Stock prices can either consolidate, uptrend or downtrend and at any given period of time. Trend reversals happen when buyers overwhelm supply and push prices higher and when sellers overwhelm demand and push prices lower. When a downtrend is extensively steep, it can trigger a potentially sharp price reversal. Price reversals that have enough sustained buying may actually reverse the trend with a breakout followed by an uptrend, also known as a trend reversal. However, when the reversal bounce fails to power a trend reversal and falls back down, it may qualify as a dead cat bounce.

Dead Cat Bounce Term

The term is used less frequently as it is considered offensive to pet owners when visualizing a dead cat carcass temporarily bouncing off the pavement after falling from a substantial height implying that anything can bounce if falls from high enough. Inversely a ‘living’ cat would absorb the plunge and jump back up with vigor and followthrough like a trend reversal. It was first quoted in the Financial Times newspaper in December 1985 to describe the Malaysian and Singapore short-lived stock market bounce after a significant sell-off during the recession.

What is a Dead Cat Bounce?

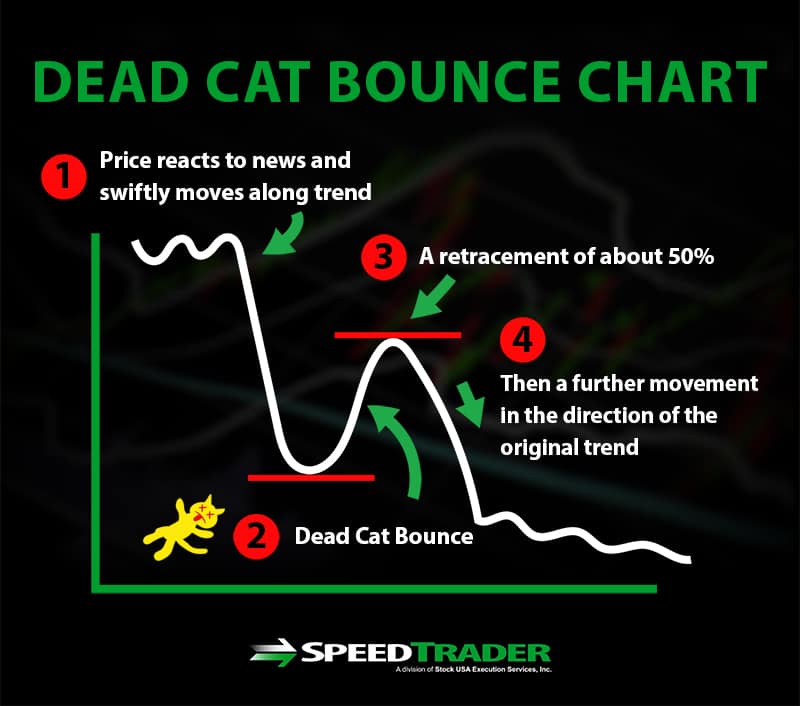

A dead cat bounce is a type of short-term price reversal bounce in the context of a larger downtrend. From a visual perspective, a dead cat bounce describes a temporary but sharp V-shaped reversal bounce that forms at the bottom of an extensive sell-off in stock prices, often triggered by short-covering.

However, the bounce fails to reverse the downtrend and loses momentum as it deflects off a resistance level and resumes its downtrend with a new batch of trapped buyers. The extra supply leads to heavier selling that breaks the lows and forms another leg on the downtrend.

