What is an ETF?

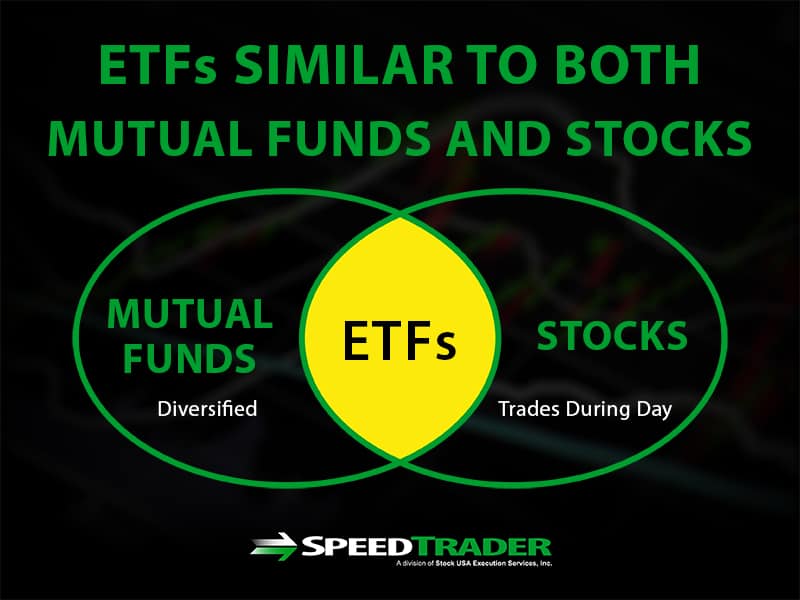

An exchange-traded-fund (ETF) is a tradable security that tracks/mirrors the performance of a specific stock market index, sector, industry or group. ETFs are usually listed on the NYSEARCA or AMEX exchange and traded through specialists, market makers and ECNs just like a normal stock. Prior to ETFs, investors could only monitor the performance of the benchmark indices like the S&P 500 index, the Nasdaq 100 and Dow Jones Industrial Index, but couldn’t participate in actually trading the index.

In fact, the only way to trade the indices would be through corresponding index futures contracts or buying all the component companies that compose the index. ETFs provide a way for investors to track and trade the underlying indices as they would a stock.

What types of ETFs are there?

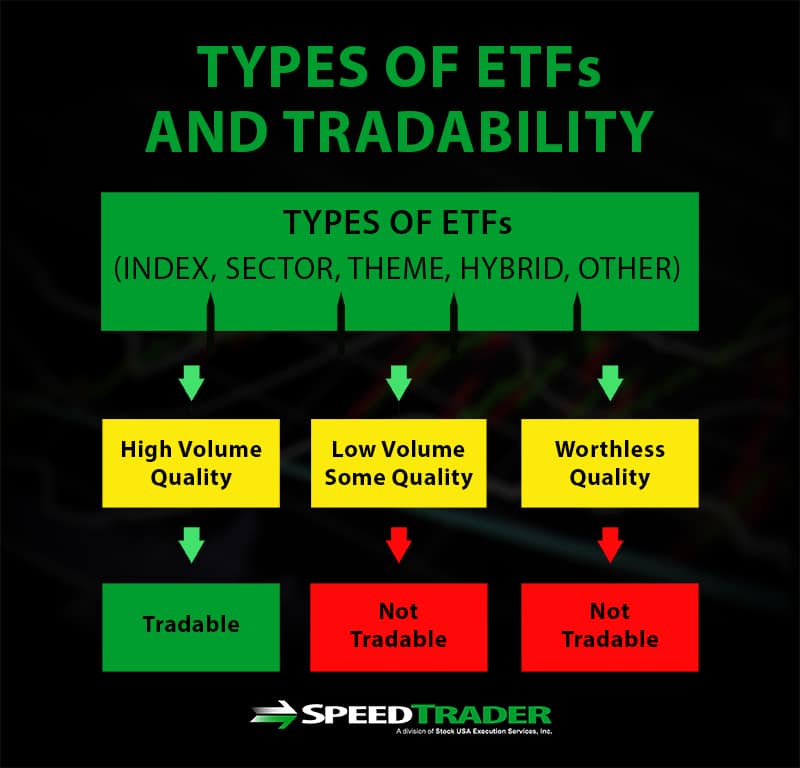

The universe of ETFs covers every possible index, sector, theme and hybrid versions. The landscape is littered with thousands of (worthless) ETFs. Liquidity can vary greatly meaning you may start a position in the red just because the spread can be so wide. As a rule of thumb, stick to ETFs that trade a minimum average volume of three million shares a day. The SPDR Sector ETFs cover every sector of the S&P 500 and have plenty of liquidity.

