Introduction To ETFs

Exchange-traded funds (ETFs) are similar to mutual funds in that they represent a portfolio of stocks and other securities. ETFs have become popular because unlike mutual funds, they can be traded on an exchange just like individual stocks and have commensurately lower commissions and fees. There are a number of different types of ETFs available to trade and traders should be aware of the factors that can affect the price of any ETFs they hold.

What is an ETF?

An ETF, or exchange-traded fund, is a basket of individual securities – such as stocks, bonds, or even options – similar to a mutual fund. However, unlike mutual funds, ETFs are traded on exchanges in the same way as individual stocks. This means that the price of an ETF will change throughout the day, just like stock prices, whereas mutual fund prices are calculated at the end of each trading day.

ETFs have grown in popularity in recent years as they have become more widely available. Many traders prefer them over mutual funds because they have lower commissions and no management fees. Plus, like mutual funds, ETFs allow traders to diversify their portfolios by holding multiple asset classes or multiple stocks across one or more industries.

How Can Traders Take Advantage of ETFs?

While ETFs have broad advantages for investors, they can also be a tool for short-term traders to profit off of. ETFs allow traders to make broad bets on a sector or asset class. For example, if a trader believes that the tech sector will rise across the board, that trader can invest in an ETF that holds many tech stocks.

This style of broad-based investing in ETFs is beneficial for several reasons. First, it can limit an investor’s commissions by allowing them to effectively trade multiple stocks in a single trade. Second, it can limit an investor’s exposure to price changes in individual stocks – if the sector rises broadly while a single company falls, traders will still see a net profit. On the other hand, ETFs can limit profit if a single company rises more than the average and that company is underrepresented in the ETF portfolio.

Things to Be Aware of When Trading ETFs

Not all ETFs are designed in the same way, so it is extremely important to be aware of the type of ETF you are trading and the factors that can affect the prices of its constituent assets.

Leverage

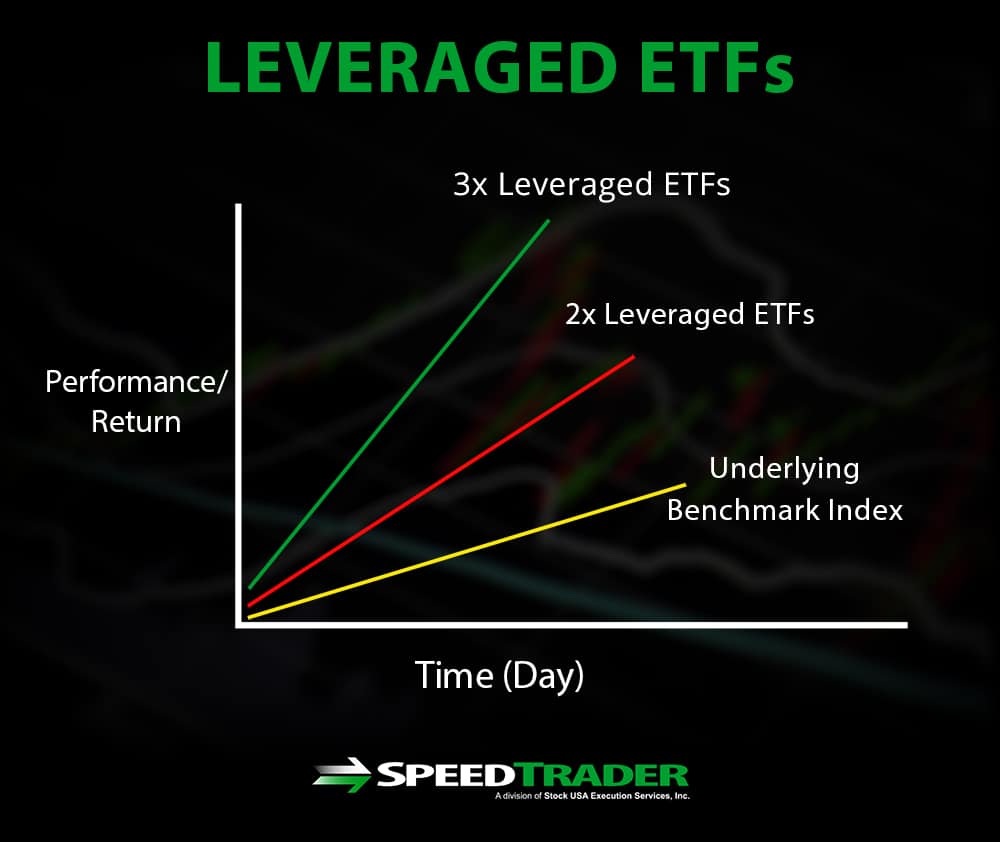

ETFs commonly represent stocks or another asset class at a 1:1 value ratio. However, ETFs can also represent derivatives of securities, such as options or futures. These types of ETFs, known as leveraged ETFs, can be leveraged such that any movement in the price of the underlying stock or commodity can change the weighted price of the ETF by a multiplicative amount. Leveraged ETFs are often leveraged 2x or 3x compared to their underlying assets, making them more risky but also potentially more profitable for traders.

