Introduction to Stock Borrows

Stock borrows are the acts in which a brokerage loans out shares of a stock to an investor. Most often, traders borrow stocks in order to sell them short, buying additional shares at a lower price to return the borrowed stock. Just as in a traditional loan system, stock borrows entail paying interest to the loaning brokerage.

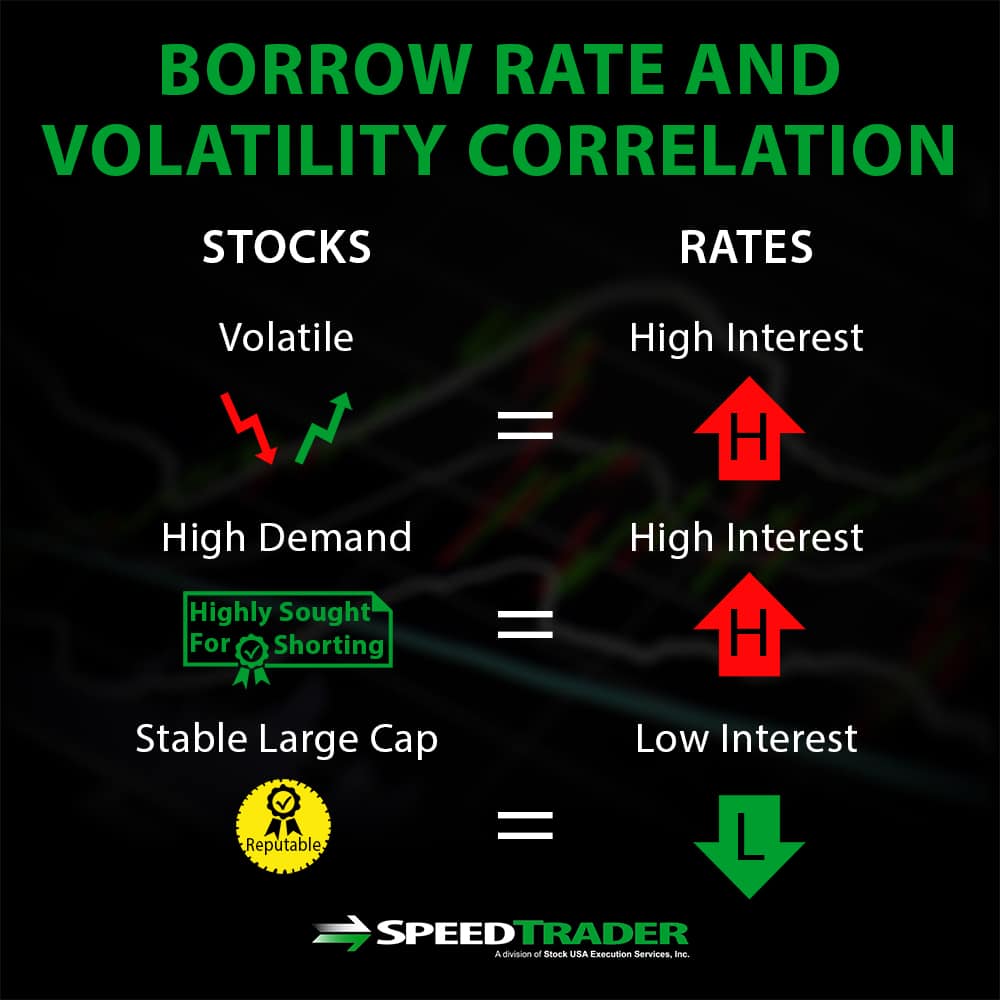

However, the interest rate on stock borrows is set by the market itself rather than prevailing interest rates. In general, stocks that are highly volatile or are in high demand by short sellers are more difficult to borrow since they are scarcer and typically come with higher interest rates. For example, biotech stocks or stocks like Tesla that have high volatility and significant interest among traders will be harder to borrow or, at some brokerages, cannot be borrowed. Stable large-cap stocks such as Apple or Exxon Mobil, on the other hand, are typically straightforward to borrow and brokerages charge lower interest rates for these stocks.

Types of Securities Lending

Stock borrows are one part of the much larger securities lending industry. Understanding the types of securities lending mechanisms that are available can give context to traders interested in borrowing stock.

