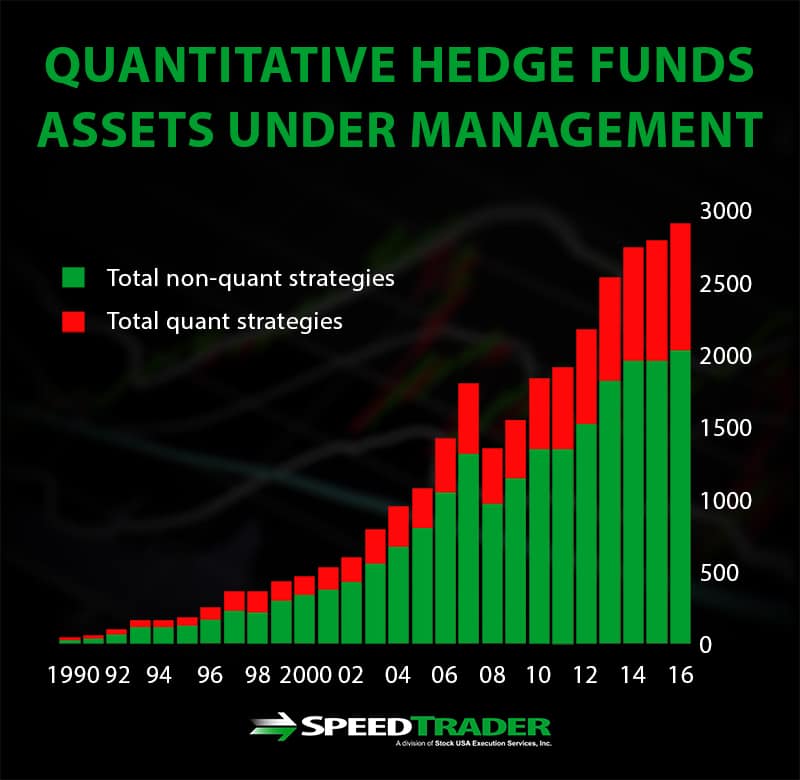

Over the last decade, we have seen a parabolic rise in quantitative trading. The story cannot be told with a simple chart displaying quant funds AUM; quantitative thinking has permeated the entire industry, trickling down to the most qualitative aspects of finance. Fifteen years ago, MBA graduates dreamed of being high-flying risk takers like that of SAC Capital’s early traders, now they’re learning Python and R, spending late nights focused on data mining.

What is Quantitative Trading?

In a nutshell, quantitative trading is making trades decisions based on large amounts of data. The term casts a wide net, there’s algorithmic trading, high-frequency trading, market making, arbitrage, and many others. They all come down to a programmer trying to find repeatable patterns in market data to profit over a large amount of occurences.

Types of Quantitative Trading

Algorithmic Trading

Algorithmic trading, a relative term, usually refers to a more basic trading system that is automated by an algorithm. In contrast to a statistical arbitrage system, algo trading systems are usually based off fewer criteria.

The term algorithmic trading doesn’t necessarily imply anything complex. Many systems are simply automated versions of what everyday technical traders use. A simple example of a algorithmic trading system would be a moving average crossover system. Everytime the 50-day simple moving average crosses over the 200-day moving average, get long. When the 50-day crosses under the 200-day, close the position.

High-frequency Trading

HFT is one of the most controversial corners of the market. HFTs are often referred to as thieves, who are “rigging” the market against the individual investor. The strategy was the subject of a New York Times bestseller, Flash Boys by Michael Lewis.

There is a great deal of diversity in the strategies employed by HFT firms, however, a lot of strategies they employ can be classified as market making strategies. HFTs have a significant edge over your average market maker. Those being:

- Colocation: Moving the firm’s computers as close as possible to the exchange they’re trading on. This results in a speed edge. Firms have bid up the real estate located close to stock exchanges to insane prices.

- Payment for order flow: HFT firms pay top brokerage firms millions each year to get a look at their orders before they’re sent to rest of the market.

- Imagine you place an order from your brokerage account to buy 100 shares of XYZ. Because many retail brokerages receive payment for order flow, someone else, most likely an HFT firm, is getting a chance to interact with that order before it hits the order book.

Statistical Arbitrage

While the name sounds complex, the premise of statical arbitrage is quite simple. It involves identifying micro inefficiencies in liquid markets and taking advantage of them. Many of these strategies were formally taken advantage of by human traders, and still are. Others can only be achieved through HFT.

For example, when an ETF’s price drifts away from it’s NAV, or trading the difference between two similar S&P 500 ETFs, like SPDR’s SPY or iShares’ IVV.

The Democratization of Quantitative Trading

Like most new trading developments, the first to employ the tactics are usually institutions and hedge funds. As quantitative analysis and trading became “mainstream” in finance, individual investors began to try their hand at it.