Time Decay

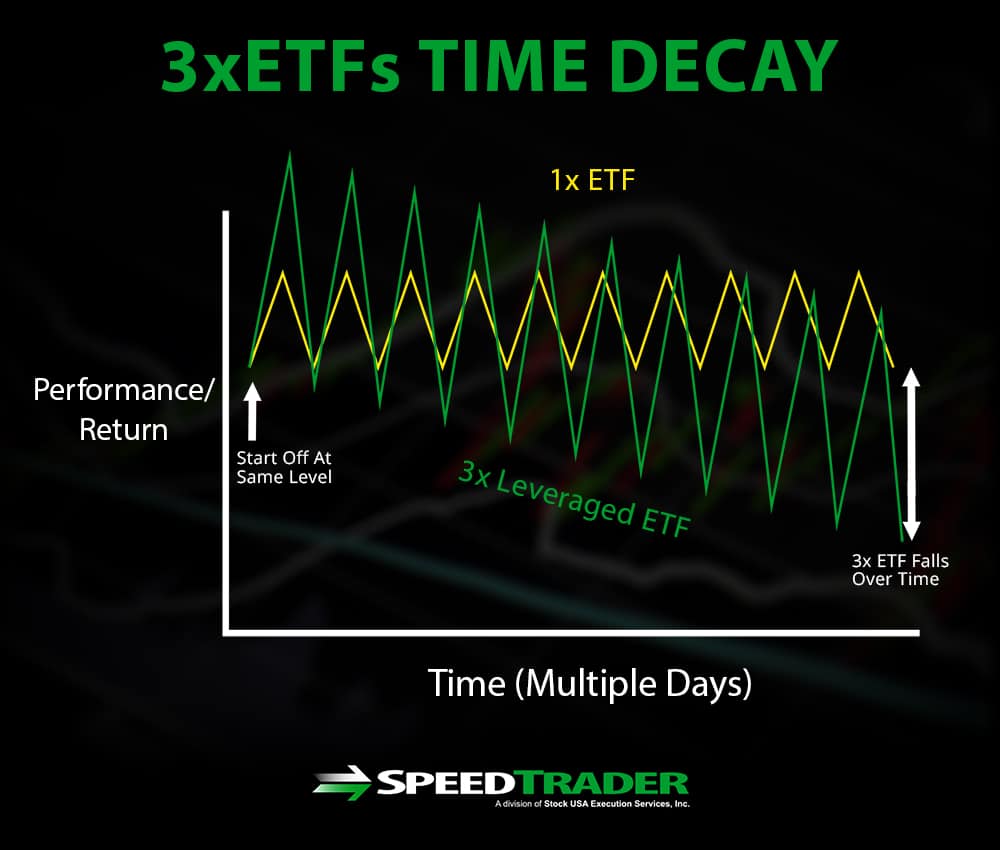

Traders investing in leveraged ETFs that hold stock options also need to consider the time decay inherent to those options. Options lose value as their expiration dates approach, with the rate of that value loss accelerating as the expiration date gets closer. This is important for traders since leveraged ETFs will reflect this time decay, ultimately losing value over time if all else is held constant.

