What is Short Selling?

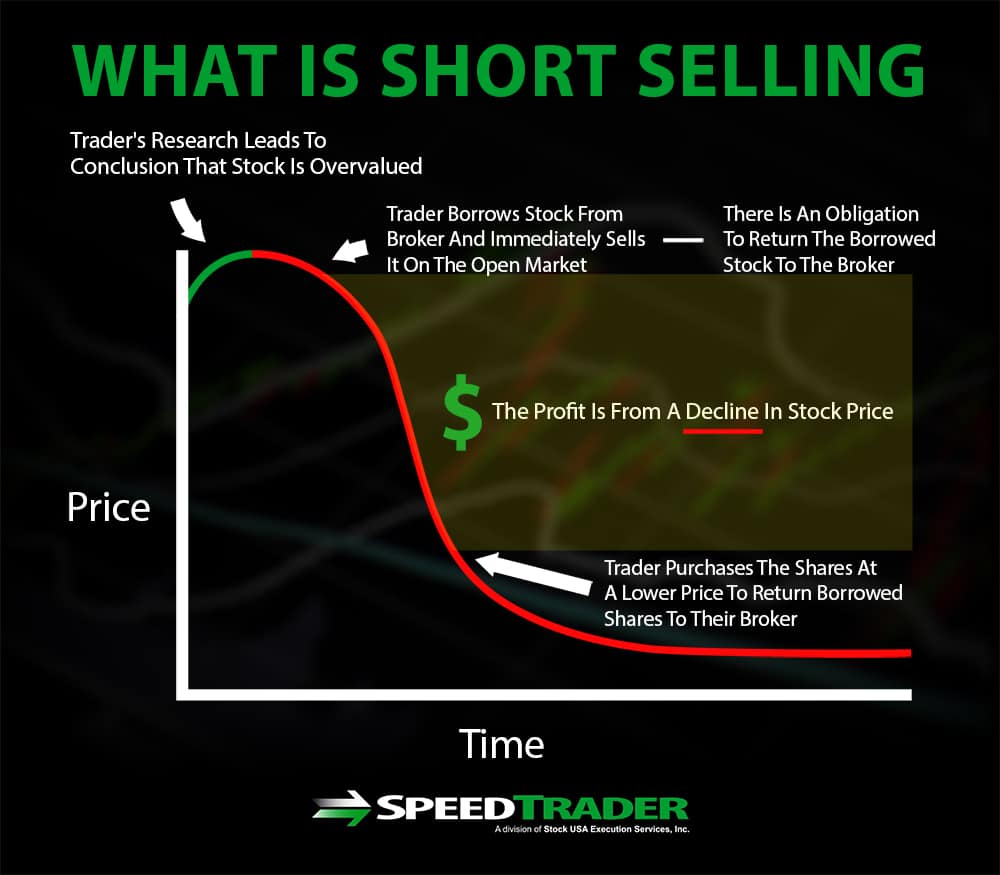

Short selling is essentially the opposite of purchasing a stock and allows traders to profit when the stock price drops. Rather than directly buying a stock, short sellers borrow a stock from their broker and then immediately sell the borrowed shares at the current price. If the stock price drops, as the short sellers predicted, they can then purchase shares at the new, lower price in order to return the shares they borrowed from their broker. On the other hand, if the stock price increases, the short sellers take a loss because they have to re-purchase shares at a now higher price in order to pay back the shares they borrowed from their broker.

When did Short Selling Start?

Although short selling is common practice in trading today, it was not always around. Short selling is thought to have originated in the Netherlands by Isaac Le Maire, a stockholder of the Dutch East India Company, in 1609. Le Maire is said to have shorted the Dutch East India Company by speculating on ships being lost at sea or valuable cargo being lost during the long transport between the East Indes and Europe.

