Options Trading

Stock options are a financial product in which a buyer and seller agree to trade a stock at a set price between the start of the agreement and a set expiration date. In this case, traders are not actually purchasing a stock itself, but rather taking positions around its anticipated future price. Trading stock options can be preferable to trading stocks themselves first and foremost because they provide leverage – it is possible to trade large stock volumes without having a huge balance sitting in a brokerage account. Options can also provide security – unlike stop loss orders, which fail in the case of a downward price gap overnight, options are active all of the time.

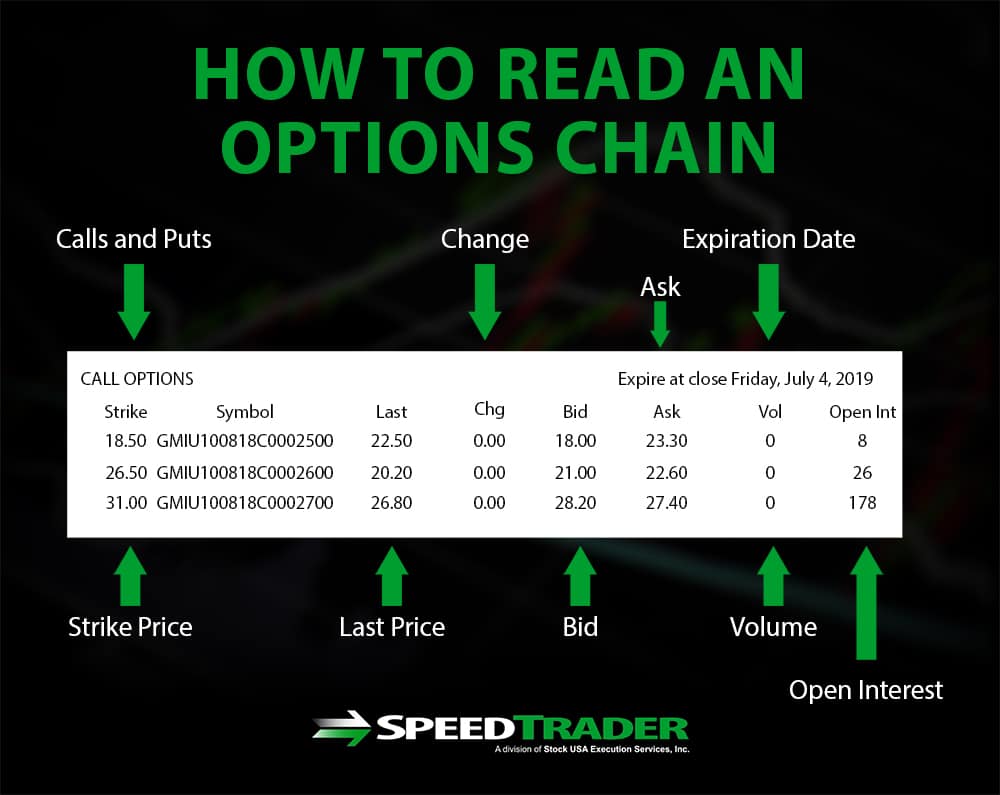

One of the major reasons that not all traders turn to stock options rather than sticking to stocks is that options can seem overwhelming to the uninitiated. Options chains in particular appear as unwieldy tables of stock symbols and numbers that seem to be written in a language all their own. But stock options chains are extremely valuable because they provide information about all of the options available for a particular security in a compact, consistent format.

How to Read an Options Chain

Options chains are tables that list all of the options available for a given stock and all of the important details that go along with these options. Learning how to read options chains is critical to trading options successfully. Options chains updated for current pricing can be found on nearly all financial websites, just a link away from a stock’s real-time price data. When reading options chains, remember to apply the same technical analysis and risk management strategies that as when trading stocks in order to determine which options represent good positions.

Options Chains Elements

Expiration Date

The expiration date is one of the most important points of any options contract since it is the last date to exercise a contract to buy or sell a stock at the options pricing. After the expiration date, the options contract is nullified. The time between the present and the expiration date is directly related to the value of the options contract – more time is more valuable since it gives more time for the underlying stock price to change. For the same reason, options set to expire in less than 30 days can lose value quickly. The expiration date is often the first sorting feature for options and it is typically shown across the top of options chain tables.

Calls and Puts

There are two types of options: calls and puts. An option is considered a call when it confers the right to purchase a stock at the option price up to the expiration date. In this case, the option would be profitable if the price of the stock increases. An option is considered a put when it confers the right to sell a stock at the option price up to the expiration date. In this case, the option would be profitable if the price of the stock falls. Depending on the format of the options chain, the call options may all be listed first followed by the put options or the call and put options may be listed side-by-side.

Strike Price

The strike price is the price at which the options contract gives the holder the right to buy (for a call option) or sell (for a put option) the given stock. For a call option to be profitable the stock price must rise above the strike price, while for a put option to be profitable the stock price must fall below the strike price. Call and put options with higher margins from the current stock price tend to be less expensive than options that have a strike price near the current stock price.

