Chasing high-performing stocks, buying high and aiming to sell higher, is known as momentum trading. Momentum stocks are those with long-term uptrends, typically over a period of three to 12 months, with consistently high rates of return over the same period.

Momentum vs. Value

The theory underlying trading momentum stocks differs fundamentally that governing trading value and growth stocks. Value stocks are identified by finding stocks whose current worth are higher than their current prices, while growth stocks are those for which the current price does not reflect future value. For both value and growth stocks, the objective worth of the company the stock represents is essential to determining at what price to buy. For momentum stocks, on the other hand, the value is irrelevant – the assumption is that the value of the stock will continue to increase according to its current trend, at least in the short term.

Momentum trading has historically outperformed value-based trading while the uptrend continues. Take, for example, the tech boom of the 1990’s, when technology stocks vastly outperformed the market up until the momentum collapsed. However, momentum trading is necessarily short-term since it requires frequently moving capital from stocks whose momentums are petering out to those who are beginning to heat up. Thus momentum trading involves placing a much larger number of trades than value-based trading, which in turn can incur additional trading fees and be disadvantageous from a tax standpoint.

Typically, momentum stocks are performing at their best when the market as a whole is pushing towards new highs. In this case, investor sentiment tends to be optimistic and numerous stocks are setting continuous uptrends. When the market is nearing its bottom, on the other hand, value stocks are a better trading choice. While momentum stocks may exist, they will be less common across a bear market and many dependable stocks are likely to be undervalued relative to their objective worth.

Momentum Stock Criteria

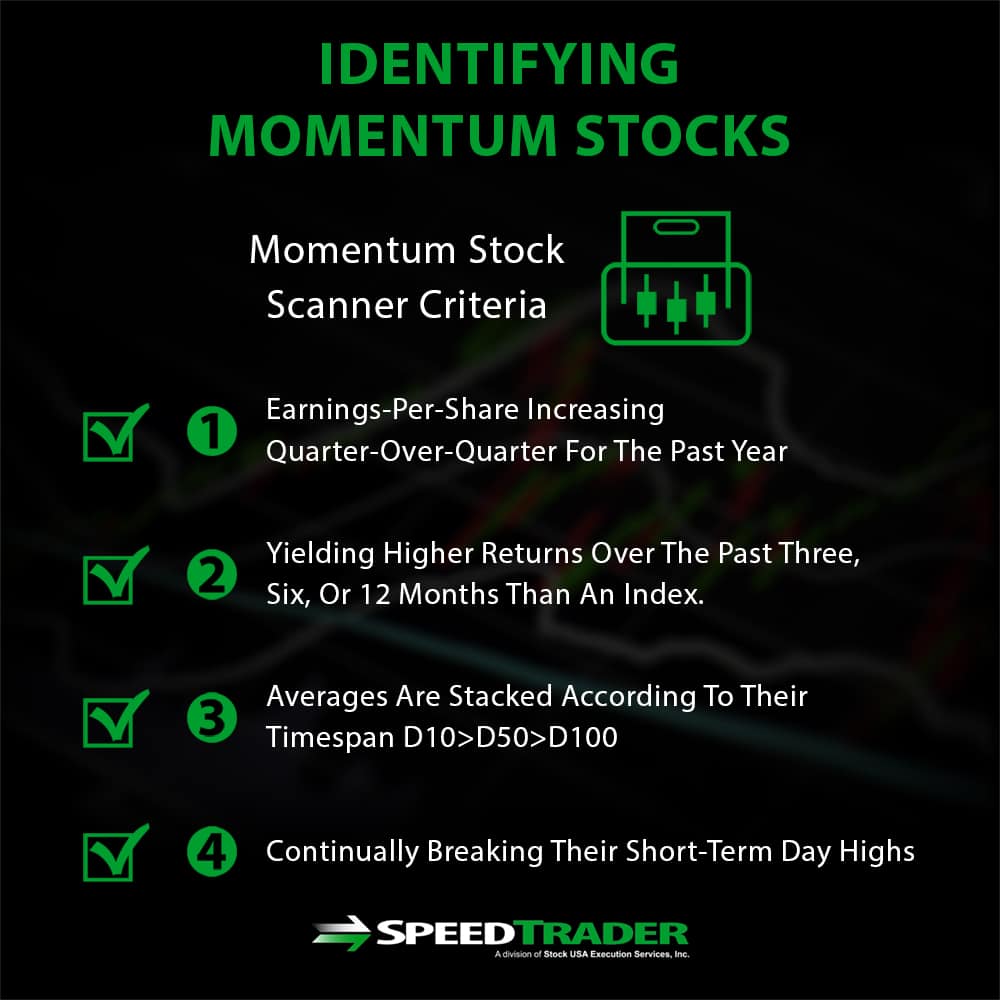

Identifying momentum stocks within the broader market is the first step in momentum trading. There are several distinct criteria that can be used, either separately or in combination, to narrow down trending stocks to those truly experiencing momentum. The best way to apply these criteria is through a stock scanner that will return a small list of potential momentum stocks that can be further analyzed before trading.

Earnings Growth

One of the characteristics common among momentum stocks is that they consistently report growing earnings-per-share and revenue. Many momentum stocks also tend to outperform analyst predictions when earnings reports are released. To find stocks with accelerating earnings, scan for stocks whose earnings-per-share have increased quarter-over-quarter for the past year and whose most recent earnings-per-share was significantly higher than for the same quarter last year.

High Returns

Since momentum stocks tend to outperform the market in the short-term, a simple method for identifying potential momentum stocks is simply to scan for stocks that are yielding higher returns over the past three, six, or 12 months than the S&P 500 or another index. A first pass scan is likely to yield a large number of stocks, which can then be narrowed down by repeatedly removing the bottom 10% until the list is short enough to investigate each stock further.

Positive Short-Term Averages

When a stock is consistently trending upward – as a momentum stock should – its short-term moving price averages should consistently be higher than its long-term moving price averages. Thus, it is possible to identify momentum stocks by scanning for those whose averages are stacked according to their timespan. In practice, this could mean searching for stocks where the 10-day moving average is greater than the 50-day moving average, which in turn is greater than the 100-day moving average.

Setting New Highs

Another outcome of the consistent uptrend characteristic of momentum stocks is that the stock will be frequently setting new highs, only to break those highs by moving even higher. The key here is determining how your trading plan matches with the period of the highs. For day trading, for example, momentum stocks that are continually breaking their four-day highs are more appropriate targets for momentum trading than stocks that are breaking their 20-day or 55-day highs.

Conclusion

Momentum trading can be quite risky since it is rarely clear for how long a stock’s momentum will last. Choosing your entry into a position wisely is critical since the decelerating momentum can quickly ruin a momentum trade and the reversal can be severe if the stock is considered overvalued at the end of its uptrend. When searching for momentum trades, it is often better to establish positions in stocks whose momentums are just maturing rather than those whose momentums may be aging. Typically, it is best practice never to hold momentum stocks overnight once the momentum appears to be waning.

However, when used in concert with a broader trading plan, momentum trading can be a viable and profitable strategy. An example is to use momentum as a factor in discriminating among value stocks to invest in or for determining entry and exit points for a value stock. In addition, momentum can be used as a short-term strategy in the broader context of long-term value-based strategy. However you choose to apply momentum trading, it is important to understand the difference between momentum-based and value-based investing and to be able to recognize and find stocks that have momentum.