Dividends

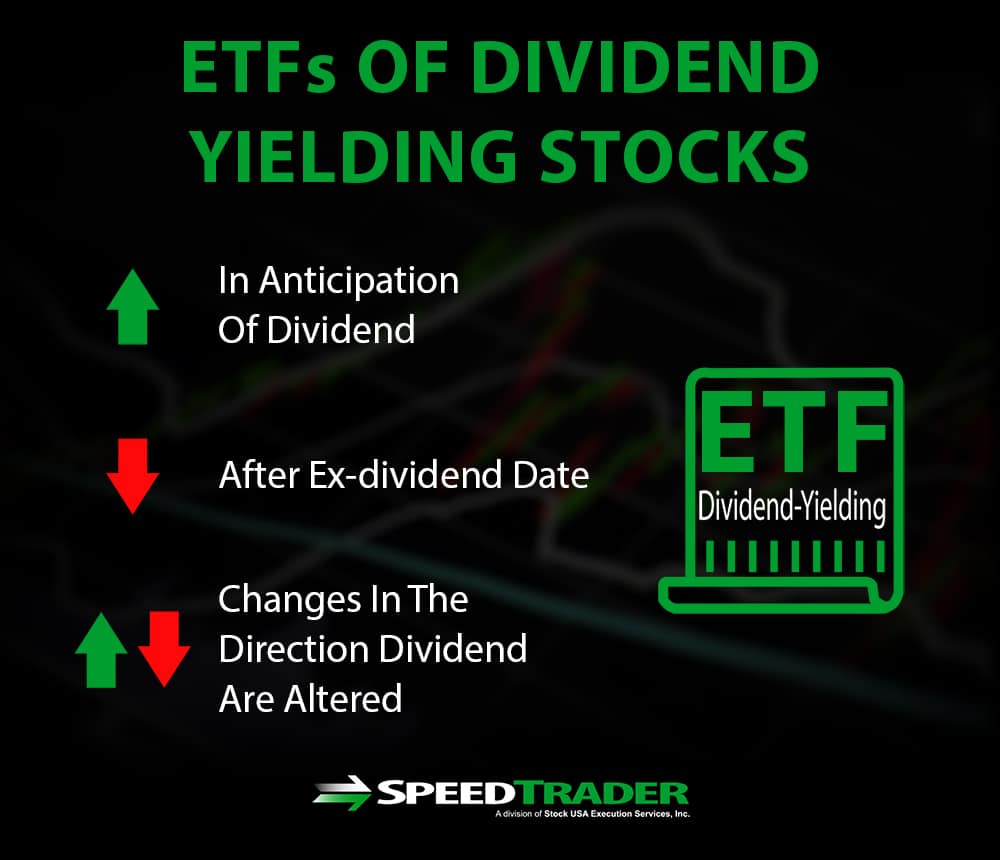

ETFs that represent dividend-yielding stocks will also vary in value as ex-dividend dates approach and are passed, or as dividends per share are altered. The reason is that the price of stocks typically increases in the short-term in anticipation of dividends, and falls to account for the passage of the ex-dividend date. Thus, ETFs holding a significant share of dividend-yielding stocks may see variations in price due to dividends that traders can take advantage of.

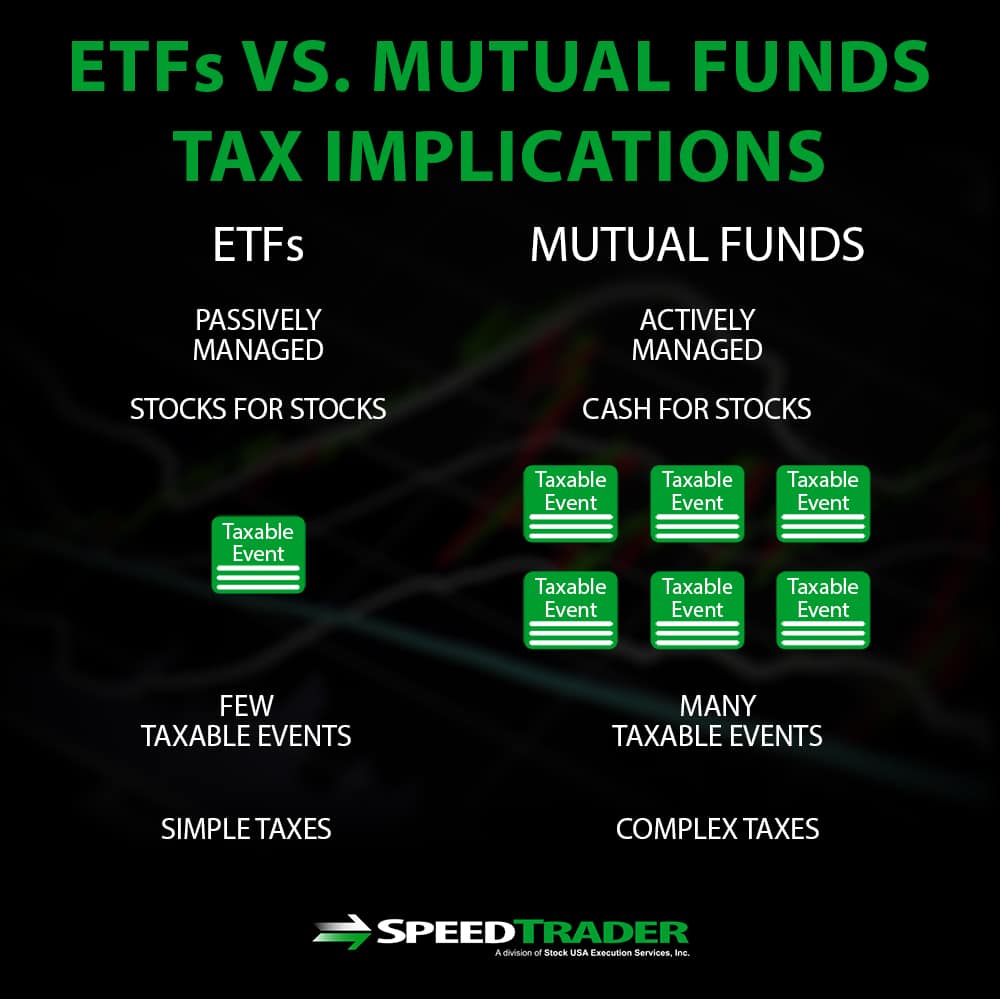

Tax Implications (ETF’s vs. Mutual Funds)

While most traders utilize ETF’s as trading vehicles instead of investments, it’s helpful to understand the tax implications for longer term holding periods.

