The types of brokers that cater to day traders are very different than the types of brokers that many retail traders normally think of. Whereas retail investors are normally making long-term investments, day traders are starting and ending the day with no open positions – and placing a large volume of trades in the meantime.

As a result, day traders need to be able to place trades that execute more quickly than classic discount brokers can offer and need the ability to place trades through charting or other technical analysis software. In addition, day traders need real-time margin and buying power updates, which retail brokers don’t typically offer. Finally, since day traders are placing a high volume of trades, they typically need a broker that offers lower commissions or prices commission by shares rather than trades.

Better Commission Pricing

Day traders place a large volume of trades – far more than the ordinary long-term investor. That means that they need a break on trading commissions below what any classic discount broker can offer in order to make a profit.

Specialized brokers catering to day traders typically offer reduced prices of a few dollars per trade, or price commissions based on the number of shares traded rather than the number of trades executed.

Per-share Commissions

Many brokers catering to day traders do away with trade-based commissions altogether and instead charge commissions based on the number of shares traded. This is advantageous for day traders because it allows them to place a larger number of small trades while paying a similar total in commissions. In turn, day traders get the freedom to scale in and out of positions easily without sacrificing all of their profits to their broker.

Per-share commissions can also help traders save money simply by scaling the cost of the commission relative to the profit potential. For example, a purchase of 1,000 shares of a stock has a smaller profit potential for the same price movement than a purchase of 10,000 shares. So, traders opening smaller positions won’t burn through most of their profit potential with flat per-trade commissions for opening and closing those positions.

Better Short Lists

Another advantage to specialized brokers for day traders is that they generally keep better short lists, meaning that they offer a wider range of stocks that are available to short. This is a big deal for day traders since they typically profit off of bearish price activity as much as bullish price activity, and not having access to short a stock because it’s not on a broker’s short list can be crippling.

Specialized day trading brokers also typically have better locate services for finding stocks to short, including online locate services. This makes the process of finding shares of a stock to borrow much faster and more straightforward, which can be important as timing is critical when day trading.

Direct Market Access

A number of day trading brokers offer direct market access, meaning that traders’ orders are routed directly to the exchange where the stock is traded rather than through an intermediary market maker. With direct market access, traders have access to see an exchange’s order books and all of its trade orders at any given time.

The primary advantage to direct market access is speed. Direct market access allows traders to get their order to the exchange as quickly as possible, which in turn allows them to have their orders filled at more favorable prices. In addition, direct market access can be paired with algorithmic trading applications to significantly reduce the cost of trades.

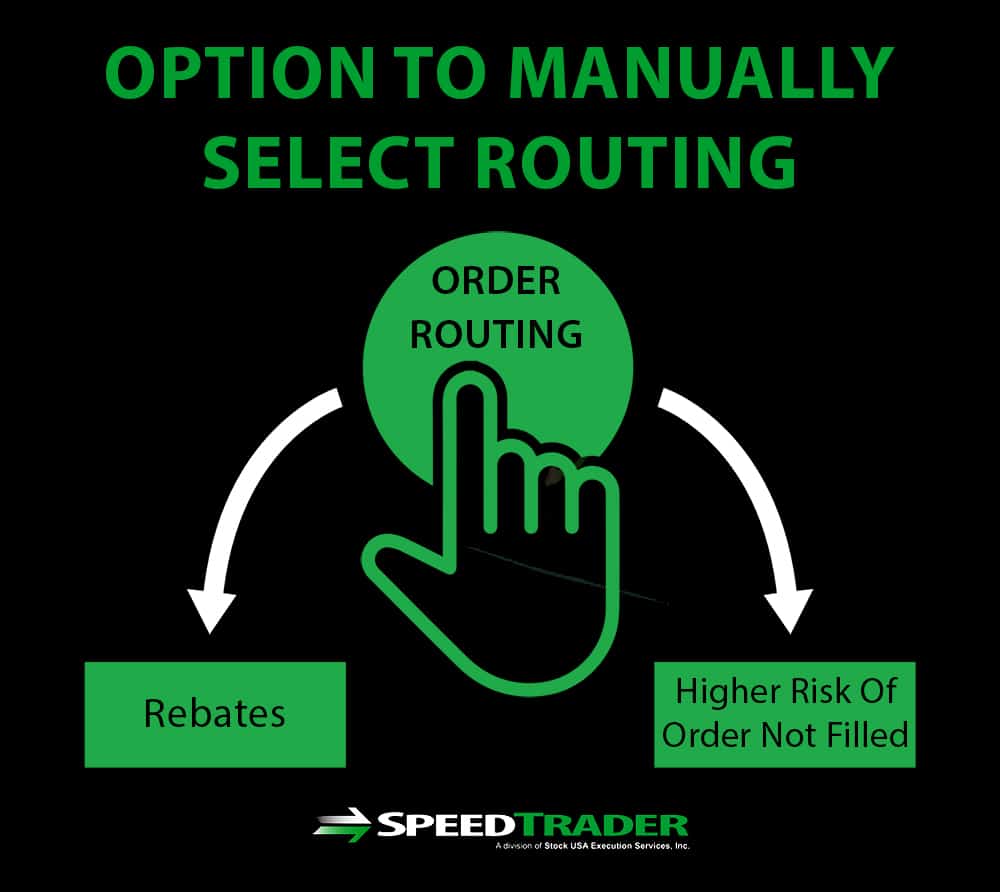

Routing Rebates

Specialized day trading brokers also offer traders the option to manually select the routing process that their order follows, which can allow them to claim rebates in exchange for adding liquidity to the market. Rebates are typically provided when routing orders through electronic communication networks (ECNs) and buying at the bid price or selling at the ask price, which adds liquidity to the network. Brokers that enable order routing thus allow traders to offset their trading commissions, although there is a higher risk of an order not getting filled when trading with rebates in mind.

Unique Features for Traders

Integrated Short Locates

One of the most useful features for day traders that is not found with standard brokers is integrated short locates. Short locates typically take the form of an electronic search for where a stock can be borrowed from and at what cost. Having short locates integrated into a broker can reduce the time it takes to open a short position and ensures that trades won’t be missed because shares cannot be found to borrow.

Multiple Platform Options

Some day trading brokers offer multiple trading platforms to their customers, which can increase the number of options available for algorithmic trading or technical analysis. Traders can choose the platforms that best suit their needs instead of settling for the default platform provided by most discount brokers.

Advanced Order Types

Day trading brokers also offer traders the ability to place advanced order types, such as market if touched or one cancels other trades. While most long-term investors do not need order types beyond standard limit and stop orders, and most discount brokerages do not offer options beyond these order types, day traders often need more advanced order logic in order to avoid missing out on trades or to manage risk.

Specialization

Last but not least, there’s a customer service aspect for why serious day traders need a specialized broker. Discount brokers often cater to a wide range of customers and it can take a trader in need of assistance significant time and effort to establish their trading experience with a customer service representative and get the help they need. Even then, discount broker service representatives often can’t offer the advanced help that day traders may need. Specialized brokers, on the other hand, know that they are dealing with day traders and are knowledgeable about the types of day-trading specific issues and needs that frequently arise.

Conclusion

In contrast to retail investors, day traders place a high emphasis on trade execution speed, commission reduction, and the ability to short stocks. However, most classic discount brokers cannot deliver on these needs, whereas specialized brokers catering specifically to day traders can. As a result, any serious day trader will sooner or later need to make the jump from a standard broker to a specialized broker for day traders.