Trade commissions charged by your brokerage every time you buy and sell stocks can quickly add up and eat into your trading profits. While you may not be able to avoid commissions altogether when trading, it is possible to lower your commissions and improve your profit margins with a few simple changes.

The Costs of Being a Trader

Trade commissions are part of the costs of being a trader. Just as a manufacturer has material costs in making a product, trade commissions are part of the cost of doing business as a stock trader. An important thing to remember about trade commissions, though, is that even if they could be lower, they should not make or break your trades. If your margins on trades are commonly narrow enough that commissions can determine whether or not your trades are profitable, you likely need to reconsider your trading strategy.

In addition, while saving money on trade commissions can be helpful in increasing your profits from trading, don’t get carried away with cutting trade commissions. Having a broker you trust, a trading style that is profitable regardless of commissions, and a strong strategy for every trade you make is far more important in the long run.

Ways to Save

Find a Better Rate

Chances are, there is a cheaper broker out there than the one you’re currently trading with. Discount brokers typically offer fewer services, particularly less human-based customer service and investment advice, but offer significantly lower trade commissions than full-service brokers. Some investor-centric discount brokers also discard the ability to trade mutual funds and ETFs in favor of offering stock trading, often at a lower price per trade than brokers that offer fund trading.

Negotiate with Your Broker

Brokers will often negotiate commissions with active traders. Unlike investors who may place a few trades per quarter, a trader is generating commissions daily. Typically, the more volume you trade with your broker the more likely you are to be able to negotiate a lower commission rate. In addition, how successful you will be when negotiating with your broker depends on factors such as the size of the brokerage, how long you have been with that brokerage, and what classes of trade commissions you are looking to reduce.

Switch to Per Share Pricing

The typical trade commission structure for stocks requires you to pay a flat fee per trade, no matter how many shares are bought or sold in that transaction. A per-share rate allows you to pay according to the number of shares you trade rather than the number of trades you make.

This type of commission can be extremely useful for day traders trading moderate volumes, especially when scaling in and scaling out of trades in multiple transactions. For example, when scaling into a position and placing four buy orders of 400 shares each at a flat commission of $5, the total commission paid is $20. However, at a per share commission of $0.005, the total commission over all four trades would only be $8.00. Over time, these savings can add up for active traders.x

Note: Per-share commissions generally have an order minimum (i.e. $2).

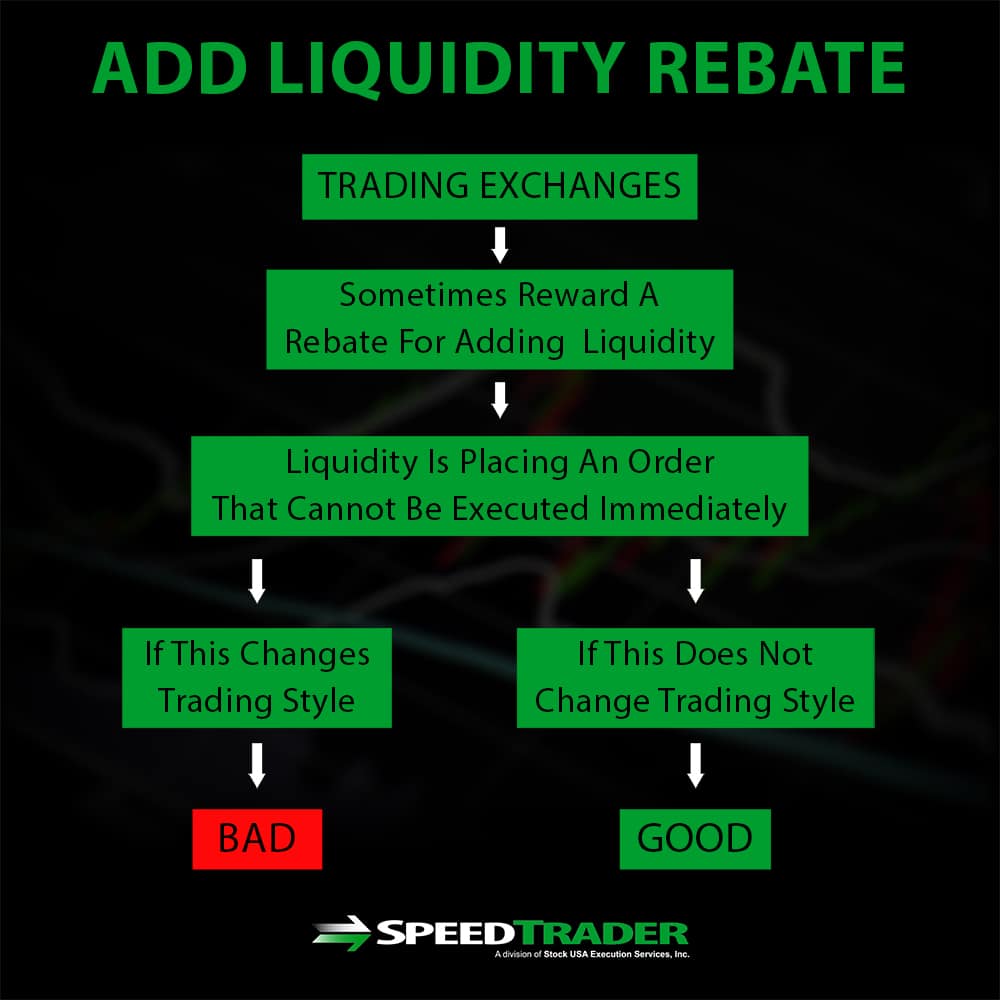

Add Liquidity

Some exchanges will offer a rebate for adding liquidity to the market, which can then be applied against your broker’s commissions to help offset that cost. Liquidity is considered to be added to the market when you place an order that cannot be executed immediately – for example, a limit order that is above or below its execution price. It is usually not wise to change your trading style to receive these rebates, especially since aiming to add liquidity can cause positions to go unfilled or to be filled at a disadvantageous price when prices are changing rapidly. However, it is worth keeping in mind when immediate trade execution is not essential.

Review Your Trading Style

If you find yourself being charged a significant amount in trade commissions, in addition to your commissions being too high your trading style may be to blame. The more trades you make, the higher your commissions will be – so trading too much is very possible, especially if you are making trades that are not of high quality. Scaling in and out of positions using a large number of trades can also multiply your commissions if you are being charged a flat fee per trade, so ensure that you are balancing commissions against risk when scaling. Reviewing your trading style and identifying where the bulk of your commissions are coming from can be one of the best ways to begin the process or reducing your trade commissions.

Conclusion

Trade commissions are part of the costs of being a trader, but your trade commissions shouldn’t be extravagant. Although lowering commissions should not be your main focus when trading, these five changes are easy to make and will help you reduce your commissions and increase your overall profits from trading.