Being a successful day trader is all about being able to predict a stock’s future price action. If you go long a stock, you’re betting that the stock will go up. If you short a stock, you’re betting the stock will go down. The strategies that go into this decision making process rely heavily on historical data. Day traders analyze a stock’s historical price action in order to make an educated guess about where the stock is heading next. Understanding a stock’s trend can be incredibly helpful in aiding this process.

A stock’s trend is simply the direction the stock has been moving in for a given time period. For example, if a stock has been increasing in price for the past few years, it would be in a long-term uptrend. It’s important to note that a stock can have multiple trends for different time frames. Understanding these trends in relation to your trading style is critical. So, in reference to the previous example, a stock with a 2-year uptrend may be a solid long prospect for an investor utilizing a “buy and hold” strategy. That being said, if the same stock has been dropping in price for the past few days, a day trader may have no interest in going long. The main point being that traders need to focus on trends that are most relevant to their trading style, whilst still understanding all trends in play.

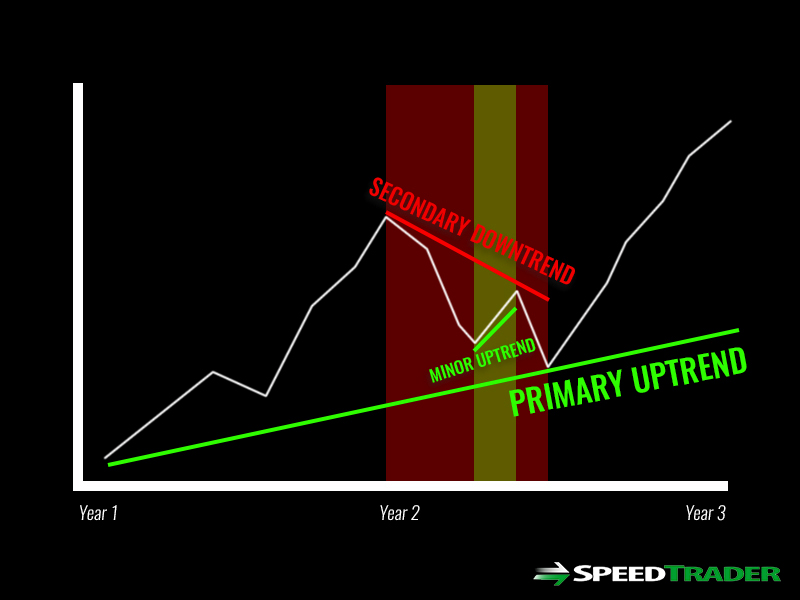

According to the Dow Theory, a stock can be broken down into three main trends: primary, secondary, and minor. Each trend represents a different time frame.

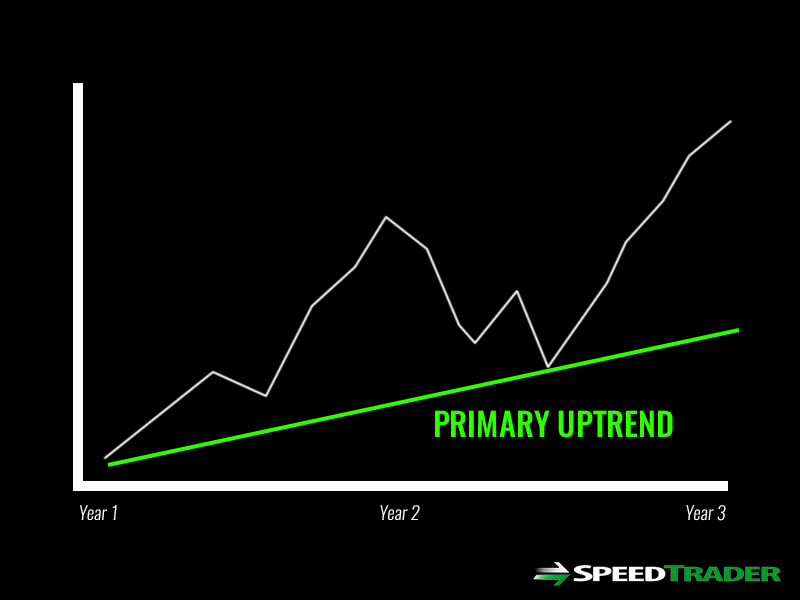

Primary Trends

Primary trends account for a stock’s price action over a long period of time. If a stock price was $10 in 2009 and $30 in 2015, it would be thought to have a primary uptrend because the price has increased 200% over the past two years. Primary trends are of most significance to investors who may be holding a stock for years. While the stock in the fictional example above moved from $10 to $30 in 6 years, it may have experienced many shorter-term downtrends along the way. This leads to the significance of trends on smaller time frames.

