Many investors don’t look deeply into a company’s share structure before buying stock, but this fundamental organization of shares can affect everything from the price of a share to how prices move with buying and selling action. As a result, intelligent and savvy traders investigate the share structure of a company before opening positions. In this article, we’ll cover the basics of stock share structure and how different share structures can impact trading.

What is a Stock’s Share Structure and Why Does it Matter?

A stock’s share structure is the way in which a company chooses to issue its shares to potential investors. When going public, there are several common ways that companies can organize their shares as well as numerous less common mechanisms for distributing shares. The share structure describes everything from how many shares exist, whether all shares are created equally or come with different privileges, and whether new shares may be released to the public going forward.

Stock share structure is important because it reflects fundamental investment information not explained by stock price alone. For example, a stock’s price does not indicate whether a company is a good value unless you also understand the share structure underlying the current price. For example, two stocks that have the same price may represent different values if they have widely different numbers of shares available to investors.

Share structure also impacts how a stock’s price acts in relationship to buying and selling activity by investors. After all, bid and ask prices for stocks ultimately reflect supply and demand economics – which in this case is directly tied to the number of shares of a stock available for purchase.

Finally, understanding special shares, such as preferred and restricted shares, can help you to identify when new shares may become available on the open market. This can in turn lead to buying opportunities or help you to predict when a stock’s price may change rapidly.

Basic Share Structures

Authorized Shares

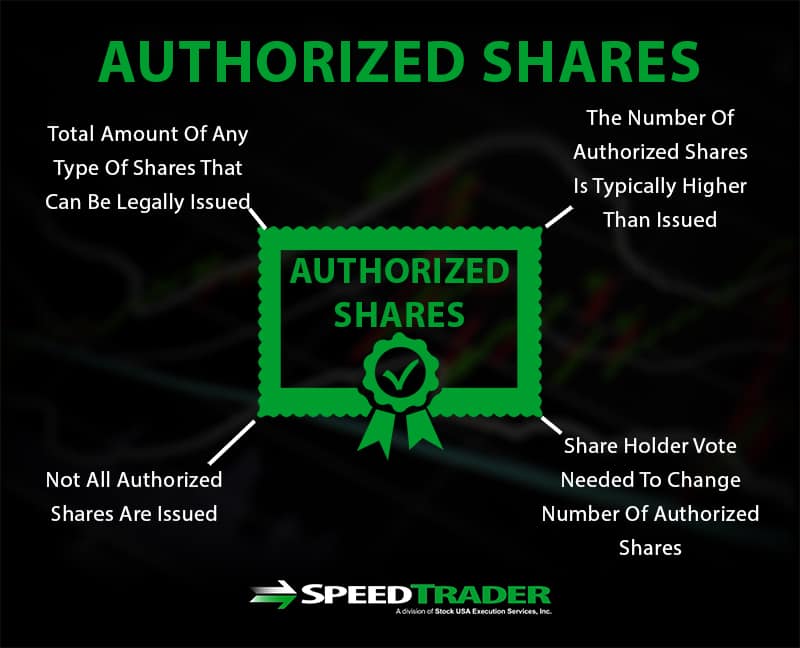

A company is required to declare how many shares of its stock it will issue in total at the time it goes public. This total number is known as the number of authorized shares a company offers. The number of authorized shares is often greater than the number of shares released at any given time, as discussed below, since this allows the company to retain a controlling stake in itself or gives it the option to sell existing shares in the future to raise money. Although the number of authorized shares can be changed, this typically requires approval from existing shareholders.

Outstanding Shares

The number of shares that a company has released to shareholders at any given time is known as the number of outstanding shares. Outstanding shares includes all public shares as well as shares restricted to inside and institutional investors. The number of outstanding shares is used in the calculation of earnings-per-share and can fluctuate frequently in response to share buyback programs, releases of previously company-held shares to raise equity, or stock splits and consolidations. The number of outstanding shares cannot exceed the number of authorized shares and is typically much lower so that a company can keep shares in reserve for future employee stock benefits and raising equity.

Float

Float describes the number of shares of a stock that are available to the public – that is, the number of outstanding shares minus those shares held by company insiders and employees and institutional investors as well as restricted shares that cannot be sold for the time being. Float is one of the most important considerations when looking into a stock’s share structure since it directly affects a stock’s price volatility. Stocks with because there are fewer shares available for changes in public supply and demand, while stocks with float approaching the number of outstanding shares tend to have less volatility.

Special Shares

Preferred Shares

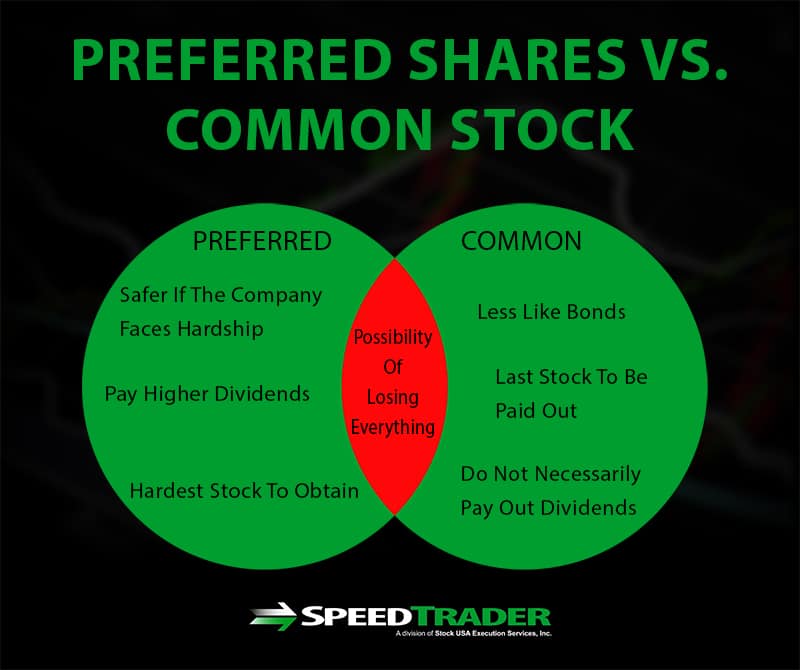

Preferred shares blend the line between stocks and bonds since they typically offer preferential payout of dividends over common stock and provide some claim over company assets that are sold in the case of debt. Although they are often available to individual investors, preferred shares tend to be purchased in bulk by institutional investors since they provide tax advantages for these companies and have little price volatility for individual investors to profit from. Preferred shares are included in the count of a company’s outstanding shares.

Restricted Shares

Restricted shares are shares that may or may not be held by the company, but are not available for public trading. Common examples of restricted shares are shares granted to employees that have a time period restriction during which they cannot be sold and shares that are held by a company during the embargo period following an initial public offering. Restricted shares can be a source of new publicly traded common stock once restrictions are lifted on a set of shares.

Conclusion

A company’s stock share structure can have a significant influence on how available its stock is for public trading. This availability affects everything from earnings-per-share calculations to share price, so it is important to understand in order to determine a stock’s value and potential price response to buying and selling action. In particular, a stock’s float can be a valuable indicator of how much volatility to expect from a stock.