Like any skilled craftsman, a day trader must be equipped with the proper tools in order to operate as efficiently as possible. Trading without the right tools can cost day traders a lot of time and money. Day trading tools are designed to provide traders with access to more data, better market visibility, and the power to execute their trading strategies with ease. There are plenty of trading tools out there. Trading tools should be chosen strategically. You shouldn’t use them just for the sake of using them; they should fulfill a need of yours.

Here are a few important tools for day traders.

A Trading Computer

It’s important for day traders to have computers that will allow them to trade efficiently. Traders should be focused on their trading strategies and should not be hindered by sub-par machinery. Now, this doesn’t mean that all day traders need a state of the art computer with 12 monitors, however it’s important for traders to make sure that their hardware will allow them to execute their plan without any problems. Some traders use their mobile phones or tablets to trade, while others require a more sophisticated setup. Think about what you need to make the most of your efforts.

Here are a few considerations:

Operating System

Day traders need to decide which operating system they will use and why. Generally speaking, Windows computers are more popular than Macs, however you can trade on both. Make sure the operating system you use will support your trading software. Most trading software works on Windows computers. If you’d like to run a Windows-based software on a Mac, you may consider using Parallels or Bootcamp.

Computer Specs

Day trading software can be resource extensive, meaning you need to have the proper hardware to keep up. Most new computers should be able to support your trading software but you should check your computer specs first.

Although you can get away with lower specs, here are some recommended baselines:

- 8GB+ RAM

- Dual-core or quad-core processor with 2GHz+ processing power

- Solid State Hard Drive

- Powerful graphics card capable of supporting multiple monitors

(If you plan on running a lot of monitors, you may need higher specs.)

Make sure your computer is capable of running your trading software with ease before you start day trading. Don’t go out and make a huge investment in a new computer if it’s not necessary. Just make sure that your computer is not going to be the factor that will limit your success. The last thing you need is to face computer issues while you’re in a trade.

Brokers

Believe it or not, a broker is actually considered a trading tool. Your broker is the direct connection between you and the markets. Remember, trading tools are designed to help day traders execute their plan as efficiently as possible, and a good broker does just that.

Here are a few things to look at when considering brokers:

Reputation/Credibility – Not all brokers are created equal. Consider the reputation and credibility of a broker before transferring funds. A broker that has been serving clients for years is a much safer bet than a broker that emerged in the past year.

Available Trading Software – Make sure your broker provides a trading software that will allow you to execute your trading plan properly. (We will discuss this more in the next section)

Commission Structure – Find a broker with favorable trading commissions. This can save you a lot of money in the long run. Think about whether you’d prefer to pay per share or per order and see if your broker can accommodate your preferences.

Speed/Routes – Make sure your broker has access to the routes you need so that you can execute your orders as fast as possible. A few seconds can make a big difference when it comes to executing a day trading order.

Requirements – Some brokers have specific requirements, such as opening an account with a certain amount of capital. See if you meet the requirements before applying for an account.

Support – Make sure your broker has a good support team. If something goes wrong or you just need some assistance, you’ll want to make sure your broker can help.

Specialties and Other Considerations– Make sure your broker is going to be able to accommodate your trading style. For example, if you plan on primarily shorting stocks, you’ll want to make sure your broker can get you the borrows. If you have any other specific needs, make sure your broker can accommodate them. If you’re not sure, just ask.

There are plenty of brokers out there, but they are not all the same quality. At SpeedTraderPRO, we work diligently to prove our value to our customers. We’ve been around for over 16 years, we offer a top-of-the-line trading software, and we have great commissions structures.