What are some examples of common ETFs?

It’s best to stick with the most widely traded index ETFs like the SPY (S&P 500), QQQ (Nasdaq 100), DIA (Dow Jones Industrial 30) and IWM (Russell 2000 small-caps). Stay away from low volume ETFs where spreads can be very wide and volume very light. Not all ETFs are the same.

The Pros of ETFs

ETFs are versatile in their use. They can be traded intra-day, swing traded and held longer term as a hedge or investment. They have the features of a mutual fund and the flexibility and liquidity of a stock. Unlike a mutual fund, the management fees for index ETFs are super low. As long as there is liquidity with tight spreads, ETFs are great vehicles to trade. The SPY is the king of liquidity (averaging well over 40 million shares a day) and the top traded ETF due to the correlation with the S&P 500 futures, which are the most heavily traded futures contract in the world.

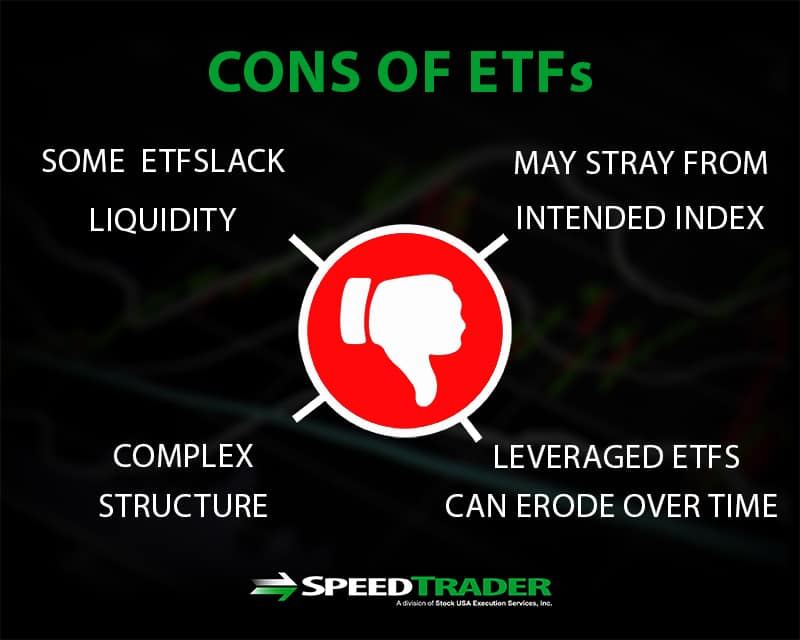

The Cons of ETFs

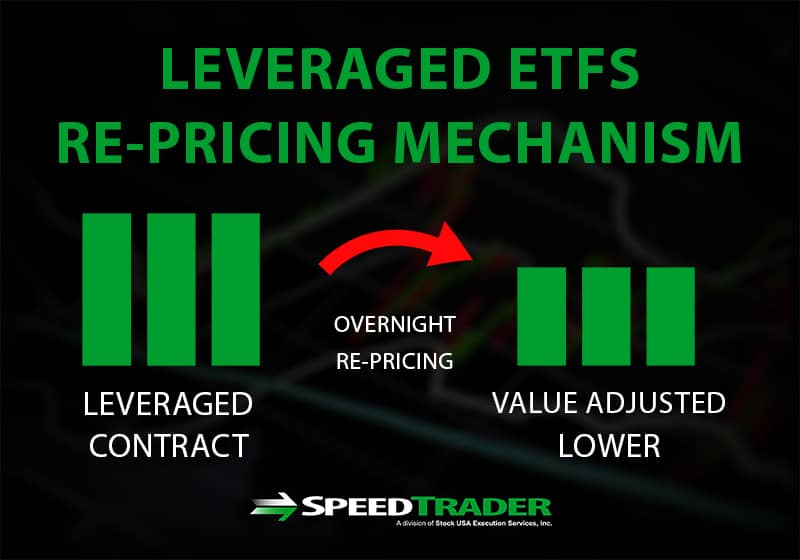

The most costly mistake new traders make with ETFs is holding inversely levered bearish ETFs. These ETFs are designed to inversely mirror the underlying index for one day. They are re-priced nightly. If the index drops, then the bearish ETF should rise proportionately by the leveraged amount. For example, the ProShares Ultra-Short –2X S&P 500 ETF symbol SDS is designed to inversely mirror twice the S&P 500 for a single trading session. This means if the SPY falls 2% then the SDS rises 4%. However, as time goes by, the SDS loses value regardless of market direction. The losses are magnified when the SPY gaps in the morning, due to the re-pricing effect. Therefore, it’s important to understand that bearish ETFs should not be held long-term. It’s safest to use them for a single session or a few days on a swing trade.