General Reception of Short Selling

Positive Reception

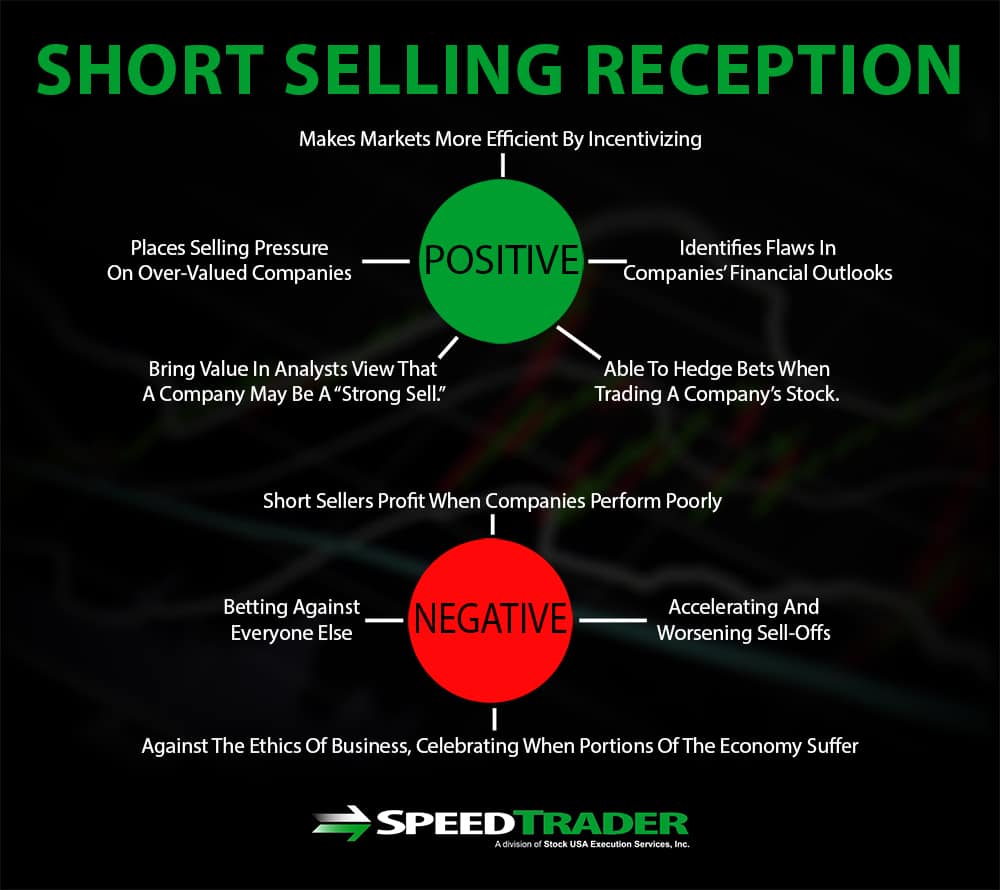

Although rampant short selling can be problematic for markets, particularly during moments of panic, short selling is generally considered to be a good thing for the market. Short selling makes markets more efficient by incentivizing investors to place selling pressure on over-valued companies and identify flaws in companies’ financial outlooks. Short selling can also lead to better market research, since with short selling as an option there is value in analysts suggesting that a company may be a “strong sell.” Finally, short selling is critical for investors, and particularly institutional investors, to be able to hedge their bets when trading a company’s stock.

Negative Reception

Despite the services that short selling provides for the market as a whole, short selling and those who sell short are generally despised both among other traders and among the public at large. Part of the reason for this is that short sellers profit when companies perform poorly, which goes against the ethics of business and results in celebration when portions of the economy suffer. Short sellers themselves are also disliked in part due to human nature – they are outside the main pack of investors, betting against everyone else.

Short selling also has a bad reputation because of its role in accelerating and worsening sell-offs, such as those that led to the Great Depression and the more recent 2008 recession. Many countries have, at various points in history, implemented temporary regulatory bans or rules around short selling in order to limit the damage that short selling can do to markets during major sell-offs.

