While most investors are now familiar with exchange-traded-funds (ETF), exchange-traded-notes (ETN) allude investors since they may not distinguish the difference between the two structures. They may appear and trade identically in performance, but the underlying structure is a major distinguishing factor. These instruments are great for traders that want to trade a sector or industry rather than a specific stock. They can also be used to gauge the performance of a specific sector or industry as well or compare how a stock is performing in the context of its peers. They have more favorable expense ratios than mutual funds

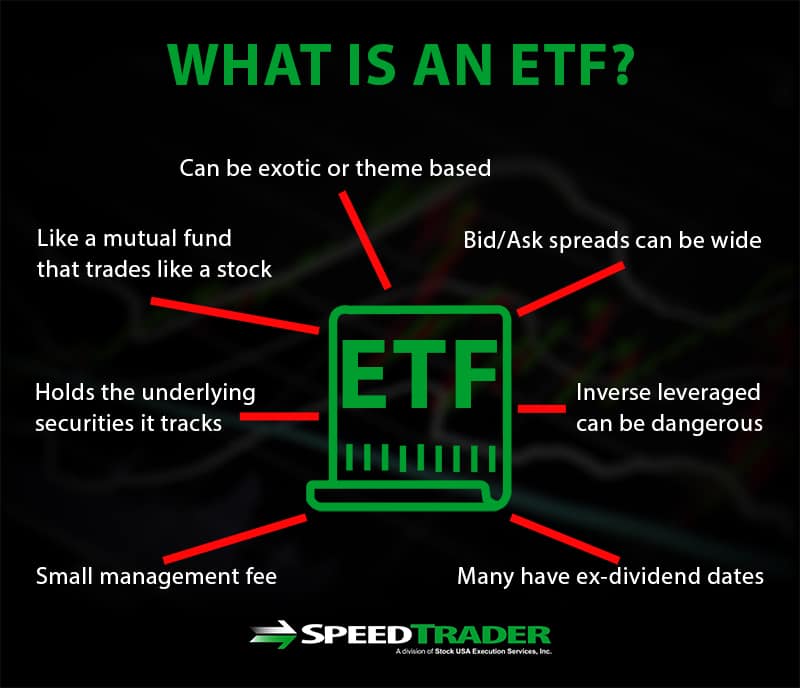

What is an ETF?

An ETF is a fund that holds the underlying securities in the sector, industry or theme that it tracks. Think of it like a mutual fund that trades like a stock. There is a small management fee and many of them have ex-dividend dates that will distribute dividends to long holders while short-sellers pay the dividend. Liquidity is important as bid/ask spreads can be wide with exotic or theme based ETFs that don’t track a benchmark index. Most ETFs can also be sold short, but always check with your broker. Inverse leveraged ETFs are especially dangerous if held long-term since they are structured to lose value from gap compounding and contango. Leveraged ETFs are designed only to mirror the performance of the underlying for a single day.