Stock Borrows

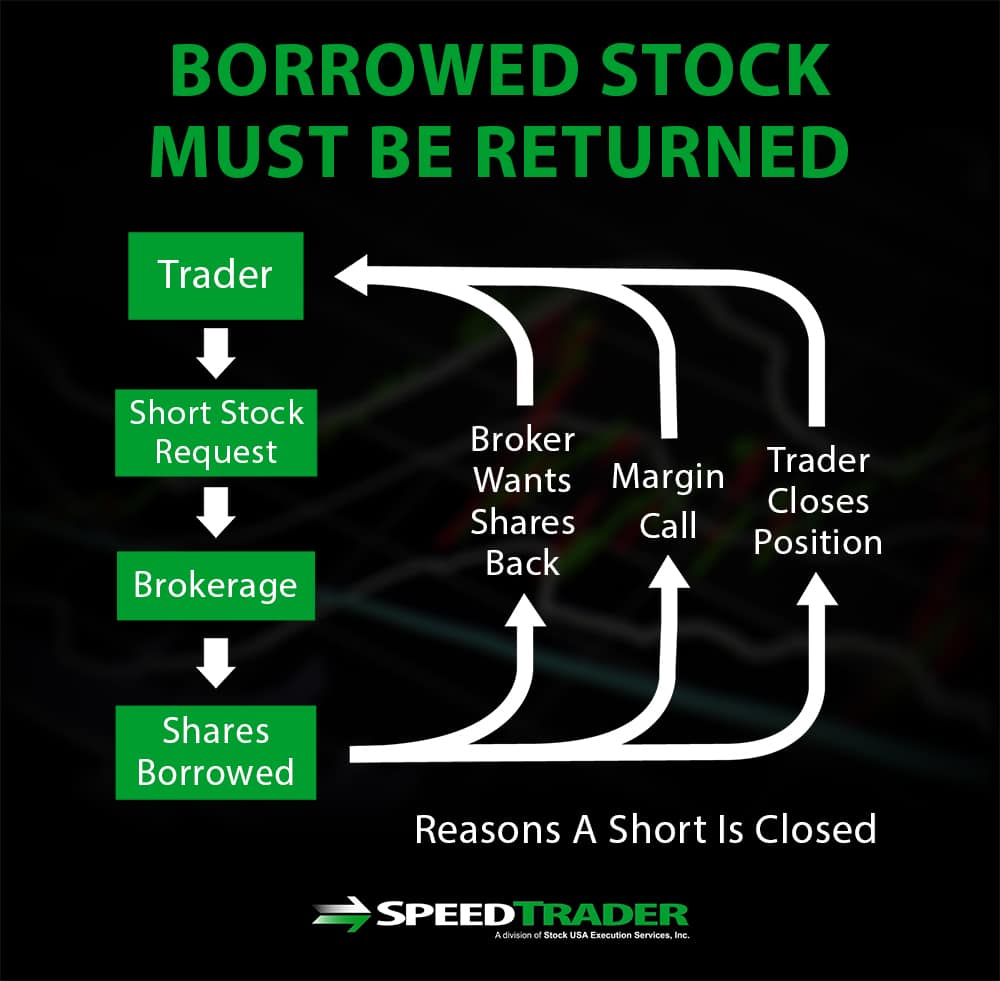

A stock borrow is the traditional mechanism used for short selling. A trader who wants to short a stock requests from their brokerage to borrow shares of the stock from another trader within the brokerage, which the brokerage will facilitate while charging interest. Typically, stock borrows can be of any duration up to 12 months, but the person from whom the shares were borrowed can request them back at any time. This is a serious risk for short sellers holding borrowed shares for any length of time since there is little control over when the borrowed shares may be called back in by the brokerage.

Stock Lending

Stocks can also be used as collateral to secure a cash loan, in a transaction known as stock lending. In this case, the owner of the stock places them in a secure account with a lender and receives a cash loan in return. The cash loan is subject to interest similar to a traditional loan and the stock is returned to the owner when the loan is repaid to the lender with interest. Depending on the stability of the stock put up as collateral, some lenders will offer up to 90% of the value of the stock as cash in the loan. This valuation is known as the loan-to-value ratio.