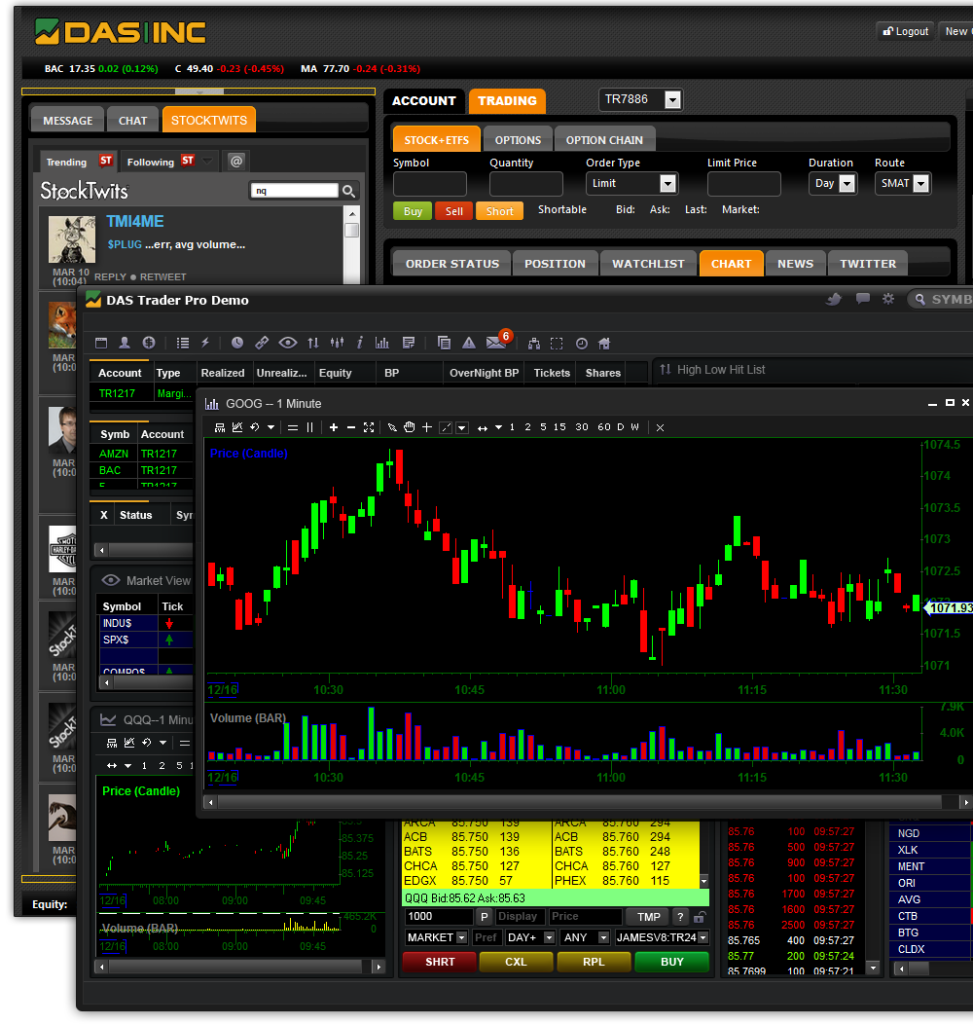

Trading Platforms

Your trading platform/software will quickly become your day trading workstation. You need to make sure your software has all of the features you need and works smoothly on your computer. Most of the analysis day traders do is through their stock software, so this may be the most important tool you choose.

Here are a few things you will want to look for:

Charts and Technical Indicators – Most day traders incorporate some level of technical analysis into their trading strategies. This requires a great charting setup with access to the technical indicators you need to implement your strategy. Make sure to check out the charting setup for your software in order to ensure that it will meet your requirements.

System Requirements – Make sure the trading software you use will work on the devices you need it to. If you plan on trading while on-the-go, you should see if your trading software has a mobile version. If you are trading from a Mac, you will want to make sure your trading software can be run on a Mac.

Order Placing Functionality – What type of order functionality are you going to need? Most trading software comes equipped with the functionality to place basic order types. Some people will need more advanced order types, in which case, you need to check to make sure your software can support these orders.

Data Streams and Accuracy – As a day trader, you need to be able to make trading decisions on the fly. This requires a speedy system with access to the data streams you need for your trading.

Level 2 – Level 2 can shine light onto the order flow in the stock market. A lot of traders utilize level 2 windows to make better trading decisions. Make sure your software has a solid level 2 setup if you plan on using it for your trading.

Scanners – Day traders are constantly scanning the market for new trading opportunities. Quality trading software can help automate this process by allowing you to scan for certain criteria in real time. If you plan on running scans via your trading software, make sure to do some research on the market scanner they provide.

Cost – Of course, cost is also a factor in choosing a trading software. Some software is free, while others cost. The fees for paid software may be waived for individuals who place a certain amount of trades per month. Make sure you fully understand the costs involved with your software before committing to it.

By now, you’re on your way to developing a solid foundation in the world of day trading. Of course, day trading is a constant learning process, so you will need to focus on improving your strategy regularly.