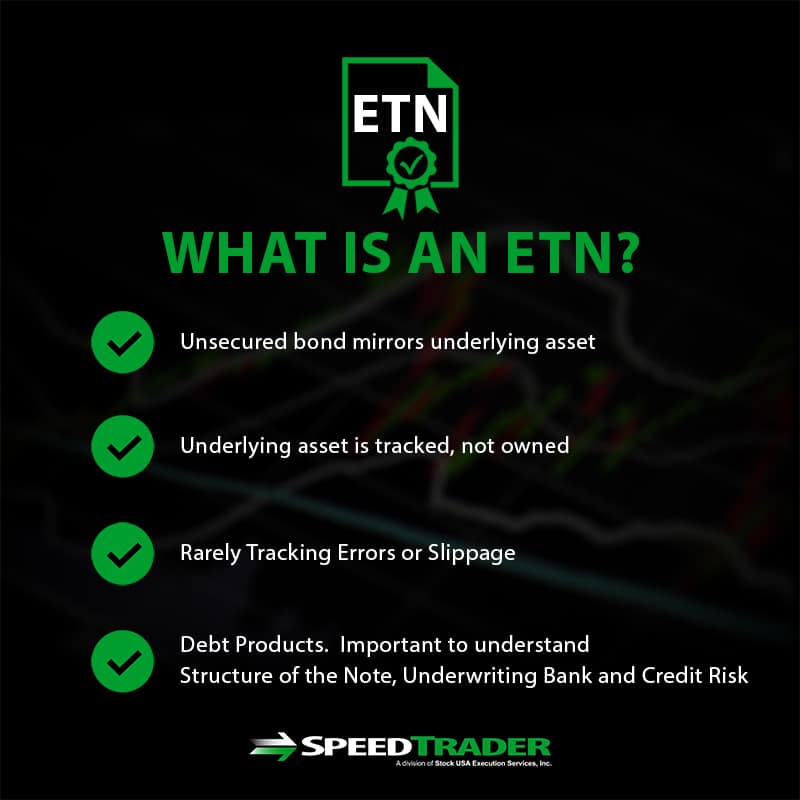

What is an ETN?

An ETN is an unsecured bond that mirrors the moves of the underlying asset like an index, sector of industry ETNs and strategy. They don’t own the underlying components like an ETF, but rather tracks them. ETNs are prepaid contracts so there is rarely tracking errors or slippage. Since ETNs are a debt product, it’s important to be familiarized with the term structure of the note, the issuing and underwriting bank and the embedded credit risk. If the issuing bank suffers from liquidity problems, systemic risk or credit downgrade, the ETNs can also suffer backlash.

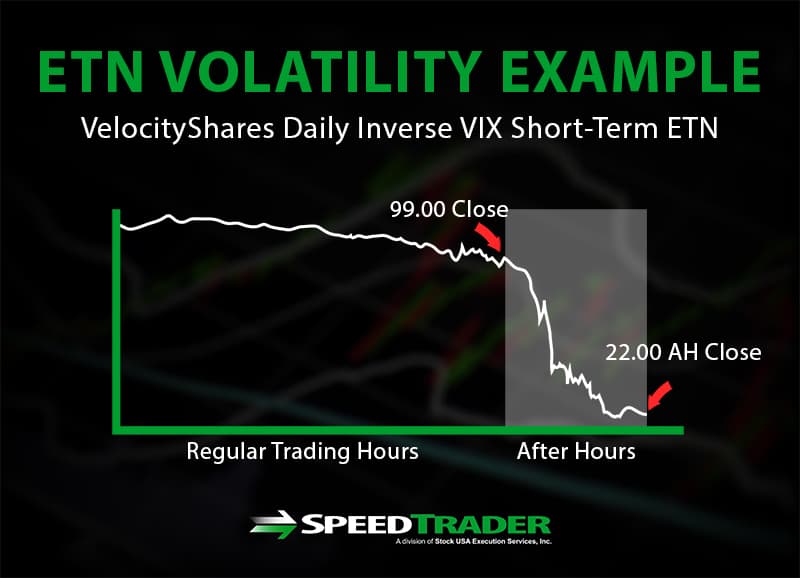

The Dark Side of Leveraged ETNs

The terms of the note are important, traders must be careful about leverage and if the ETN is susceptible to insolvency. The XIV (VelocityShares Daily Inverse VIX Short-Term ETN) mirrors the inverse movement of the VIX (CBOE Volatility Index). The XIV became a crowded trade due to the low volatility in the markets. On Feb. 5, 2018, the VIX spiked over 100% as U.S. equities markets collapsed causing the XIV to fall from 115 to 99 into the close. However, unbeknownst to most traders, the spike in the VIX triggered a liquidation event on the XIV causing it to collapse from 99 to 22 in the afterhours session before it was halted indefinitely. This caused the levered SVXY ETN to collapse from 60s to 15s overnight. A lot of investors and traders were baffled with the price collapse and discovered the hard way how an ETN differed from an ETF.

