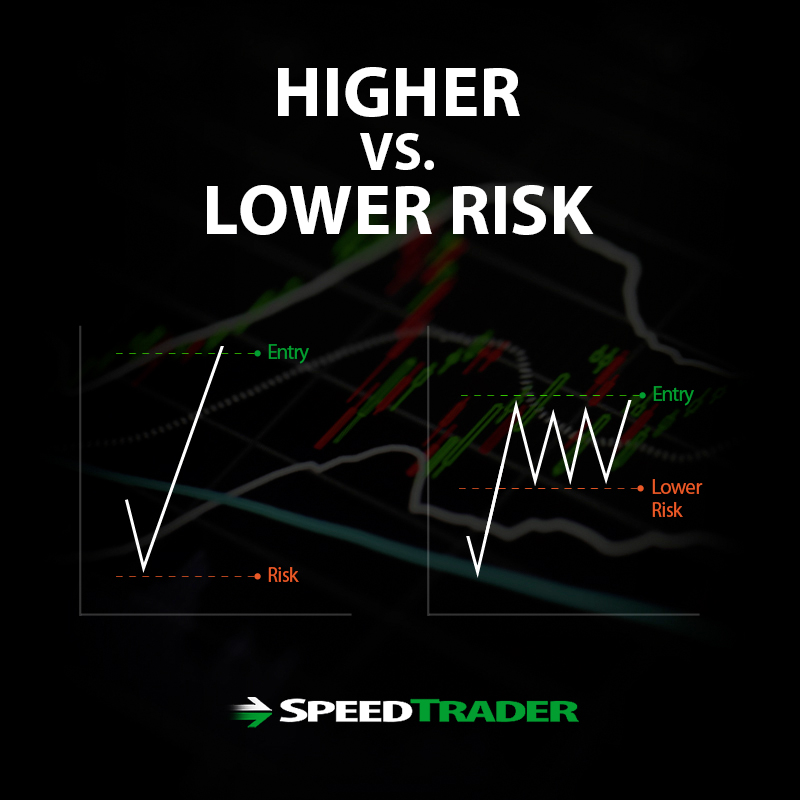

Tip 5: Avoid Higher Risk Trades

It can be tempting to press higher risk trades by taking much larger share positions or throwing a “Hail Mary” type homerun swing. Usually these types of trades are taken out of desperation to make back large losses and these end up badly for the trader. The market has the uncanny ability to win during high-risk trades. This is because the market understands that these trades are based on emotions and desperation. It’s human nature to fight back and go heavier when taking losses, not the other way around.

Understanding this concept will help you to identify high-risk trade situations and avoid them. When a trader has a series of losing trades, the right thing to do is to trim down shares and/or quit if max daily dollar loss levels are hit. Remember, it only takes one bad over leveraged trade to lead to an account blowout.

If you are unfamiliar with a certain trading setup or considering trading a highly volatile stock, make sure you are confident and have a foolproof trading plan in place.

Tip 6: Stick to Your Niche

Every trader has a trading style (strategy, types of stocks and plays) which they are most comfortable with. The trick is discovering what they are without going broke. The combination of the aforementioned facets is what composes your niche. Once you find your niche, stick with it and be careful not to stray. Once you are able to identify your niche, it is prudent to stick with that niche until it is no longer a niche. Eventually, the transparency gets exposed thereby effectively shutting the window of opportunity to profit. Therefore, when a niche is found, it’s best to capitalize on that niche until it becomes saturated or too transparent, usually both.

Tip 7: Avoid Vengeance Trading

Most people will agree that having a profit and then losing it is worse than never having made the profit in the first place. Why is that? The ego. The need to be right is ingrained in our psyche. It’s not a matter of being a braggart or shallow. The brain always seeks simplicity and the reduction of stress and tension as in the Cognitive Dissonance theory by Festinger. The need to ‘make things right’ is what can subconsciously force a trigger to try to make back the losses and lose the sense of logic and objectivity in the process. The term vengeance means to enact revenge to ‘even’ or balance things back to normal. It’s an inherent flaw that the market hopes to exploit. Therefore, it’s important that traders recognize when the vengeance trading kicks in and immediately pull the kill switch. Vengeance trading sets a very bad precedent and ultimately can be fatal to your account.

Never place a trade solely to make up for another trade. No one likes dealing with losses, but it is important that traders remain level-headed.