New tools that aim to democratize the access to programming libraries and backtesting software were called the “latest DIY craze” by the Wall Street Journal, signalling its popularity among individual investors.

Additionally, more and more non-quant targeted trading platforms like charting platforms and stock screeners are adding backtesting, proprietary scripting languages, and other support for potential quants. Day by day, less programming knowledge is required to create and backtest basic algorithmic trading strategies.

Strategy Development

Idea Generation

Finding actionable ideas to program is one of the biggest obstacles for quants. It can be risky to “throw spaghetti” at the wall, as you run the risk of curve fitting, or over-optimizing your strategy to fit a data set.

Because of this, quants usually want to ensure their ideas have a fundamental basis. So they browse trading forums and blogs, read books, academic journals, and news, and talk to other quants. Even just sitting down at your terminal and watching the market can spur some of the best ideas. Humans have an instinct to search for patterns in everything, so your hunches from watching market data may just have some basis in reality!

Putting the Strategy to a Test

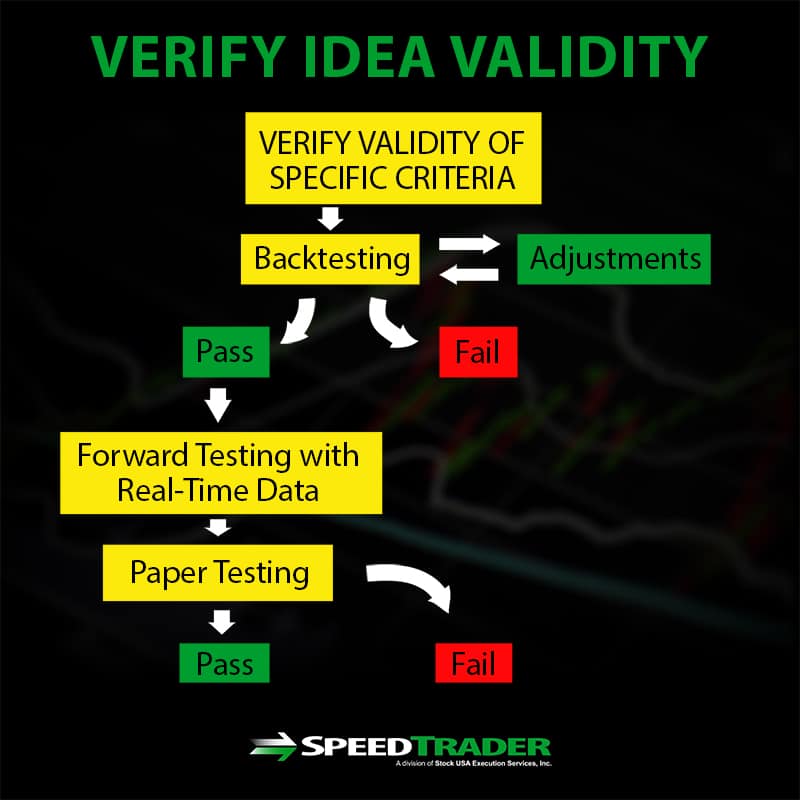

Once a quant has an idea they think can produce an edge, the next step is to verify it’s validity. This is done in various ways, the first is through backtesting.

Backtesting is testing a strategy against historical market data to see how it would have performed over time. One can run into many problems when backtesting a strategy, misleading them about the validity of their strategy. A large enough sample size, and amount of trades is required. That means market data during bull and bear markets, and where black swan events occured.

Before one can backtest a strategy, they must have a specific set of criteria to trade. “Buying pullbacks in uptrends” cannot be quantified or backtested, but “buying the first close below the 20-day EMA after a 55-day high has been broken in the last 10 days, while the price is above the 200-day SMA” is a quantifiable strategy that can be backtested and automated by an algorithm.

Forward testing involves taking a successfully backtested strategy and testing it on real-time data with a paper-trading account. This step is vitally important because of the factors we laid out before. Some degree of curve fitting, intentional or not, will always occur in backtesting, because you are looking for the best performance based on that historical data. Forward testing will allow your strategy to be played out on fresh data that your backtest couldn’t optimize its performance for.

Testing your strategy on out of sample data is another important step in verifying a strategy’s validity. It involves not including a certain period of data in your backtest, and using that period of data after you’ve found the best results on your first backtest. Significantly reduced returns on the out of sample data implies some degree of curve fitting occurred during the first backtest.

Pros & Cons of Quantitative Trading

Pros

- Save time by automating strategies that require no intuition

- High scalability

- Consider the robo-advisor industry, and how quant trading makes their margins much better

- Not falliable to human error.

- Computers are more efficient at data analysis and trade execution

Cons

- No qualitative human element to judge

- Requires vast knowledge of trading, investing, mathematics, programming, and data science

- Bad analysis will lead you to losing money on autopilot

- Some of the most profitable strategies (i.e. HFT) require massive capital expenditures