Trading software is the most important tool for any trader. Your trading platform should be configured in a manner to provide the most efficiency for analyzing, scanning, monitoring and executing trades. Most direct access trading software can be configured with precision to save time, especially with intra-day trading where seconds count. We will review ways to improve the efficiency of your platform, which should consist of research functions including charts, scanners and workspaces as well as order entry features. Check with your trading platform for specific configuration details.

Save Layouts of Workspaces

Your trading platform will have either layouts or workspaces that contain all the various windows including charts, account summary, watchlist, level 2, news feeds, scanners and order entry modules. You may opt to have different layouts with different themes/styles or strategies like an intra-day layout that contains shorter time frames including the 1-minute, 5-minute and 15-minute charts and a swing trading layout with wider time frames including 15-minute, 60-minute and daily charts. You may opt to have a research layout with all the time frames, news feeds and scanners.

The most important thing is to save your layouts often and keep a backup copy just in case. Having multiple layouts will save time when switching between styles. It also lets you access your layout from different computers when the layout is saved on the cloud.

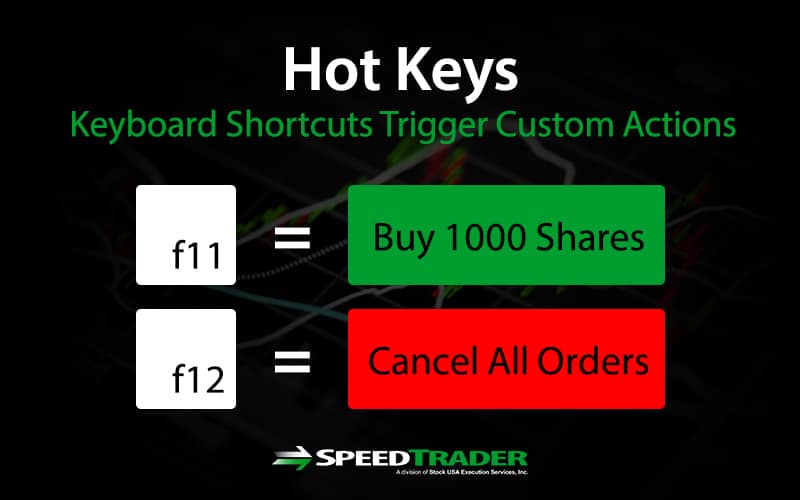

Use Hot Keys

Hot keys are pre-configured keystroke combinations that execute specific functions and actions on the platform. Hot keys are shortcuts that get tasks done in a single keystroke(s) what may normally take many keystrokes and mouse clicks to accomplish. This saves time, improves efficiency and most importantly keeps the trader focused on the trade rather than fumbling on the keyboard. For example, a “cancel all open orders” hot-key could save a trader from having to manually go through 10 stocks and individually cancel each order, when he sees the futures take a hard collapse.

Set Alerts

There are only a finite number of stocks that any trader can directly monitor at any given time. Traders are always on the hunt for set-ups that may trigger. Trading platforms allow users to set alerts when specific price or indicator conditions are triggered. It takes some preparation ahead of time to determine the condition triggers and set the alert, but it is well worth it. Rather than stare at the screen to catch moves, you can do the legwork ahead of time and just wait for alerts to trigger.

Link Windows

To save time from having to type in a stock symbol across multiple windows (ie: Level 2 window, 1-minute chart window, 5-minute chart window and 15-minute chart window), most platforms allow you to link the windows together. Typing in a symbol in one window will update the symbol on the rest of the linked windows. This helps you analyse stocks quicker.

Back-Test Your Scanners

While scanners come with pre-configured theme scans, it is also prudent to backtest the scans to test the quality of results. Review the history of scan results by running a quick analysis on the symbols that were spit out to see how well they moved after the scan spotted them. Configure and re-configure the settings to produce the most tradable stocks that fit your style. Make sure to set the minimum/maximum price and volume settings to filter out irrelevant stocks.

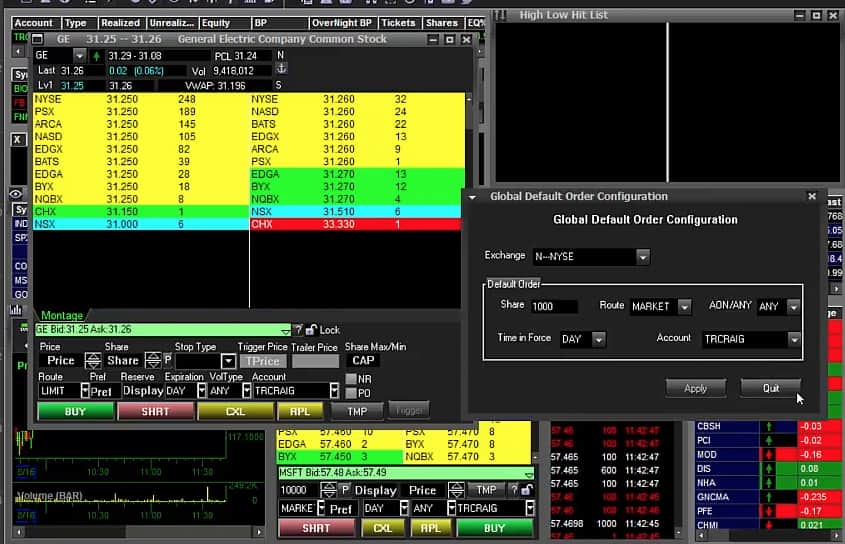

Set Up Global Default Orders

To save time, set the order default specifics ahead of time for all stocks through the global settings. Specifically, the routing preferences and default share sizes. For example, you may set the default size to 500 shares for all U.S. stocks with routing preference to ARCA. This saves time by not having to key in the share size to 500 every time you change a symbol in the order entry or level 2. Many traders also find it useful to add sounds to specific actions, like a “beep” when orders are filled and a different sound when they are cancelled. This is a quick efficient way to confirm actions by audio, rather than squinting at the screen to confirm visually.

Store Multiple Watch Lists

As you get acclimated with more and more stocks, your watchlist will continue to grow. In order to avoid clutter and stay focused, it’s a good idea to consider segmenting stocks into multiple watchlists. Watchlists can be categorized by sector/industry and themes. The type of trade can be used to create intraday, swing and long-term investment watchlists.

Take Advantage of Multi-Monitor Layouts

Multiple monitors allow for more stocks to be followed. The additional screen real estate helps traders add more thorough analysis tools with more time frame charts. This helps provide a more thorough read and perspective of the markets. The continuing drop in monitor prices makes this more affordable option for traders. It allows for linking multiple time frame charts for any stock, which in turn gives greater insight into the complete price action. Make sure your graphic card can accommodate the extra screens.

Create Charts Windows for Multiple Time Frames

Multiple time frames provide a complete panoramic view of the stock price. Having the shorter (1-minute, 5-minute) and longer time frame (15-minute, 60-minute and daily) charts allow traders to spot the near-term price inflection points within the wider time frame trends intra-day. This complete picture of the price action helps traders be aware of what lurks beneath.