The ETF tax implications for traders are similar to those of individual stocks. For short-term trades, capital gains taxes and the wash sale rule still apply. For investors, ETF’s offer some unique advantages.

ETF’s have quickly grown in popularity because they serve as viable alternatives to mutual funds. ETF’s are not only easier to trade than mutual funds, but they are also more tax efficient in most cases. Mutual funds tend to have higher taxes because of the active management process. Fund managers buy and sell securities within the funds, meaning more taxable events take place and higher capital gains taxes may be paid annually. ETF’s are more passively managed and generally involve less taxable events.

The best way to conceptualize the difference is by thinking of a mutual fund as a managed portfolio and an ETF as an individual stock.

- Mutual Funds: Mutual funds are actively managed using cash transactions. When you buy into a fund, you’re essentially buying a portfolio management service. The fund manager will take your capital and invest it into different stocks. Throughout the year, the fund manager may rebalance your portfolio, leading to a combination of “winning” and “losing” trades. These trades represent taxable events, meaning you could end up paying a capital gains tax even if the fund has a net negative return for the year. Think of this like building a portfolio of 10 stocks, 5 of which have positive returns and 5 that have negative returns. If you sell the 5 winners and hold the 5 losers, you would pay capital gains taxes even if the unrealized losses are higher than the realized gains.

- ETF’s: ETF taxation is a lot simpler and the taxable events are similar to those of individual stocks. Because these funds are passively managed, you only incur taxes when you close a position or when you receive a dividend. This is because ETF’s transact using “creation units,” which are exchangeable groups of stocks. When you buy into an ETF, your ETF shares are “exchanged” for shares of the stocks in the fund. Whereas the mutual fund management process of exchanging “cash for stocks” triggers taxable events, the ETF management process of exchanging “stocks for stocks” does not.

Types of ETFs

Broader Markets

Broad market ETFs are designed to track major market indices. For example, the SPY SPDR ETF is designed to track the performance and yield of the S&P 500 index. These ETFs are among the most widely traded ETFs, although many track lesser-known indices as well.

Broader market ETFs are useful for traders because they allow traders to easily go long or short on the overall market.

Foreign Markets

Foreign market ETFs are a convenient way for traders to place bets on foreign markets. These ETFs may track major indices in a single country or region, or may represent a specific sub-sector abroad. For example, the EWJ ETF is designed to track the Nikkei index in Japan.

Foreign market ETFs allow traders to go long or short on markets in a specific country or region. Traders can also use foreign market ETFs to hedge against foreign investment or to invest in an emerging market.

Foreign Currencies

Foreign currency ETFs are designed to track the performance of a specific foreign currency, such as the British Pound. This allows traders to take advantage of currency price fluctuations without getting directly involved in complex forex trading. Some foreign currency ETFs manage risk by tracking multiple currencies rather than a single currency.

Sectors

Sector ETFs allow investors to track the performance of a specific sector – such as biotechnology, healthcare, energy, and more – without directly investing in multiple individual stocks within that sector.

Short-based ETFs

Short-based ETFs are ETFs that bet on bearish market activity. These ETFs allow traders to make broad short bets across the entire market or across a specific industry sector. For example, the SPXS ETF allows traders to short the S&P 500 index without actually opening a short position with a brokerage. Keep in mind that trading volumes for short-based ETFs may be lower than other types of ETFs, especially during a bull market.

Bond ETFs

Bond ETFs track the bond market, providing investors the liquidity of an easily tradable asset while letting them invest indirectly in low-liquidity bonds. There are a huge variety of bond ETFs available to track different types of bonds, such as corporate bonds and government treasury bonds.

Commodity ETFs

Commodity ETFs allow traders to invest in the performance of a specific commodity, such as soybeans or oil, without actually investing in that commodity itself.

“Fund-style” ETFs

“Fund-style” ETFs, also known as actively managed ETFs, combine the best of both ETFs and mutual funds. The content of the ETF varies under the direction of a fund manager – Kevin O’Leary is a well-known ETF manager – but the ETF still trades like a stock and typically carries lower fees than a comparable mutual fund. Fund-style ETFs are available to track the broad market, specific sectors, and non-stock securities like bonds.

Conclusion

ETFs are highly versatile trading instruments that offer the portfolio characteristics of mutual funds while trading like stocks. Traders can take advantage of the many different types of ETFs to make broad sector- or market-wide bets to profit off of any market environment.