Borrowing as a Trader

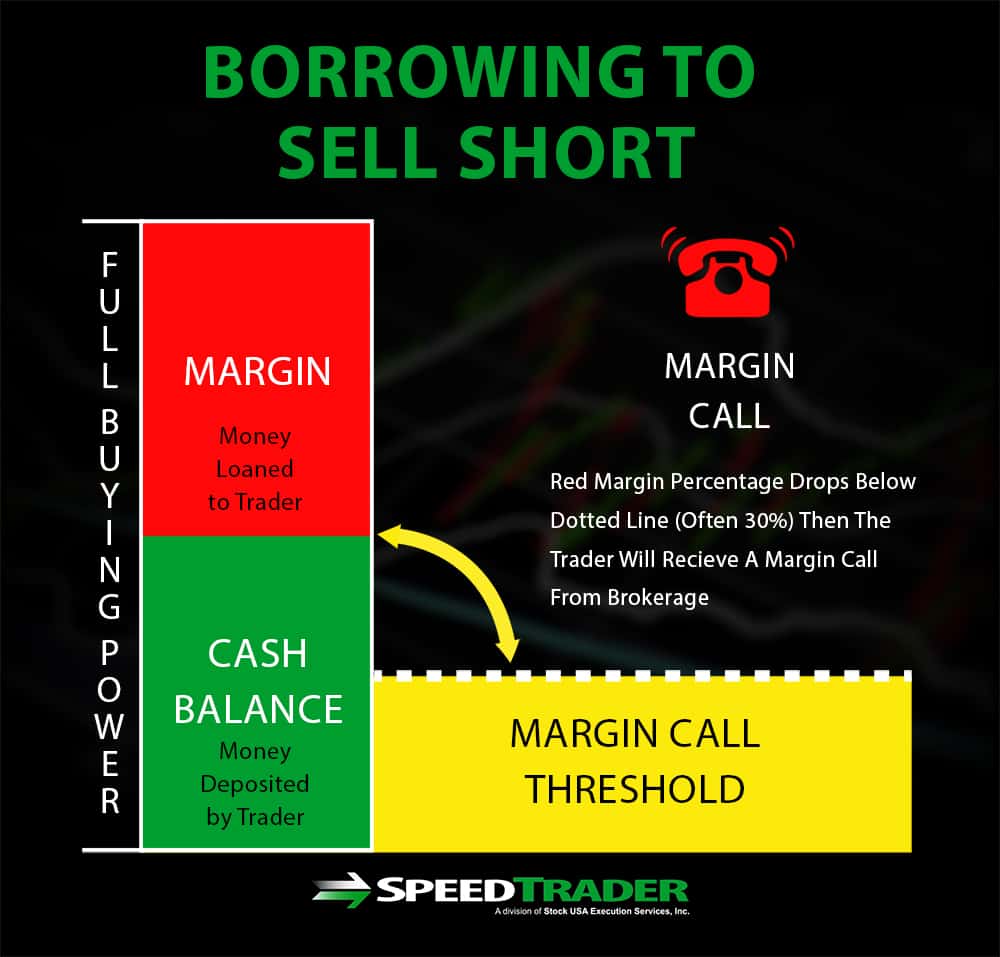

Borrowing in order to sell a stock short is straightforward, but comes with several important rules. First, almost all brokerages will require you to keep a minimum cash amount in your brokerage account in order to serve as collateral for the borrowed shares. This amount varies among brokerages and depends on the value of stock being borrowed. If the cash balance in your account falls below the required margin, you will receive a margin call from the brokerage – essentially an ultimatum giving you a short window of time in which to deposit more money or else have the brokerage liquidate your short position.

In addition, your stock borrow will be subject to interest rates set by the brokerage. Interest rates typically vary depending on the volatility and scarcity of the stock being borrowed, as discussed above. Finally, you are also responsible for paying back any dividends that are paid out while you are holding the shares. The brokerage will then pay these dividends out to the original owner of the stock from whom the shares were borrowed.

Conclusion

Stock borrowing comes with significant risks. Borrowed shares may be called in at any time by the original owner, potentially forcing you to prematurely liquidate your short position. In addition, it is important to fully understand your brokerage’s margin requirements since failing to meet these can also result in having to liquidate your position. Another downside to borrowing shares for short selling is that you must pay interest to the brokerage on the shares you borrow as well as repay dividends that are paid out while you are holding the stock.

Despite these downsides, borrowing shares enables a straightforward method for profiting off of falling stock prices. Traders should fully weigh the risks and rewards of stock borrowing before attempting short selling and be prepared to deal with losses from interrupted positions.