History of Regulations

The Uptick Rule

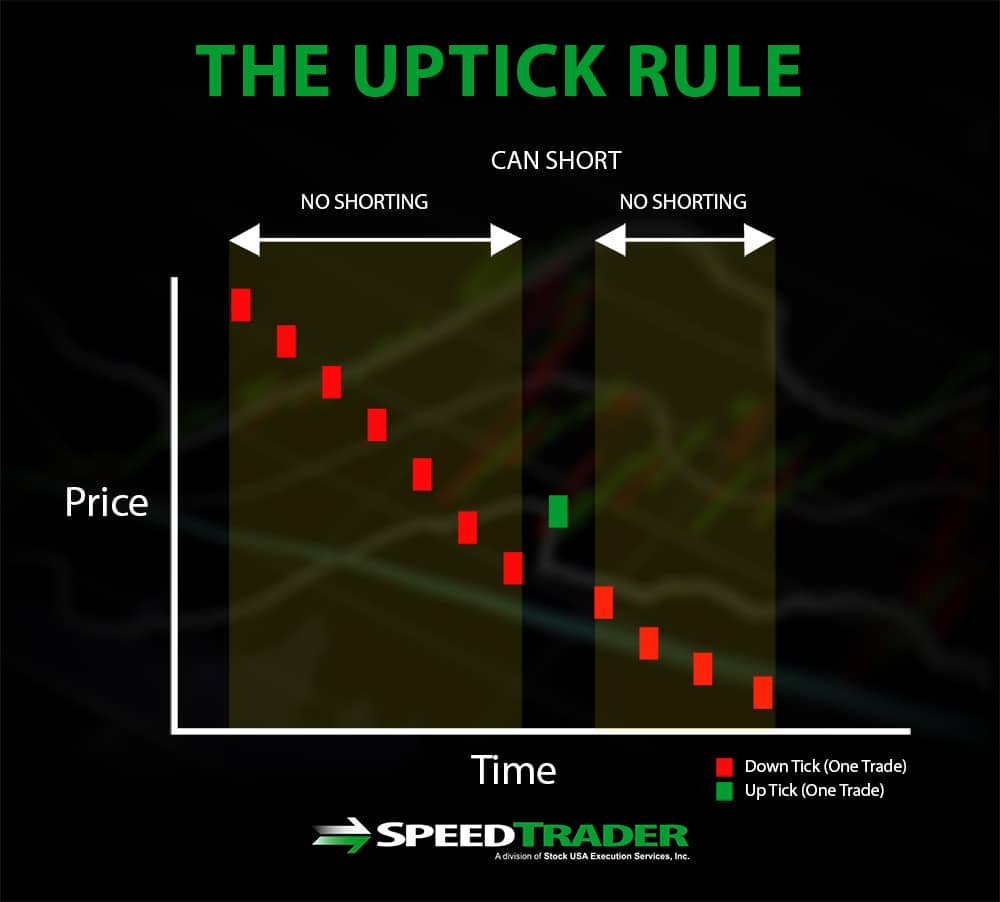

The uptick rule, implemented by the SEC in 1938 after being introduced in the Securities Exchange Act of 1934, required that short sales could only be entered when a stock’s price increased relative to the previous price – that is, went up a tick. Essentially, this rule required that short sellers enter their trades with a price above the current bid so that it would be certain to be filled on an uptick. The rationale for this rule was that it would help minimize the ability of short sellers to incessantly drive down stock prices during a panic, as had occurred during the selling that triggered the Great Depression. The uptick rule was eventually repealed by the SEC in 2007.

Naked Short Sales

In a typical short sale, the short seller has borrowed shares of the stock on hand to sell to a buyer. In a naked short sale, however, the seller does not have any shares of the stock they have promised to sell and have not confirmed that they can obtain shares – thus, naked short sellers often fail to deliver to their buyers. In the US, the SEC banned naked short selling in 2008 following the financial crisis because this practice is thought to have contributed to issues with liquidity.

Regulation SHO (RegSHO)

Regulation SHO was implemented in 2005 by the SEC in order to regulate naked short selling. The “locate” provision of the regulation requires that brokers have a reasonable belief that the desired number of shares of the stock to be shorted can be provided to the short seller by a specified date. The “close-out” provision placed additional delivery requirements on stocks that have high frequencies of delivery failures at clearinghouses. The regulation provided loopholes for options market makers, although this exception was removed in 2008.

Alternative Uptick Rule

The alternative uptick rule was implemented by the SEC in 2010 as a way to replace some of the protections lost by the repeal of the 1938 uptick rule. The alternative uptick rule essentially states that the uptick rule comes into effect for any stock that has lost more than 10% of its value in a single day, thus helping to prevent market instability and extreme selling pressure.