What Are Options?

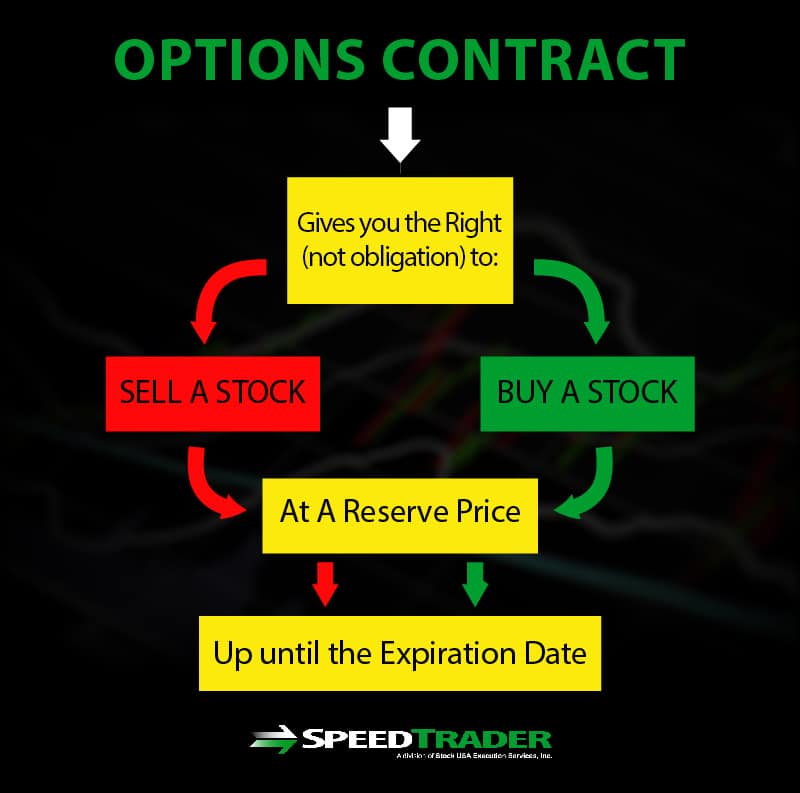

Options are contracts that give the holder the right, not obligation, to buy or sell a stock (or any underlying financial instrument) at a pre-determined price (strike price) up to a pre-determined date (expiration date). In essence, the options contract purchaser may buy or sell the underlying stock at a reserved price up until the expiration date.

House Purchase Example

For a real-life example that illustrates the ultility of options contracts, imagine if you had your heart set on buying the next-door neighbor’s house before he goes to market. Your neighbor would prefer to avoid the costs of going to market and agrees to sell you the home for $300,000. With all the bulldozers and cranes in the area, the value is no doubt going to rise. Since you know the neighborhood well, the $300,000 is a good value.

The problem is you don’t have enough money saved up to buy the house today October 15th. You are expecting your bonus on December 1st, just two and a half months away. Of course in three months, the house could rise in value and your neighbor may be able to sell it at a higher price. On the flipside, the value could drop in value if interest rates start to rise. To reserve the house, you ask your neighbor for an option to buy the house. You tell him that you want to lock-in the $300,000 purchase price that is valid until December 15th. For this option, you offer to pay a 5% premium of $15,000 cash upfront, which gives you the right but not the obligation to purchase the house at $300,000 by December 15th. Should the contract expire without having purchased the house, the seller of the option (your neighbor) would keep the $15,000 and be free to put the house on the market. For $15,000 you have the option to buy the house for $300,000 regardless of what happens to the value of the house.

Equity Options Offer Flexibility

In this example, you lose the $15,000 the moment you sign the contract. Let’s say the house price rises to $350,000 but you no longer want to buy it. You could sell the contract back (or to another buyer) at a higher value before the expiration date of December 15th. This flexibility is what the equity options markets provide.

Replace the “house” in the example with a “stock” and now you are trading options contracts. Options contracts, like stocks, can be traded. Options prices are dynamic and movement is based on the time value (until expiration), the underlying stock’s price moves and volatility.

