A whole world of trading exists beyond simple stock trading, offering additional possibilities, risk, and reward for traders. The futures market is one of the most widely traded markets beyond stocks and enables traders to make financial decisions based on what they expect the future price of a stock, commodity, market, currency, and more to be. This article will cover the basics of the futures market and futures contracts, covering key points about how futures are calculated and used for trading as well as introducing several of the most common futures.

What are Market Futures?

A future is a financial contract that requires the buyer or seller to purchase or offer a specific asset at a predetermined price. The asset at stake can be a stock, a physical commodity, or another financial product, and the contract underlying a future specifies the quantity and other aspects of the asset.

Futures allow traders to profit or loss based on changes in the price of an asset over time. If the price of the asset goes up after the futures contract is set, the trader stands to profit; it the price drops, the traders stands to lose. The timespan of futures contracts can insulate traders from short-term fluctuations in the price of the asset for which the contract is made, and thus can help stabilize markets.

An important feature of futures is that they provide typically provide more leverage than trading stocks. This is because many brokers allow more margin when trading futures – they require only that traders have 5-15% of the value of the futures contracts being purchased as cash in their account, compared to 50% for most stock purchases. The result is that it is possible to purchase a futures contract for far less cash upfront than the value of the contract, and profits and losses are magnified accordingly with each change in the price of the futures contract.

How are Futures Calculated

The current value of a market future is calculated pre-market each day and is typically based on the going cash price of the asset that the futures contract covers. For example, in the case of a futures contract on the S&P 500, the contract price would be calculated by accounting for the current price of the index, the interest rate for cash held out of the market, and the total value of dividends that would be paid out to a trader that actually held positions in all of the stocks in the index.

In a larger sense, the present value of a futures contract is based on the net consensus on what the price of the underlying asset will be at the expiration of the contract. That is, some portion of traders may believe that the asset price will increase into the future, and another portion may believe that the price will decrease – the point in the middle, from which price there are as many traders saying it will go up as saying it will go down, is the price to which both buyer and seller of a futures contract will agree.

How are Market Futures Applied

Leading Indicators

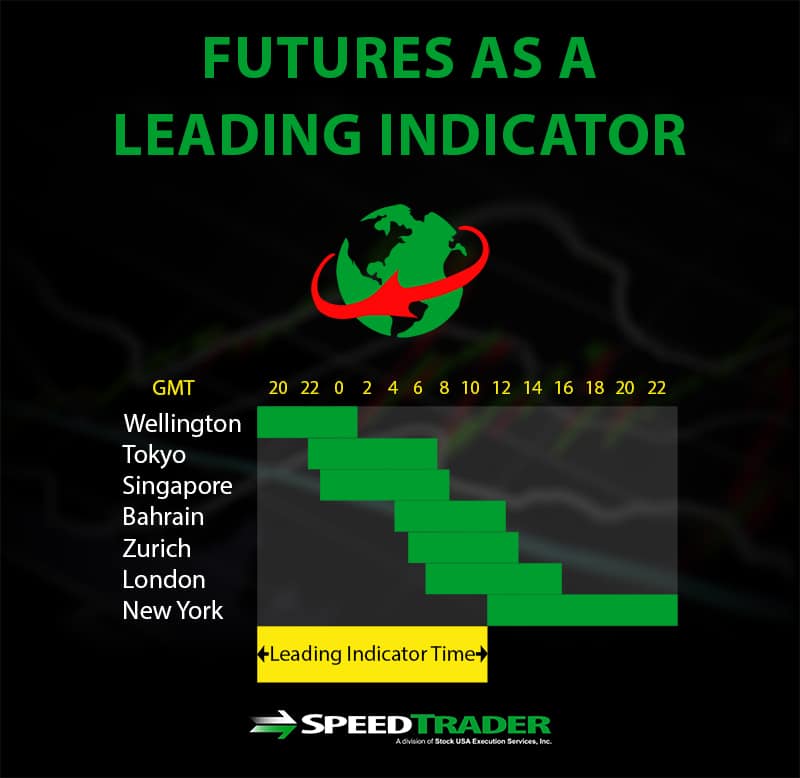

One of the advantages of the futures market over the stock market is that futures, and particularly futures contracts based on the price of the major market indices themselves, are traded 24 hours a day around the world. That means, for example, that the futures contract based on the price of the S&P 500 is continuously adjusting in price based on events globally, even if the price of the S&P 500 itself is only adjusting during market open hours in the United States. As a result, it is possible to predict whether the price of the S&P 500 will gap up or down in the coming day based on whether the price of futures contracts for the index have gone up or down around the world.

The segmentation of trading hours around the globe also makes it possible to identify which markets are potentially driving changes in the price of an index. For example, if the price of the future does not change while the Asian markets are open, but it changes precipitously during the time that European markets are open, it is likely that events in Europe are driving changes in the future outlook of the index price.

Trading

Of course, it is also possible to trade futures contracts themselves. Although some futures for commodities require the physical delivery of the product at the end of the contract, most futures are settled in cash so can be traded without concern for delivering physical goods. Like stocks, futures contracts can be traded long or short to profit from either increases or decreases in the price of a given future.

Unlike stocks, futures contracts have an expiration date – a date beyond which they can no longer be traded. Expiration dates typically occur several times per year, and most traders will sell the contract prior to expiration and “rollover” onto a new futures contract with an expiration date that is further out. However, futures contracts can be traded at any time.

Types of Market Futures

There are several types of market futures available for trading. Historically, futures began with trading based on the anticipated future price of a commodity, such as corn, wheat, oil, or gold. Since some commodity contracts require the physical storage and delivery of goods, the cost associated with these physical inventories may be built into the price of the futures contract.

Today, one of the most commonly traded types of futures contracts is index futures, which are based on not on physical products but rather on the price of a specific market index such as the S&P 500. Stock futures are also common – while the owner of the futures contract does not actually own shares of the stock underlying the contract, this contract is based on the anticipated future price of a specific stock. Futures based on anticipated changes in currency values, interest rates, or other financial derivatives are also available for trading.

Popular Market Futures

Several of the most popular futures among traders are futures tied to the major US indexes. In particular, the S&P 500 e-mini futures contract, which is a less expensive version of the full index future contract, is the single most popular futures contract worldwide. Futures contracts for the Dow Jones Industrial Average and NASDAQ indices are also traded widely.

Another popular market future is the US 10-year treasury note. The popularity of this future stems from the speculation it enables on interest rates in the US, while at the same time the 10-year span insulates it from day-to-day market forces.

Crude oil futures are also traded frequently. These futures tend to be volatile, which offers high risk but also the potential for high reward.

Conclusion

The futures market offers a variety of trading opportunities that go above and beyond what is available from trading only stocks. Futures comes with an increased level of complexity and risk thanks to the additional leverage they provide for trading. However, futures can also be used to inform day trading because they serve as continuous indicators for markets that are only open for a short portion of the global market day. In any case, the futures market, and especially futures for market indices, US treasury bills, and crude oil, is widely exercised among traders.