What are Hot Keys?

Hot keys are shortcuts that execute a pre-selected task or series of tasks at the press of a single or combination keystroke. Whereas it may take a few mouse clicks and/or additional inputs to perform the task, a hot key can be easily configured to complete the task with a single keystroke or combination keystroke. On a trading platform, the main benefit is speed, which leads to efficiency. The extra seconds that are shed can result in better entry/exit prices, faster trade executions and less distraction.

How Do You Set Up Hot Keys?

Most online trading/charting and especially direct access trading platforms provide hot key functionality. Hot keys can be set up in the SpeedTrader PRO via Setup > Hot Keys. You can choose between pre-made hot keys or custom scripts.

The Action and The Hot Key

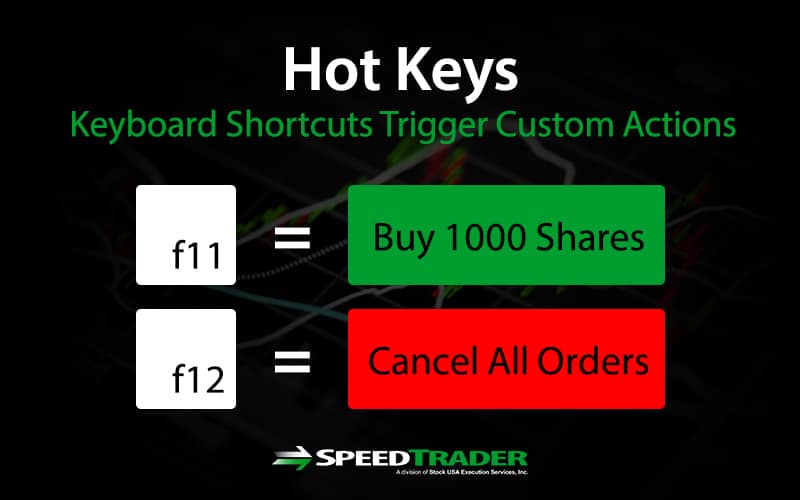

There are two parts of a hot key set-up, the “action” and the hot key.

The action is the task(s) that the user is trying to perform.

The hot key is the key or combination of keys that trigger the action.

Trading platforms have pre-set actions usually linked to default hot keys. Users can edit/change the hot key to the action. Depending on your broker, the list of actions can be very extensive. Additionally, more advanced trading platforms will allow you to create your own series of actions to configure to your choice of hot keys. Most basic hot key functions are set by default. The user can also add additional hot keys or re-configure the default hot keys. Set up as many as you need but don’t feel the need to overdo it. The goal is to make your current strategy more efficient by automating common tasks.

Consideration: Hot Key Conflicts and Overlaps

Make sure you aren’t using a hot key that is already configured in another program. For example, the F5 key may already be configured to refresh your screen in another program. Re-configuring the F5 key to a task on your trading platform could present conflicts that may cause malfunctions in both programs. When there are too many hot keys, it’s easy to accidentally duplicate the same actions to different hot keys as well. In order to be useful, hot keys should be easy to remember and used often to reinforce the habit.

Benefits of Hot Keys

Although they may seem extraneous at first, there many benefits of using hot keys. Once you get acclimated through repetition, you will find them indispensible.

Speed of Executions and Orders

The most obvious benefit of hot keys is speed. While point and click is fast, using a hot key to place your buy and sell orders can shed seconds off your trade execution. The speed advantage becomes most noticeable when having to placing multiple orders on different stocks. Additionally, you can set a hot key to buy a limit on the inside bid or sell limit on the inside ask with a set number of shares. This shaves a lot of time from the normal “point-click-cancel and repeat with new price” routine. Hot keys are a boon for trading fast moving volatile stocks.

Faster Cancels

One of the most convenient hot keys is the “Cancel All Orders” function. This can mean the difference between getting a bad fill and dodging a falling knife. For example, you may have 10 different buy-limit orders in for 10 different stocks. You notice the futures starting to collapse hard and quickly decide to pull all the limit orders until you find out why the market is tanking. Normally, you would have to pull up each stock and then cancel the specific order. However, if you programmed a “Cancel All” hot key, you could cancel all live orders in a single keystroke.