By this point you should be aware of two main facts:

1. Options give traders the right (but not the obligation) to buy or sell a stock at a specific price before a specific time

2. Options contracts can be executed OR traded

Chicago Board of Options Exchange

U.S. equity options trade through many competing exchanges. The oldest and largest exchange is Chicago Board of Options Exchange (CBOE). The BATS exchange began offering options trading in February 2010 generating almost as much volume as the CBOE. On Sept. 26, 2016, the CBOE Group announced the acquistion of the BATS Global Markets, which reestablished the combined entity as the largest U.S. equities options exchange.

Common Options

There are two types of options contracts, representing the direction of the underlying stock, calls and puts. Options can be taken as a long position or a short position. When a position is taken, it is considered opening a position. When the position is exited, then it is closed. This may seem obvious, but they have to be distinguished ahead of time. It’s easy to confuse the underlying stock for the option, which is not the case. For example, if you are long the puts, it means you are expecting the underlying stock price to fall, even though you have a long position (on the puts).

Calls

Call options are bullish bets that the underlying stock will rise in value. In other words, the holder expects price will move up.

When buying a call option, you will choose “Buy to Open” a call option position.

When selling, you would “Sell to Close” the position.

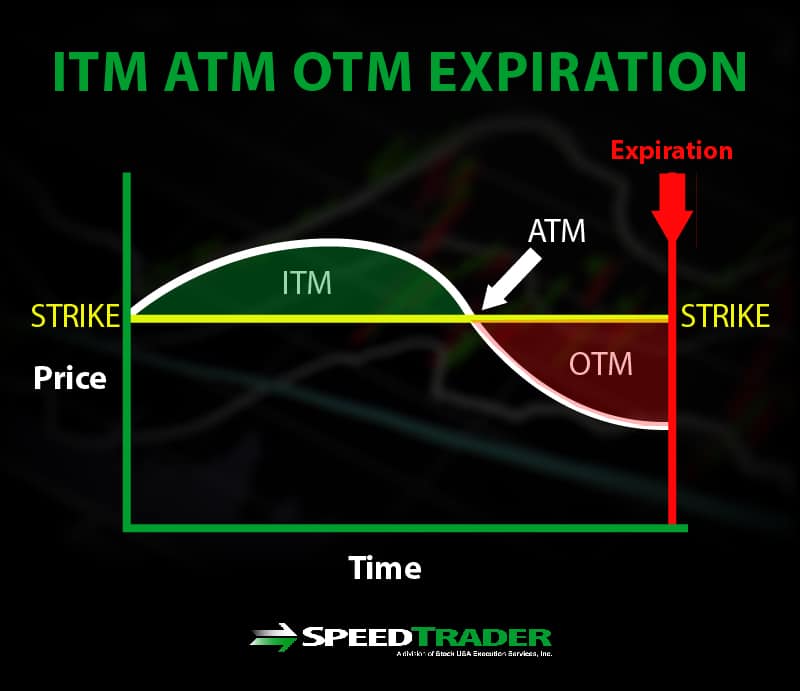

The underlying stock generally needs to trade higher than the strike price in order to be profitable, also known at ITM (in-the-money).

The earlier example using the sale of the house was an example of a call option. You are willing to buy the house at $300,000 if the price appreciates, but would hold off on the decision if the value collapses by the expiration. The seller of the call option risks missing out on the extra profit if the house rises higher than $315,000 ($300,000 plus $15,000 option premium), but would also be able to absorb a $15,000 drop in value thanks to the collected premium.

With stocks, call buyers are looking to profit on the rise in value while limiting losses to just the cost of the option. Call sellers are looking to collect the premium and hope for the stock to close just under the strike price by expiration to keep both the stock and the premium.

Puts

Put options are bearish bets that the underlying stock will fall in value, in other words, the holder expects price will move down. When buying a put option, you will choose “Buy to Open” a put option position. When selling, you would “Sell to Close” the position. Puts buyers are hoping for a sharp drop in the underlying stock’s price, while put sellers are expecting a rise in the underlying stock price. The underlying stock price generally has to trade below the strike price for puts to be profitable, also known as ITM (in-the-money).

Components of an Options Contract

Strike Price

The strike price is the price level that applies to underlying stock’s price. This is the price that an options buyer can buy or sell the underlying stock at.

