Although both day trading and investing share the same ultimate goal of generating profits from the markets, the means through which this goal is achieved are much different. Understanding the difference between the two will allow you to focus on the activities that are conducive to your success. Think of this concept with a real world example:

A 100-meter dash and a marathon are both activities that involve running. That being said, they are incredibly different from each other. The dash requires maximum speed for a short period of time, whereas the marathon requires a consistent pace for a longer period of time. You would train for and take part in both events using different strategies. The same approach holds true for trading and investing. You need to make sure your training and execution are properly aligned with your goal.

Here are a few major differences between day trading and investing.

Frequency

A day trader may be in and out of trades a few times each day, whereas an investor may only place a few trades every month or year. Investors may have a few stock picks for the year, while it’s not uncommon for a day trader to trade hundreds of tickers in a year.

Time Frame

A day trader is generally focused on entering and exiting a position within the same day, whereas an investor may hold a stock for years.

Stock Types

Day traders tend to look for volatile stocks with high volume. This ensures that they can get in and out of a trade quickly. A trader may not care if the company is running on hype because a trader’s focus is price action.

Investors are generally focused on quality companies with bright futures. Whereas a day trader is generally betting on a stock’s price action, an investor is more focused on the underlying company.

Fundamental Analysis

As mentioned above, day traders tend to focus more on price action and stock charts. Many day traders could care less about the underlying company’s free cash flow, profit margins, etc. Therefore, traders are generally focused more on technical analysis (reading charts) than they are on fundamental analysis (studying a company’s financials & current standing).

Because investors are focused on a much longer timeframe, they will study the overall health of a company. This may include researching management, analyzing financial documents, and reading SEC filings.

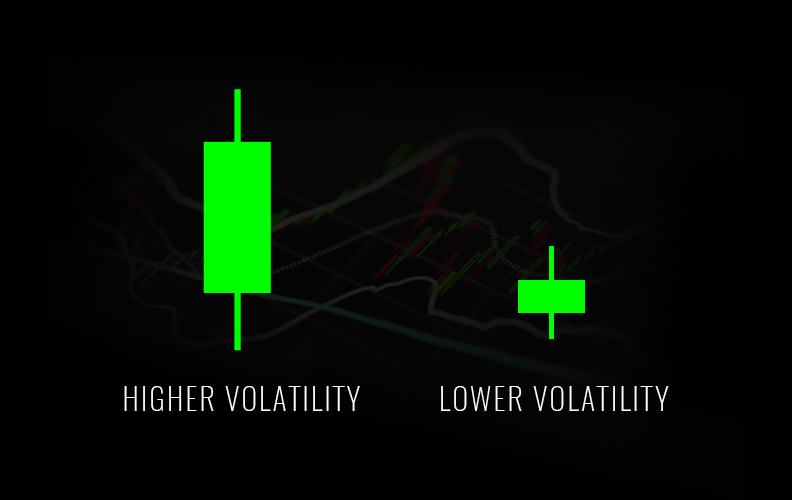

Volatility/Stability

Day traders are looking for opportunities that will prove to be profitable within the day. A stock that moves up or down a few cents a day is not very exciting. For this reason, day traders tend to look for volatile stocks.

This volatility that provides profitable opportunities for day traders can be a red flag for investors. Investors tend to look for stability in their investments. While a stock that is up 20% one day and down 10% the next may be appealing to a trader, it can be nerve-wracking for an investor.

Involvement

Day traders need to be engaged in the markets all day. A few ticks up or down can cost a trader thousands of dollars if they have a large position. Because of this, traders tend to watch their positions at all time.

Investors are not as focused on the intraday price movement of a stock. While investors may check their stocks on a daily basis, they are more focused on the long-term price movement of a stock.

Profit Goals

Obviously, both traders and investors are trying to profit from the markets. That being said, traders and investors will both have different profit goals.

Whereas a 20% yearly portfolio growth may be a great return for an investor, it may be considered minimal for a day trader who has spent hours analyzing and trading the markets. Day trading is a career for many traders; therefore, they need to generate a full-time income as opposed to an investor who may just be supplementing their income.

External Factors

There are many factors that affect a stock’s price movement. Some of these factors have long lasting effects while others only last for a short period of time. Traders are more focused on the factors that affect a stock’s short-term price movement whereas investors are focused on factors that affect a company’s long-term outlook.

For example, a hype-based press release may effect a stock’s short-term movement without affecting the long-term outlook of the underlying company.

Risk Tolerance & Stop Losses

Traders and investors both have different thresholds for risk tolerance. Traders generally cut losses sooner than investors. For example, let’s say a trader and investor have long positions in the same stock. The stock drops 5% mid-day. This may be enough for a trader to cut their position, as the outlook for the day is not positive. This same price movement may be irrelevant to an investor who plans on holding the stock for years to come.

Taxes

Believe it or not, you are taxed differently depending on how long you hold a stock for. Capital gains taxes are broken up into short-term and long-term brackets. If you hold a stock for less than a year (as day traders do) you will pay the short-term capital gains tax, which is a higher percentage than the long-term rate.