Common Hot Keys

Here are some of the common hot key actions for both buying and selling. The actual hot key can be configured manually. Check with your broker for the default hot keys linked to the actions. The most common hot keys use the F1-F12 keys, but it’s important to make sure they are not already taken.

Buying Shares

When buying shares, you will have to configure the default size as number of shares or a percentage of capital. The proximity of the limit price can be configured off the inside bid/ask. The “X” is the user-defined number that the hot key will execute.

Buy “X” Shares at Market

This hot key will execute a market-buy of however many shares “X” on the inside ask price. Market orders can result in very expensive fills in fast moving, volatile stocks if the timing is not right.

Buy “X” Share at “$X.XX” Above Current Ask

This hot key places a buy-limit order for “X” number of shares at the user specified price increment above the inside ask. This type of order is safer than a market order since it puts a price cap on the shares you are buying.

Buy “X” Shares at “$X.XX” Above Current Bid

This hot key places a buy-limit order for “X” number of shares at the user specified price increment above the bid. This type of order attempts to split the spread, puts a price cap on the order and may result in providing liquidity, which may qualify for a pass-thru rebate. Of course, depending on the increment, it may also just execute the buy order on the inside ask.

Selling/Shorting Shares

When selling shares, the user will still have to specify the “X” number of shares and the “$X.XX” amount above/below the bid or ask price. These values need to be determined when configuring the hot key(s).

Sell “X” Shares at Market

This hot key will execute a market-sell order for “X” shares. Technically, a market order gets top priority and must fill at the inside bid price. However, market orders can result in expensive fills when using them on fast moving and thinly traded volatile stocks.

Sell“X” Share at “$X.XX” Above/Below Current Bid/Ask

These are just the sell version of the aforementioned buying shares segment. The user can pre-set the number of shares and the price increment during the hot key configuration. You may want to use different hot keys to adjust the values for different types of stocks. For example, a more expensive stock trading in the $200 price level may have spreads as wide as $0.50 compared to thick stock trading at $15 which pay only have penny increment spreads. Using a hot key set to “Sell 200 Shares at $0.50 Above the Ask” applies to the $200 stock, but wouldn’t really apply to the $15 stock since the tight spreads wouldn’t result in a fast fill since it’s so far away from the inside market.

Close Position at Average Price

This hot key places a sell-limit order for your total position to be executed at the average price/cost as calculated on the position minder.

Close X% Position of Position

This hot key will sell a specified percentage of the total position at market price. The purpose is to quickly trim down exposure risk by decreasing position size.

Platform Hot Keys

Platform hot keys are used to perform non-trading related actions pertaining to the trading software. Some of these hot key functions include:

Refresh which reloads a specific chart(s) or screen(s), which updated indicator readings. This hot key is useful when your trading platform may be “stuck” or slow.

Zoom In Charts allows you to view a closer look at a chart down to single individual candles or bars.

Zoom Out Charts allows you to view a larger panorama of the data points to achieve a wider perspective of the candlestick or bar action.

Switch Between Trading Windows allows you to alternate between different workspaces and layouts.

Order Hot Keys

These hot keys help to route orders or conveniently cancel orders.

Market Maker Buy/Sell Order will route your trade to a specific market maker. You can also configure the routing orders for ECNs as well or set-up hot keys to route to specific ECNs.

Cancel All Orders will quickly cancel all open orders. This is very helpful when trading multiple stocks simultaneously.

Cancel Last Order will cancel the most recent order.

Close All Positions will immediately sell all positions at market. This is a quick way to eliminate exposure risk all together in a hurry. Since there is no discretion on price, it’s important to aware and comfortable with the impending fills. Usually, this hot key will be used in an emergency situation that calls for immediate action like an interest rate hike.

Volume Adjustment for Existing Orders lets you adjust the size of your existing open limit orders. For example, you would use this hot key to raise your size by 100 shares on an open buy-limit order.

Limit Price Adjustment for Existing Orders lets you incrementally raise your buy or sell price on an open limit order. Stock prices are not static and often times require price adjustment. This hotkey streamlines the cancel order, adjust price, and resubmit order process into a single hot key.