If the stock is trading at the strike price, the option is considered ATM (at-the-money). If the stock is trading below the strike price, is considered OTM (out-of-the-money) for a call contract and ITM (in-the-money) for a put contract. If the stock is trading above the strike price, then it is considered ITM for the call contract but OTM for the put contract.

Expiration Date

Monthly U.S. equities options expire on the third Friday each month at the end of the trading day. Widely traded stocks also tend to have weekly options, which expire every Friday at the market close. Keep in mind that not all stocks have monthly options, nor weekly options. It is best to check them through your trading platform.

How Do You Trade Options

Options can be traded just like stocks. All options contracts have bid and ask prices, last price and volume. However, the spreads can be very wide depending on the strike price and trading activity. Less volume tends to equate to larger spreads between the bid and ask. There are four ways to trade and utilize options.

Directional Trades

Taking a long position on a call or put option is usually a bet that the underlying stock reach or exceed the strike price. The buyer of the option will usually pay a premium depending on the price of the underlying stock, the volatlity and how many days are left until expiration.

The actual value of the option is the instrinsic value and the premium is the extrinsic value. Therefore if the XYZ $30 call expiring in two months is trading at $2.50, while the underlying stock is trading at $31, then there is a $1.50 premium to the option. The intrinsic value is $1 which represents the $30 strike + $1 difference with where the underlying stock is trading at. Combined with the $1.50 premium, the extrinsic value is $2.50. Therefore, if you purchased the $31 call, you would need the stock to rise to $32.50 to reach your breakeven point. In fact, you would need it to rise sooner rather than later.

Directional trades can also be made as a hedge to protect a portfolio. For example, you own 500 shares of XYZ ahead of their earnings release. You are a long-term holder and want to protect your gains, so you can buy 5 put contracts as a hedge in case the stock collapses on the results.

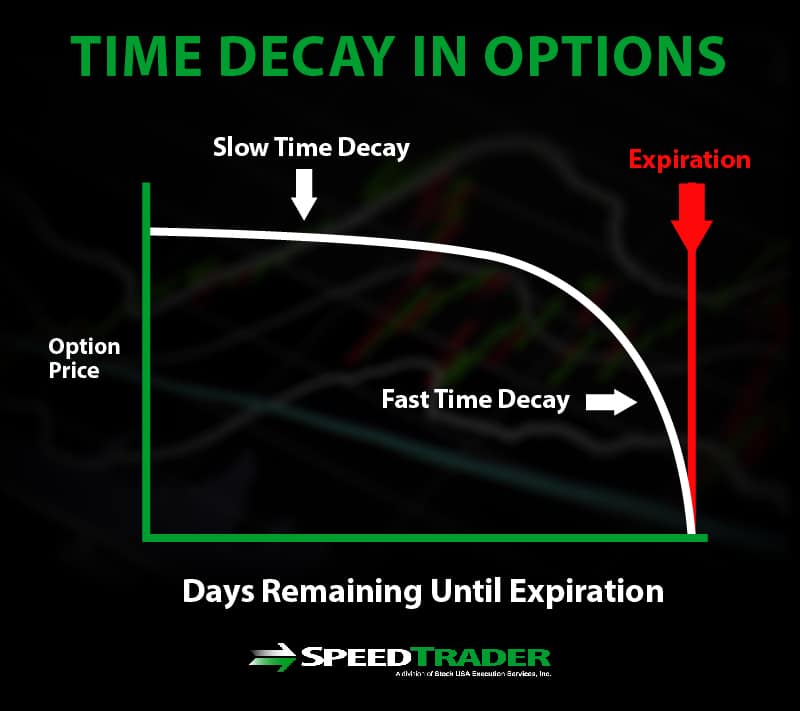

Time Decay

The longer it takes to rise, the more premium value it loses from time decay, labelled as the Greek letter theta. The goal of directional trades is to profit from a sharp and quick move to or through the strike price in the shortest amount of time. The problem for directional options trader is the erosion of premium as volatility drops and time decays. Therefore, if the stock price stays the same, you would lose money every day you maintain the options position.