ETF Trading Tips

KNOW When You Are Trading An ETF

ETFs tend to be price/market cap weighted just like the underlying indices. This means the most expensive stocks have the most influence on pricing. Unlike an individual stock, the largest stocks in the sector will affect ETFs pricing. Every ETF has a disclosure on the allocations. Be aware of the factors that affect pricing, which also include broad market moves, sector and industry sentiment .

Understand How Leveraged ETFs Work

As covered earlier, leveraged ETFs lose value over time due to the re-pricing mechanism, which erodes value during price gaps and contango. This applies to both bullish and bearish ETFs. The amount of leverage (IE: 2X or 3X) is designed to mirror the performance of the underlying by that amount percentage-wise for the day only.

Use ETFs To Make Broader Market Predictions

ETFs are a great tool to segment performance by sector or broader market, since they hold the underlying component stocks. Charting and tracking the ETF can help to determine trends, support/resistance and potential inflection points. Use the SPY as a leader indicator on stocks and market trends.

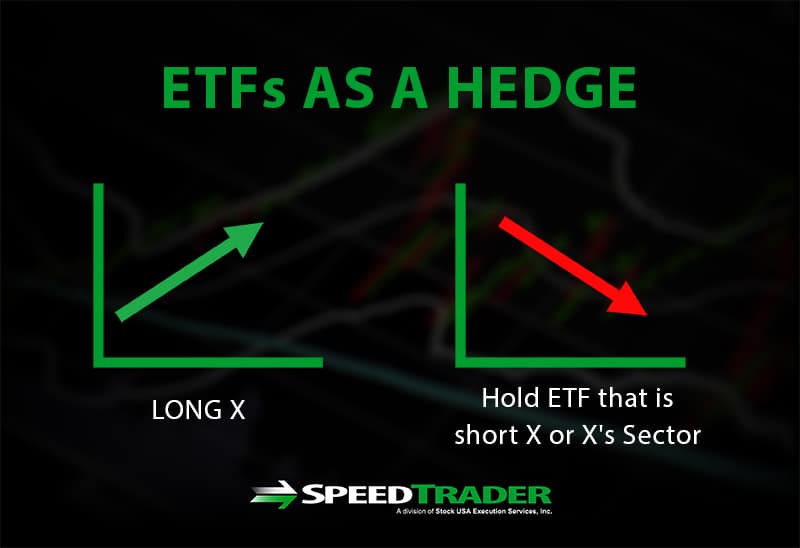

Use ETFs to Hedge positions

ETFs can be used to hedge portfolios. While there are rarely any perfect hedges, you can use specific sector hedges to provide a temporary hedge. Perhaps your portfolio or swing position is long tech stocks ahead of a large market sell-off pattern. You can short the QQQ (Nasdaq 100) as a hedge that will profit in a falling environment to offset some of the losses in the portfolio long positions. Seasoned traders may even opt to use a bearish 3X ETF for an overnight hedge.