Trading is an activity that is anchored by an individual’s preferred style, a trading style. Just as there are preferred combat styles like strikers or grapplers for mixed martial arts (MMA) fighters and then perhaps southpaws (left handed) strikers and Jiu-Jitsu grapplers, the same themes apply between investors and traders.

Difference Between Investing and Trading

Investing utilizes a longer holding period that may last from months to years whereas trading entails holding a position from seconds to days. Investors prefer fundamental analysis utilizing company research and news releases to guide their decisions and actions. Traders tend to favor technical analysis utilizing charts to interpret price action. Investing tends to be more passive, focusing on the long-term growth often implementing a buy and hold strategy. Trading is more active and requires more involvement when it comes to tracking, monitoring and managing positions. As markets have evolved, so have the styles. Just as an MMA fighter who is primarily a striker will find it prudent to also be versed in grappling and take down defense, investors are incorporating some technical analysis and traders incorporating fundamental analysis. This hybridization happens out of necessity not only in trading but in nature and all endeavors. This is how the four styles of trading have emerged.

Intra-day or Multi-day as a Trading Style?

Trading style can require different levels of involvement based personal preferences that include: holding periods, risk tolerance/temperance and speed. Simply put, the trading styles can be determined by whether the activity segmented to just intra-day or multi-day trading. Intra-day trading or day trading limits activity to just market hours (including pre and post-market) as positions are cashed out before the end of the trading day/session. Intra-day traders leave no chance for overnight risk exposure.

Scalping (Day Trading)

Scalping is an intra-day trading style that focuses on taking advantage of small price moves with larger positions sizes tempered by small holding periods. These are ‘base hits’ that add up to larger compounding profits. The main factor to reduce risk comes from utilizing high probability set-ups and limiting holding times ranging from seconds to minutes. This applies to exits, whether they are profits or losses. Quick and decisive exits are key to staying solvent.

Goals: To capture profits from incremental price moves with large shares in the shortest period of holding time. This is a risk averse strategy as long as the holding period is limited, this means quick profit taking or stop-losses.

Who it’s best for: Scalping is tailored for highly active intra-day traders with quick reflexes and the discipline to take stops just as decisively as profits. They have an affinity to avoid the extended risk that comes with holding positions too long.

Tools of the Trade: Scalpers must have a real-time direct access trading and charting platform. The basic tools include smaller time frame charts (IE: 1-minute, 5-minute, 15-minute) , direct access online broker, hot-keys for speed, level 2/market depth windows with time and sales for tape reading, rhythm monitoring and

Momentum Trading (Day Trading)

Momentum trading focuses on piling into the existing direction of the momentum and exiting before it evaporates. Buy high and sell higher. Short-sell low and buy-cover lower. This style follows newsfeeds and scanners to screen for the most active stocks to trade at the moment.

Goals: To capture profits from taking scalps on the most active stocks trading at the moment. Entries at already extended price levels are taken in anticipation for continued overextension.

Who it’s best for: This style applies best to risk-tolerant, disciplined active intra-day traders who have a solid methodology to integrate precision timing on their entries and exits. Since entries are riskier than normal, the prudence to take stop-losses immediately are imperative.

Tools of the Trade: Scalper tools are a basic necessity including smaller time frame charts (IE: 1-minute, 5-minute, 15-minute), direct access online broker, hot-keys for speed, level 2/market depth windows with time and sales and real-time newsfeeds.

Swing Trading

Swing trading seeks to hold positions overnight to multiple days in order for the pattern to play out. Swing trading relies on extending technical analysis to longer time frames like the 60-minute and daily charts. It’s a popular variation of trading styles.

Goals: To capture profits from holding stock positions at least overnight and up to several days to weeks. This style takes on overnight risk exposure so the share size allocation must be less.

Who it’s best for: Swing trading tends to be more passive compared to scalping since the holding times are longer and price ranges are wider. Traders who have the patience to wait out short-term wiggles in order to profit from the longer-term trend set-up will fare the best.

Tools of the Trade: Swing traders utilize a combination of both fundamental analysis and technical analysis for their trading style. The basic tools include multiple time frame charts for short-term and medium-term perspectives (IE: 1-minute, 5-minute, 15-minute and 60-minute, daily and weekly charts), direct access online broker, hot-keys for speed, level 2/market depth windows with time and sales. A newsfeed and research platform that provides analyst reports, news and company filings helps the swing trader understand the company operations and fundamental catalysts for price moves.

Position Trading as a Trading Style

Like swing trading, position trading also has a longer holding period that may extend from weeks to years. This is similar to investing but with the heavier focus on fundamental analysis like an investor but tempered with basic technical analysis to interpret trends and price action.

Goals: To capture profits from longer term trending moves as a trading style, while bypassing short-term ‘noise’. This style has the longest holding periods and must integrate diversification and smallest share size allocation to spread the risk.

Who it’s best for: This style suits passive investors who rely mostly on long-term perspectives of the underlying companies. Most of the decisions are based on earnings and analysts reports and company filings that have a material impact on the future growth.

Tools of the Trade: Since this style is the least active, the minimum tools can be obtained through discount online brokers that provide both a basic order entry system, charting platform and beefed up research platform. Wider time frames charts including daily, weekly and monthly provide the best perspective of the playing field for this style. Alerts are can set to notify the trader of news and price targets since they will not be watching their stocks daily.

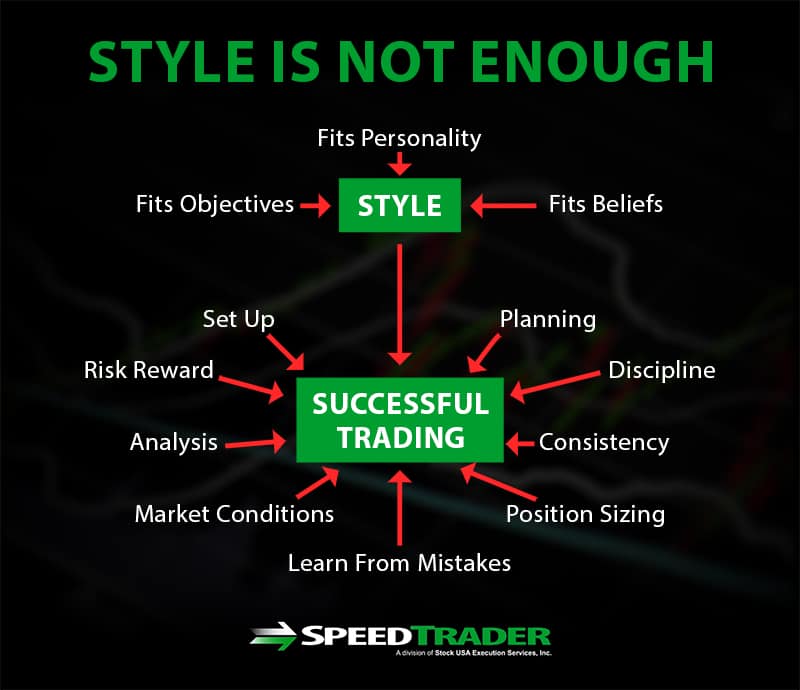

Retail investors and traders are augmenting their styles with more weapons in the arsenal lending to the evolution of the trading styles. While trading styles may vary based on temperance and persona, they all require discipline and an understanding of the components that make the style best suited for them.