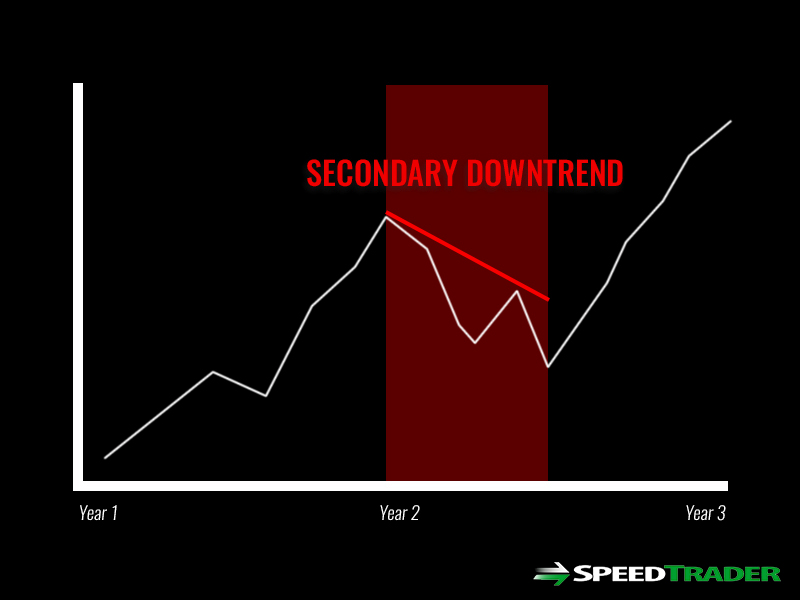

Secondary Trends

A secondary trend accounts for a stock’s price action over a shorter period of time. This may be weeks or months depending on the stock. A secondary trend goes against the primary trend. This trend can be of great significance to swing traders looking to hold stocks for a few weeks at a time. Think back to the example above. A stock moves from $10 in 2009 to $30 in 2015. We’ve concluded that the stock is in a primary uptrend. That being said, the stock may have dropped from $20 to $15 during the first eight weeks of 2012. Therefore, the secondary trend would be a downtrend, providing a great short opportunity for swing traders.

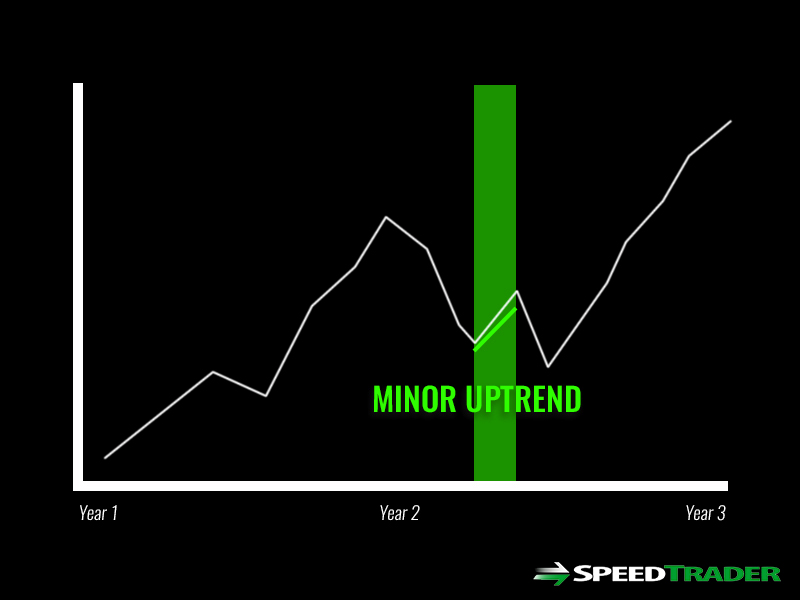

Minor Trends

Minor trends account for a stock’s shorter-term price action, generally over a period of a few weeks or less. Whereas investors may completely ignore these fluctuations in a stock’s price, a day trader can utilize these patterns to place strategic trades. So, in regards to the example above, a stock moves from $10 to $30 between 2009 and 2015 with a drop from $20 to $15 in the first 8 weeks of 2012. During those first 8 weeks when the stock is dropping, it may experience a bounce from $16 to $18, providing a long opportunity for agile day traders.

Why Does this All Matter?

Understanding a stock’s trend in relation to your trading style can help you focus on the right data. You can setup charts for the proper time frames, utilize moving averages that are relevant to your trades, and plan the proper entry and exit points.

Additionally, understanding a stock’s trend in relation to your trading style can help you filter out the noise of the markets. For example, if you plan on swinging a stock long for a couple months, you may be able to disregard a minor downtrend. Regardless of how many day traders are short the stock, you have a different plan and you can filter out the noise of the shorts that only plan on holding the stock for a couple of days. This allows you to stay more focused and stick to your initial plan.

Understanding a stock’s trends will provide you with the insights necessary to create and stick to a trading plan that aligns with your strategy. Determining a stock’s trend is a fairly simple tool that can be a valuable addition to your decision making process.