When new traders discover day trading, they are often anxious to get their feet wet. The markets are full of opportunities that can be exciting for all traders. That being said, the markets also require a lot of education, discipline and practice. Many new traders will resort to paper trading.

Paper trading is when you plan trades but do not actually invest any of your capital. You choose a position size, an entry point, and exit point. The planning process is virtually identical to that of planning a real trade, however you do not actually put money into the trade. Traders can do this by using a simulator or simply by recording their trades on paper (thus, the name). So, why on earth would anyone place a trade if they don’t stand a chance of making a profit? The answer is simple: practice.

Paper trading allows new traders to get a taste for trading before actually risking their hard-earned money. This practice can provide valuable experience and insights, whilst also protecting a new trader. Sure, you will not make money, however you also will not lose money, which is just as important.

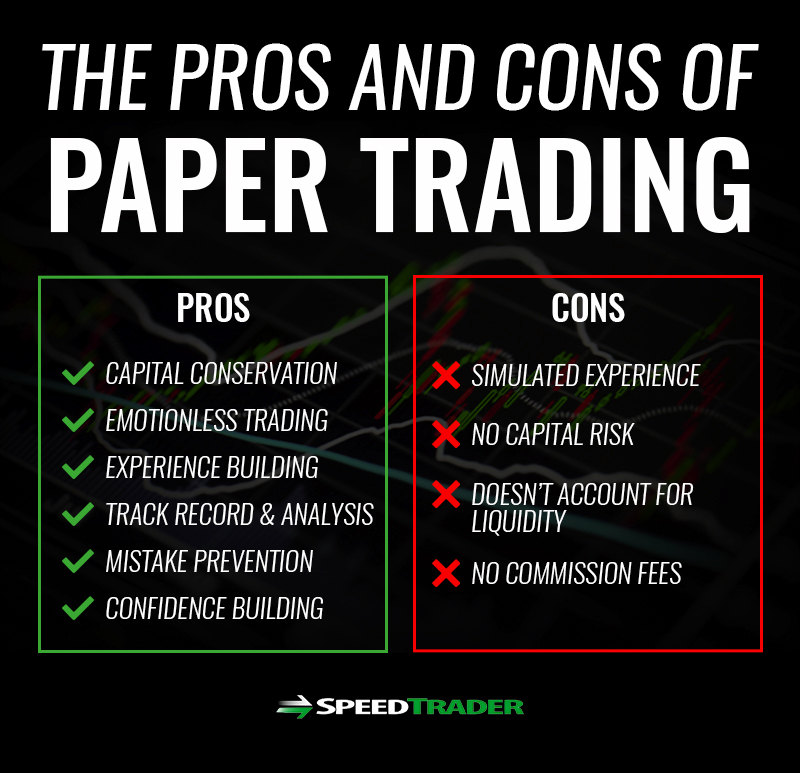

While paper trading can be a great tool for learning the markets, there are still a few shortcomings you should be aware of. Here are some of the pros and cons of using paper trading as a day trading education tool.

Pros of Paper Trading

Let’s start with the pros of using paper trading. As mentioned above, paper trading can be a great way to start learning about the market without exposing yourself to unnecessary risk. Here are a few reasons why:

Not Risking Capital

When you enter the world of day trading, you are putting a lot of capital on the line. While you have the potential to make money from trading, you also have a good chance of losing money. Losses are normal in trading, however there’s no reason to increase your exposure to them. When you start out paper trading, you can get a feel for the markets without losing your hard-earned money. This will allow you to have a larger amount of capital to draw from when you actually begin trading.

Less Stress & Emotions

Trading can be stressful enough as is. Even the professionals can feel the emotional burden of the market from time to time. More often than not, this stress is tied to the fact that you have capital on the line. When traders begin to allow emotional influence to cloud their judgments, they can make stupid decisions. Paper trading allows you to avoid this pitfall because you are not actually investing your own money. This allows you to make much smarter analytical decisions that can help improve your strategy in the long run.

Experience

Regardless of how many books you read and courses you take, there will always be a major disparity between trading theory and trading execution. The lessons you learn from actually trading the markets can be far more insightful than anything you can read in a book. While paper trading is not 100% identical to real trading, it can still provide you with the experience necessary to improve your trading.

Track Record & Analysis

Whether you are trading with real money or “fake” money, it’s always important to track your results. Paper trading allows you to pinpoint your flaws before you actually invest your money. This can help you find your niche and discover your fatal flaws.

Avoiding Future Mistakes

As we discussed in the previous point, paper trading provides you with a trading record that can be analyzed for insights. When analyzed properly, you can pinpoint mistakes that will cost you money in the future. For example, let’s say you place 20 paper trades: 10 long trades and 10 short trades. You may find that your long trades are profitable 80% of the time whereas your short trades are only profitable 40% of the time. This can be a good indicator that you should focus your efforts on long trades when you decide to start trading with real money.

Developing Confidence

Confidence plays a huge role in trading. It’s what gives you faith in your ability as a trader and allows you to hit the “Buy/Sell” button to enter a trade. As a new trader, it can be difficult to come to the markets with confidence. After all, you have no track record. As you develop a track record through paper trading, you can begin to understand your strengths. This will allow you to have to confidence necessary to start placing real trades in the markets.

Cons of Paper Trading

It’s Not Real

This one may seem obvious, but it’s important to keep in mind. Paper trading is not real, and there will be some major differences when you start trading with real money. A simulated environment, while great for training, is rarely identical to its real-world counterpart. For example, you may be able to master a race track in a virtual game/simulation, however this does not mean you are a professional racer. Once you hit the track, you leave your secure simulation environment and new factors come into play. With regards to trading, risking your capital is the main difference. This will change your psychological approach quite a bit.

No Capital Risk

One of the biggest flaws with paper trading is that you are not actually investing your own money. This was mentioned as a benefit earlier because paper trading can actually save you a lot of money, however there is a caveat. When you’re not trading with your own money, certain decisions can be easier (sometimes, too easy). It may be easy to invest $10,000 into a paper trade, however you may be overcome with a whole new wave of emotions when you put your real money on the line. The best way to combat this is by being realistic with your paper trading. If you wouldn’t actually invest $10,000 in real life, don’t do it in paper trading. You’re not doing yourself any justice by not treating “paper” trades like real trades.

Doesn’t Account for Liquidity

Another big downfall of paper trading is that it does not account for liquidity in the market. This means that you may not be able to sell the amount of shares at the prices you specified. For example, let’s say a stock opens at $10 and sets a high of $12. You may record a paper trade as buying 1000 shares of the stock at $11.10 and selling it at $12. In reality, there may have only been 100 shares sold at 12 before the stock quickly plummeted back to $11.50. Even if the sell volume was there, your order may not have been filled.

You can attempt to take a more realistic approach by monitoring a level 2 screen, however you can never get fully accurate results without placing the real trade.

No Commissions

When you paper trade, you aren’t paying commissions for your trades. While this can be a good way to save some money while you learn, it’s important to remember that real trades will cost money. While we offer low priced commissions, it’s important to remember that commissions can add up, especially if you are sizing in and out of a position. Make sure to account for this when recording your paper profits and losses.

Conclusion

Overall, paper trading is a great tool for beginners and even those who would just like to take a step back from the markets for a bit. We’ve gone over the pros and cons; however paper trading is beneficial for the most part. The cons were mentioned to help paper traders understand some of the differences between paper trading and real trading. If you understand the differences, you can use paper trading as a valuable transitional tool into real trading.