Similarities and Differences Between ETFs and ETNs

ETFs are funds that hold the underlying assets that it tracks. ETNs are structured senior debt notes that don’t hold the underlying assets. Both ETFs and ETNs both track an underlying asset and trade like stocks. Traders can buy, sell and sell short these instruments through online and direct access trading platforms just as they would a short. Most of the ETFs and ETNs trade on the American Stock Exchange (AMEX). ETNs tend to track the underlying asset more precisely since they don’t have to deal with the slippage of actually buying and selling the underlying securities like an ETF would. ETFs tend to carry more liquidity than ETNs since they are more widely traded vehicles.

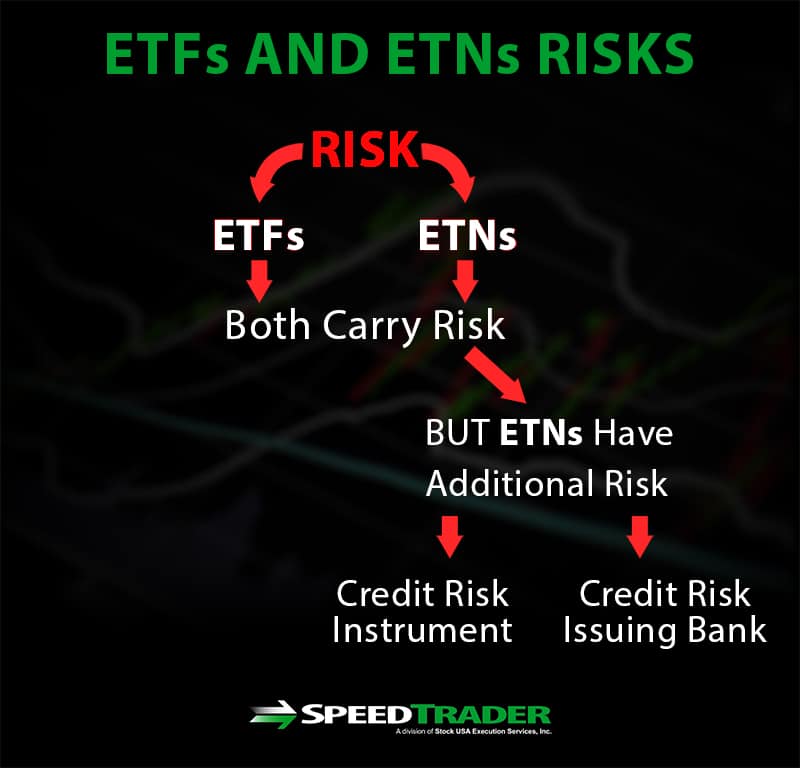

Risks Involved with Trading ETFs and ETNs

As with any trading instruments, both ETFs and ETNs carry risks. It’s prudent to have a trading or investing methodology in place before taking any positions. While they both trade like stocks, they are not stocks. ETNs are more vulnerable to credit risk not just on the instrument itself but also from the issuing bank.

While the popular benchmark indices like the Dow Jones, S&P 500 and Nasdaq 100 have been around for decades, trying to mirror the performance of these indexes often meant buying into a mutual fund or every underlying stocks in the index. ETFs provide retail traders to participate directly with benchmark indexes through the DIA (Dow Jones Industrial Average), SPY (S&P 500 index) and QQQ (Nasdaq 100 index) ETFs. ETNs enable traders to trade strategies as well like ERO (iPath EUR/USD Exchange Rate), AYT (Barclays Global Emerging Market Strategy Asia 8 Index) or AGA (PowerShares DB Agriculture Long). These products provide a wonderful opportunity to access and trade a diversified group of assets at a fraction of the cost for both traders and investors, as long as the risks are understood beforehand.