Last Price

The last price is the most recent price at which each options contract was traded. While it is possible that an option was last traded minutes ago or longer and thus no longer represents the current market price, the last price is typically a good indicator of the market price of an option along with the bid and ask prices.

Change

The change shows the difference between the last price and the previous day’s closing price for each options contract.

Bid

The bid price is the price that a buyer is willing to offer for each options contract. Typically, the bid price is the price you will receive when selling an options contract.

Ask

The ask price is the price that a seller is willing to accept for each options contract. Typically, the ask price is the price you will pay when buying an options contract.

Volume

The volume column shows how many of each options contract have been traded during the present day.

Open Interest

The open interest column shows how many of each options contract are outstanding as opposed to those that have been exercised, closed, or expired. Options contracts that have a large open interest will typically be easier to buy and sell because there are a lot of other traders with these contracts to buy and sell.

What to Look Out For on Options Chains

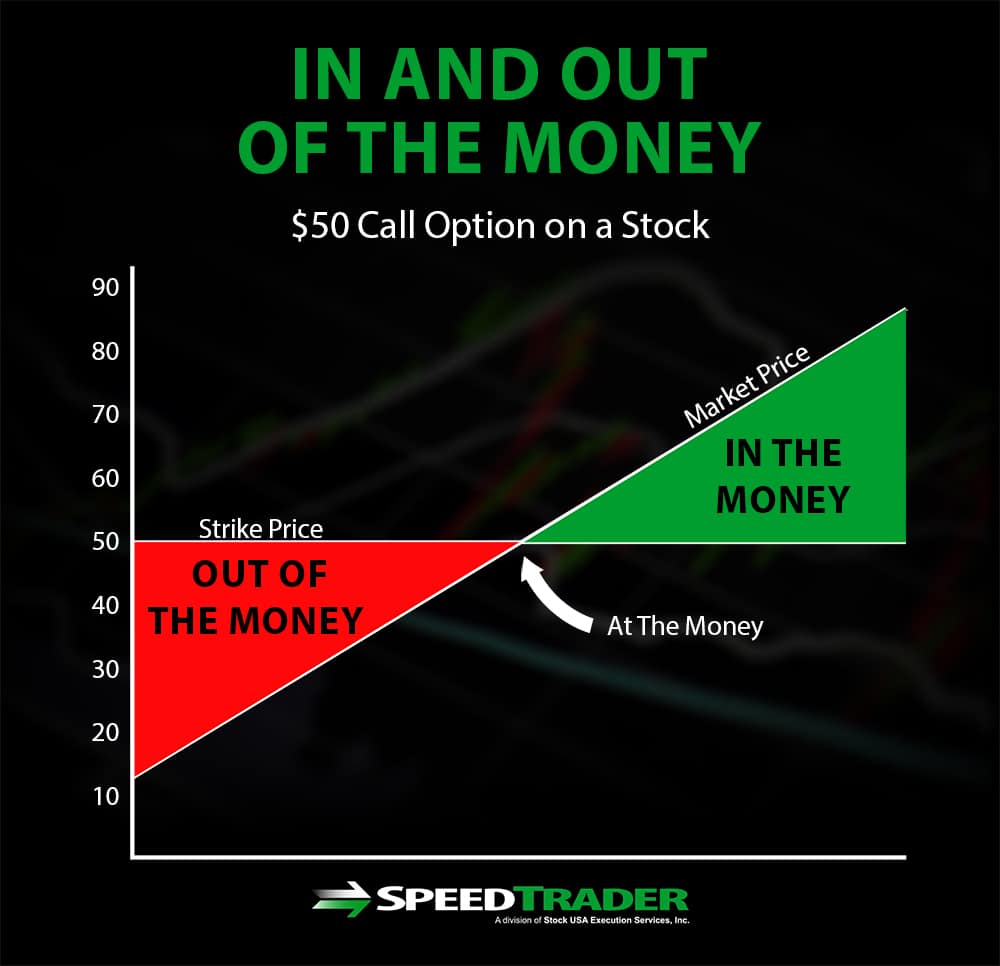

There are several things to think about when reading stock options chains and trading options. One of the most important is whether an options contract is in the money or out of the money. Options are considered in the money if they could be exercised immediately upon purchase, while they are considered out of the money if they require a stock’s price to move before they could be exercised. For example, a call option that has a strike price lower than the current market price of a stock would be considered in the money. Options that are in the money are typically much more expensive to purchase than options that are out of the money because of the initial intrinsic value of the former.

Another point to remember is that options contracts typically represent 100 shares of the underlying stock, but options chains list prices for only one share. Therefore, expect to pay 100 times the listed ask price when buying options.

Conclusion

Stock options can seem intimidating to traders who are accustomed to trading stocks, but they offer leverage and security that trading stocks directly cannot. One of the key skills to trading options successfully is being able to read stock options chains, which give pricing information about all of the possible options for every stock for which options are offered. Stock options chains are valuable resources that make it possible to quickly and easily compare options and make decisions about opening options positions.