Exercise The Option

If you decide to actually buy/sell the stock at the strike price, you can exercise the option. This would allow you to purchase the stock at the strike price of the option any time up to expiration date. For example, if you own the $30 calls on XYZ and the stock is trading at $33, you can exercise the calls to purchase XYZ at $30 per share, as long as you have the required capital in your trading account.

For puts, you would be selling your shares of the underlying stock to the options seller at the strike price. For example, if you own the $30 puts on XYZ and it is trading at $27 a share, the option seller would have to buy the shares back from you (you would sell your shares) at the strike price of $30. This is why investors’ use put options for protection in falling markets.

Hedging

Investors with long stock/portfolio postitions worried about impending sell-offs can decide to purchase put options as a hedge. The purpose of a hedge is to protect the value of a long position(s) by taking an equivalent short-sell position(s). As the value of the stock/portfolio drops, the value of the put option rises. The cost of the option is a necessary expense like insurance for peace of mind. While this isn’t a perfect hedge, it is the simplest to administer.

Income Generation

Just like the “house” buying example mentioned earlier, every options transaction requires two parties, the option buyer and the option seller. The seller must actually own the stock, or “house” as in the earlier example. The seller offers the options contracts out to bidders to collect the premiums. This is also called writing a covered call or selling a call. Income can be generated when performed on a regulary basis. The risk or the option seller is that the stock position may get exercised or assigned if the option expires ITM or ATM in some cases. Selling options without owning the underlying stock is called naked selling. It is extremely risky as the seller must go into the open market and purchase the shares if the option gets exercised. The losses are virtually unlimited with naked options.

Benefits of Options

For Investing

Investors can benefit with options contracts in many ways. They can use options as a form of insurance by hedging their stock/portfolio positions, when they feel turbulent market conditions or potentially negative catalysts are approaching. Options allow for long-term investors to write covered calls to generate monthly or even weekly income from stocks in their own portfolio.

Cheaper Bets and Limited Losses

Self-directed investors can also place cheaper speculative bets with directional options trades, without having to tie up the capital to own the stock. It is more economical to own 10 call options on XYZ, than actually owning 1,000 shares. For example, if XYZ is trading at $50, you would need $50,000 in buying power to buy 1,000 shares. The $50 XYZ call option may be trading at $1, which would only cost you $1,000 to control 1,000 shares of XYZ compared to the $50,000 needed to own the stock.

Deep ITM and Leap Options

Investors should be aware of the time decay that erodes the value of the options contract. The longer the options are held, the more value they lose. The exception applies to options that are deep in the money (ITM) or leap options. Leap options expire at least one year or more from the day you purchase them. Long-term investors may opt for leap options, but the thin volume will result in wide spreads, which can add considerably to the actual cost of the option. From a risk perspective, investors will appreciate the maximum loss on a directional options trade is limited to just the cost of the option itself, unless they are selling naked options.

For Day Trading

Options can be traded like stocks. Since a single contract represents 100 shares of stock, they provide more leverage for less cost. This allows traders to tie up less capital to benefit from stock ownership. Percentage wise, options carry much more volatility compared to the underlying stock. For example, a 5% move in a $100 stock can result in double to triple digit percentage moves in the options depending on the strike price and expiration. The weekly options carry the most volatility and price swings. The downside is 100% loss of investment with options that expire worthless and most of them do. The key is to scalp the profits quickly before the volatility tails off and time decay grows.

Complex options strategies for income generation include debit/credit spreads, calendar spreads, straddles, butterflies and iron condors, which can be employed by both seasoned investors and traders.

How To Read an Options Chain

While a stock has just one price based on the last trade and an inside bid and ask price, the underlying options are arranged by strike prices, usually in $0.50 to $2.50 increments. When placing an options trade, you will have to pull up an options chain for the specific stock. Options contracts are quoted in options chains. These are a list of all the call and put options available for the stock. The left side shows the call options generally arranged by options symbol, strike price, bid, ask and open interest and expiration month. These can be customized on most trading platforms. The right side displays the put options with the identical headings including options symbol, strike price, expiration and open interest. The full options chain can be large, so most traders will limit it to the nearest strike prices that the stock is trading around. Check with your online broker for exact display settings.