What is Pre-Market Trading?

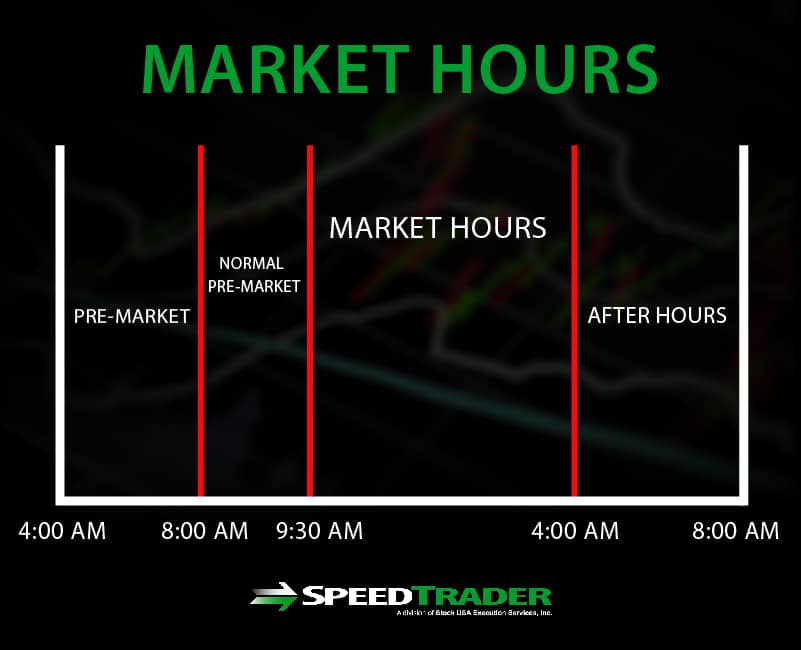

Pre-market trading is the activity of making trades before the U.S. equities market’s opening bell at 9:30 am EST. Depending on your broker, trades can be made as early as 4:00 am EST when many ECNs officially open like ARCA and ISLD. Broader volume tends to come into the market at 8:00 am EST when most retail discount brokers provide access.

Who Can Trade Pre-Market?

Any trader with an online brokerage account is allowed to trade pre-market, however, the broker determines the hours and restrictions. As for who should trade pre-market, that is based on the individual trader and their methodology. Generally, newbies and beginners should steer clear of pre-market trading because the reactions can be extreme, causing massive damage if trades are not managed prudently.

What To Look Out For

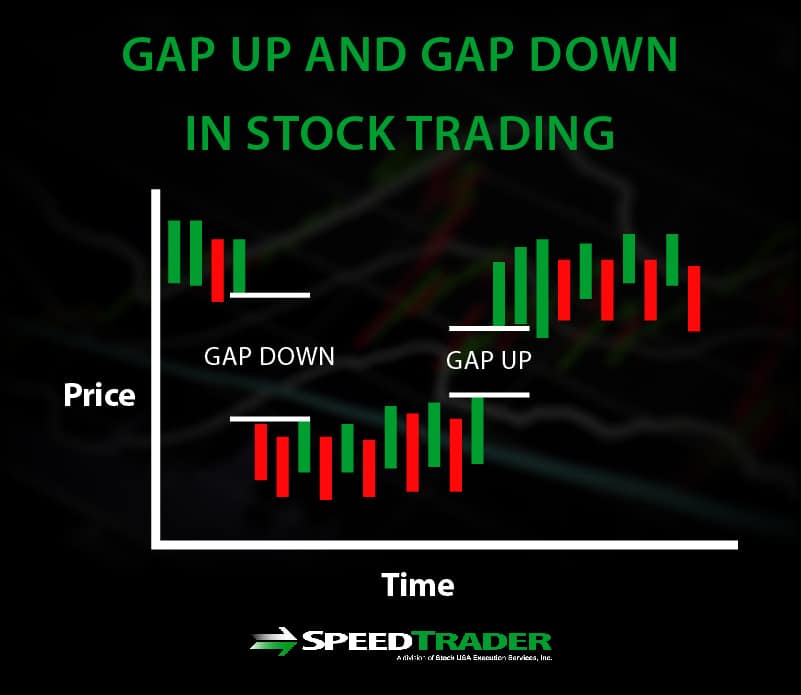

Pre-market trading comes with a lot of risk. In most cases, there is no reason to even consider pre-market trading unless there is a news event that is causing a gap up or down in the stock (IE: earnings reports, FDA decision, court rulings). Widely traded stocks may gap up or down with the S&P 500 futures, but it’s important to observe the slippage created from wide spreads indicating less liquidity. Even some of the most widely held stocks can have very wide spreads with virtually no volume in the pre-market.

Liquidity

Pre-market has less liquidity because market makers and specialists are absent leaving only ECN routes to place trades. Since there are less participants, the bid and ask spreads tend to be much wider. Additionally, there are invisible orders and reserve orders a plenty. High frequency and algorithmic trading programs tend to be absent in pre-market since the liquidity is so shallow.

Generally, NYSE stocks tend to have notably wide spreads due to lack of specialist participation pre-market. Since Nasdaq is an electronic exchange, these stocks tend to have less wide spreads but unless the underlying stock is part of a benchmark index, don’t expect much liquidity. Of course, all that changes after the opening bell.

Why Trade Pre-Market?

With all the dangers of thin liquidity, extreme volatility, lack of market makers/specialists, lack of high frequency trading programs and extreme price moves, why would anyone risk trading pre-market? The answer includes all the same reason to not trade. The lack of algos and market makers leaves the impression of a more accurate market, but that’s just an illusion. Oftentimes, stocks can spike in the pre-market and then reality sets in after the opening bell as sellers flood the market taking the price right back down. Pre-market trading can be very deceiving and should only be reserved for seasoned experienced traders.