How to Trade a Dead Cat Bounce

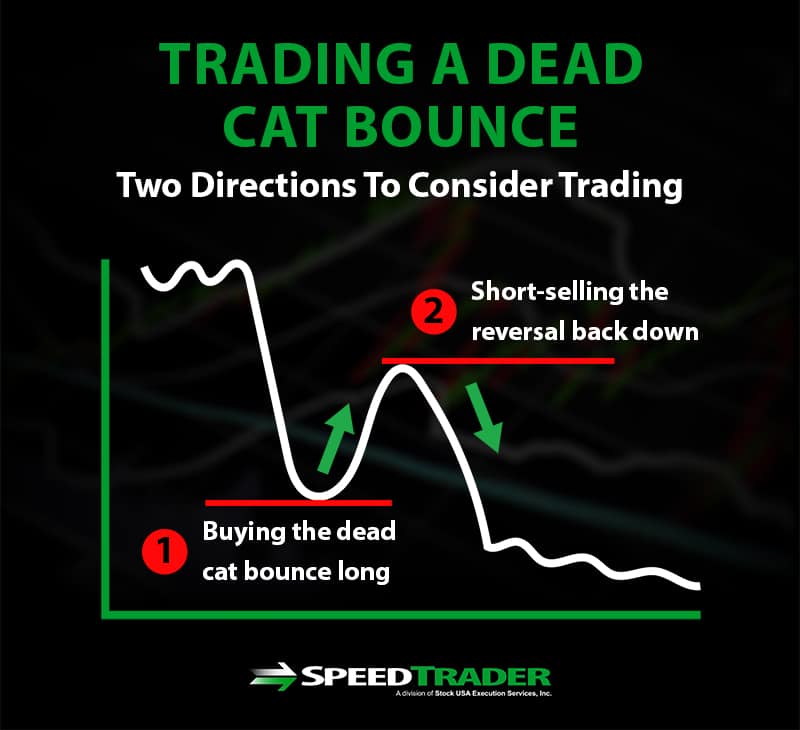

Dead cat bounces are only confirmed after the bounce fails as the stock resumes the downtrend. This presents two directions to consider trading. Buying the dead cat bounce long, or short-selling the reversal back down. The most important factor is having a methodology to determine proper support and resistances levels to determine if a trend reversal or a dead cat bounce is forming.

A commonly used method is to add moving averages to visualize the trend which then enables you to establish resistances ( IE: a 20-period simple moving average trend line).

What Makes for a Good Dead Cat Bounce Stock?

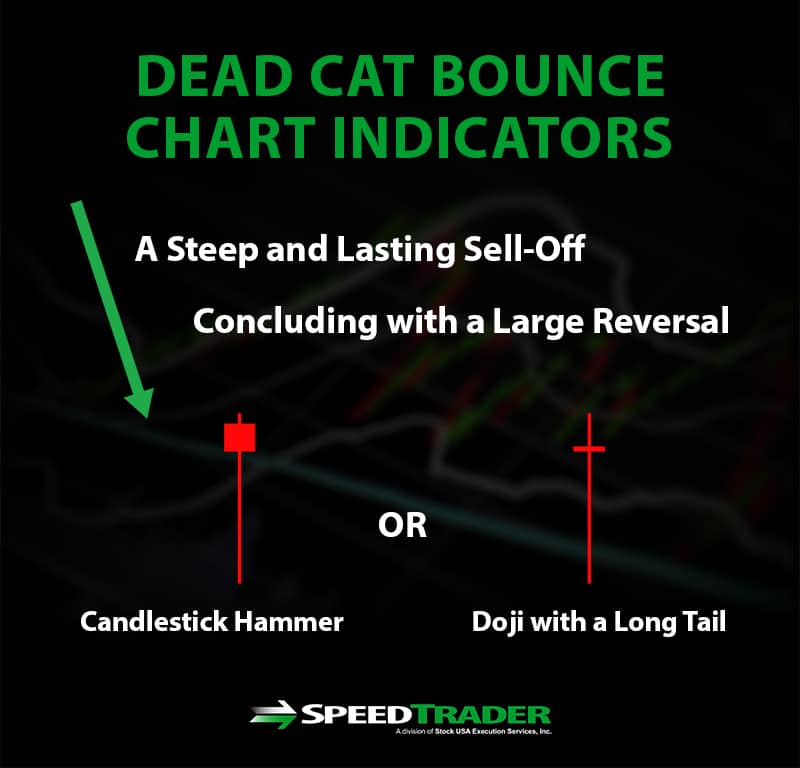

Stocks that make a very steep and lasting sell-off that conclude with a large reversal candlestick like a hammer or doji with a long tail indicating panic and capitulation tend to get the sharpest V-shared dead cat bounces. Always be aware of the resistance levels on the downtrend and be prepared to take or scale out profits ahead of and into that price level.

Stocks with a high short interest above 25% tend to generate sharp dead cat bounces after a heavy volume reversal candle as a new low briefly forms, indicating capitulation and spurring short-covering. Large short interest means there are a large number of shares to be purchased to cover the position. Always have a trading methodology in place that provides reliable resistance levels and a momentum indicator to time your entry before entering a dead cat bounce on the long side.

Dead Cat Bounce vs. Reversal

While dead cat bounces and trend reversals are seen in the rear view mirror after they materialize, it’s prudent to have the tools that give you a ‘heads’ up when the momentum is slipping to enable your exits while the liquidity is still present. Additional insight can be gained by using multiple time frames like a 5-minute, 15-minute and 60-minute charts. The larger 60-minute time frame chart shows the wider downtrend while the 5-minute chart may have actually formed a trend reversal uptrend. The key is knowing where the resistance lies on the 60-minute time frame in order to scale out your position as it nears or tests. This is where bulls may win the battle on the smaller time frame but lose the war on the larger downtrend time frame. Gaining the market insight early enough to react before the next trader is the key to maintaining an edge playing these patterns.