Gappers/Dumpers

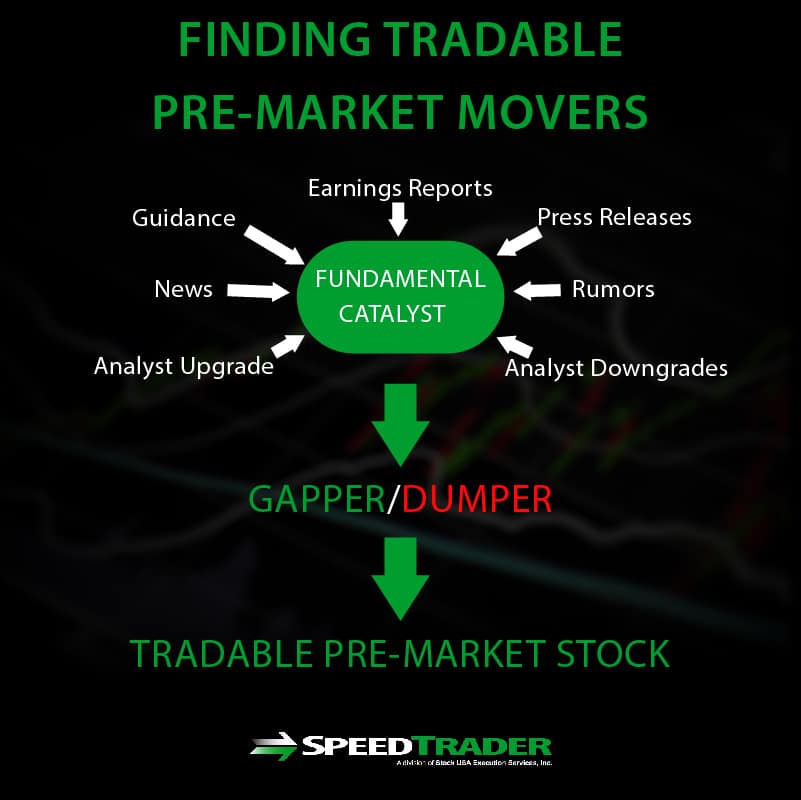

The most viable types of stocks worth trading pre-market are gapper/dumper stocks, usually during earnings reporting season. These are stocks that gap with volume up or down in reaction to a fundamental catalyst like earnings reports, press releases, news, rumors and analyst upgrade/downgrades. Notably, stocks that are gapped in reaction to earnings reports and guidance tend to get the most consistent volume, follow through and tradability.

Pre-Market Trading Tips

Understand the Environment and Trade Accordingly

Be aware of the dangers of thin liquidity, wider spreads, and less participants. There is no reason to trade pre-market unless there is a catalyst that is driving heavy volume on a gap. Even then, most traders will be best suited to wait for the market open. In fact, waiting for at least 9:45 am EST gives three 5-minute candles to interpret before making a trade is applicable for intra-day traders.

Wait for Regular Market Hours Unless There’s a Good Reason

The pre-market should be observed, not played, for most traders. It’s a good opportunity to observe how gapper/dumper stocks are trading, so that they can be played during regular market hours when there is more liquidity. Pre-market activity should be analyzed in creating your trading plan going into the day. Specific support and resistance areas can be eyeballed and confirmed on the charts and noted for potential triggers during regular hours.

Use Direct Access Brokers

Since pre-market trading is done through ECN exchanges, you should only consider trading during these time period if you have a direct access broker. You should be able to route your orders directly to selected ECNs. It’s also beneficial to have the ability to place hidden orders and reserve orders, since the other participants are likely doing the same thing.

Consider Trading Sector Peers and Sympathy Stocks

If a stock is gapped extremely large (20% or more) with volume, it may cause the rest of the sector/industry peer stocks to gap as well. These laggards and peers are often a good trading alternative if the lead stock is too volatile. Usually, the laggards will follow the lead stock that is gapping during market hours. There are opportunities to trade the laggard in anticipation of a deeper move in the direction of the gapper stock.

Have Pre-Market Charting

It would naturally make sense to have pre-market charting capabilities. This depends on your trading/charting platform. Don’t trade blindly without charts in the pre-market. It’s like going into a war without a map of the battlefield.

Have an Effective Trading Methodology

Impulse trading is the worst thing anyone can do in the pre-market. The action is meant to knee jerk traders in and traps them to panic out. Have a working trading methodology that combines price and momentum indicators with a multi-time frame filter. Be sure you know where multiple support and resistance levels are and plan your trades. Most importantly, be disciplined to keep stops. The magnitude of the price movements can cause a “deer in the headlights” syndrome that ends up trapping traders until the pain is too great of they get margin called out.

Don’t Over Leverage

It’s tempting to load up on stocks pre-market, but that can be the means to an account blowout. Be extremely frugal using margin and trade less shares than you normally would during regular market hours. When momentum shifts, the liquidity can literally vanish before your eyes because there are no market makers to stabilize prices.

Forced Liquidations on Margin Calls

Many brokers will adjust margin requirements after the opening bell on stocks that are extremely volatile. This can backfire for traders that over leverage a position going into the open as margin requirements change. If you are fully leveraged 4 to 1 and the margin changes to 2 to 1, you can face a forced liquidation literally on the open. This happens regularly to unsuspecting traders.

Stock Halts

It’s always imperative to check if a stock is coming out of a halt. Stocks that gap or drop over 20% are susceptible to trading halts pre-market. No trader wants to be stuck in a trading halt because there’s no telling where it will open back up again. Therefore, it’s important to make sure the stock has already come out of a trading halt rather than risk a trading halt, especially if there is no news.