Trading Halt

One of the most frustrating events that can trigger during the day is a trading halt. A trading halt is implemented by the stock exchange, which pauses all trading in the security for a certain period of time. The length of time depends on the circumstances for the halt. The purpose of a trading halt is to pause the trading in anticipation of a major order imbalance and allow the market to digest the news.

What Causes a Trading Halt?

There are two types of trading halts; regulatory and non-regulatory.

Regulatory halts are executed in situations when a company is about to release significant market moving news including an earnings reports/warnings, mergers/acquisitions, and government rulings. Pending FDA advisory board decisions or changes in the company board or structure. Companies will request a regulatory halt directly with the exchanges. The halt is meant to give investors and institutions some time to analyze and digest the news in order to making a more rational decision on what actions to take. These types of halts can last from minutes to hours.

Non-regulatory halts are like speed bumps that trigger when a stock breaches a price percentage move threshold either up or down too quickly. These halts are often referred to as “circuit breakers” and meant to pause the action to stabilize the order imbalance. The NASDAQ implements circuit breakers on stocks that quickly spike or fall beyond the 10% or 20% range threshold within a rolling five-minute time period for more than 15 seconds. The halt lasts for five minutes.

What is the Effect on the Stock?

When a stock is halted, trading is prohibited usually across all exchanges. During the halt, specialists and market makers determine the severity of the order imbalance to decide what price to re-open the trading at. In situations with significantly negative news (ie: lower earnings guidance), a stock may re-open at a dramatically lower price. The exchanges will post information as to when the security will resume trading. Pricing usually starts to display five minutes before trading resumes. Upon resumption, volatility and volume spikes as panic orders are furiously executed as market forces take over. In some cases, the stock may halt, but the options may still trade during the halt.

Trading Suspensions

Trading suspensions are executed by the exchanges at the behest of the United States Security and Exchange Commission (SEC). The reasons can stem from concerns or investigations into a publicly traded company’s operations, financials, corporate structure, trading activity, filings or failure to meet certain regulatory requirements. Trading suspensions are meant to protect investors by pausing trading activity until serious questions about the company are addressed.

What Causes a Trading Suspension?

The SEC to protect investors in the underlying stock invokes trading suspensions while it investigates matters of serious concern, which may include stock manipulation, lack of current and accurate information and or instances of fraud. The company needs to formally answer and address said concerns to the satisfaction of the regulators before shares resume trading. The SEC publicly lists the companies under trading suspension on their website www.sec.gov.

What is the Effect on the Stock?

Trading suspensions can last up to 10 days, during which time the company needs to address concerns. The SEC cannot announce ahead of time what companies will face trading suspensions and perform investigations confidentially. The SEC will not publicly comment on the status of the investigation after the 10-day suspension period ends.

Listed exchange traded stocks resume trading immediate after the SEC 10-day trading suspension period ends.

For stocks that trade on the Over-The-Counter (OTC) market, which include bulletin board and pink sheet stocks, trading will only resume after FINRA approves a Form 211. Broker-dealers are the gatekeepers that decide if the company financials are accurate and current. If there is a continuing investigation, then a Form 211 may not receive approval.

Delisting

All the major United States stock market exchanges have minimum requirements that companies must adhere to in order to remain listed on the exchange. Companies that fail to maintain the listing requirements can be kicked off the exchange. Listing requirements include minimum shareholder equity, share price and number of shareholders in addition to maintaining current and accurate filings with the SEC.

What Causes a Delisting?

Companies are delisted when they fail to meet requirements for their respective exchange. The most stringent listing requirements are on the New York Stock Exchange (NYSE) also known as the Big Board. Companies on the NYSE must maintain a minimum requirement based either on a valuation or earnings basis. Listed companies must maintain either at least $750 million market capitalization and $75 million in annual revenues for the most recent fiscal year or at least $10 million in earnings for the prior three-year period or $500 million market capitalization and $25 million in aggregate cash flow for the prior three-year period. Delisting can happen if a company market capitalization falls under $15 million for over 30 days or share price stays under $1 per share for over 30 days. Individual cases may vary depending on circumstances and history.

What is the Effect on the Stock?

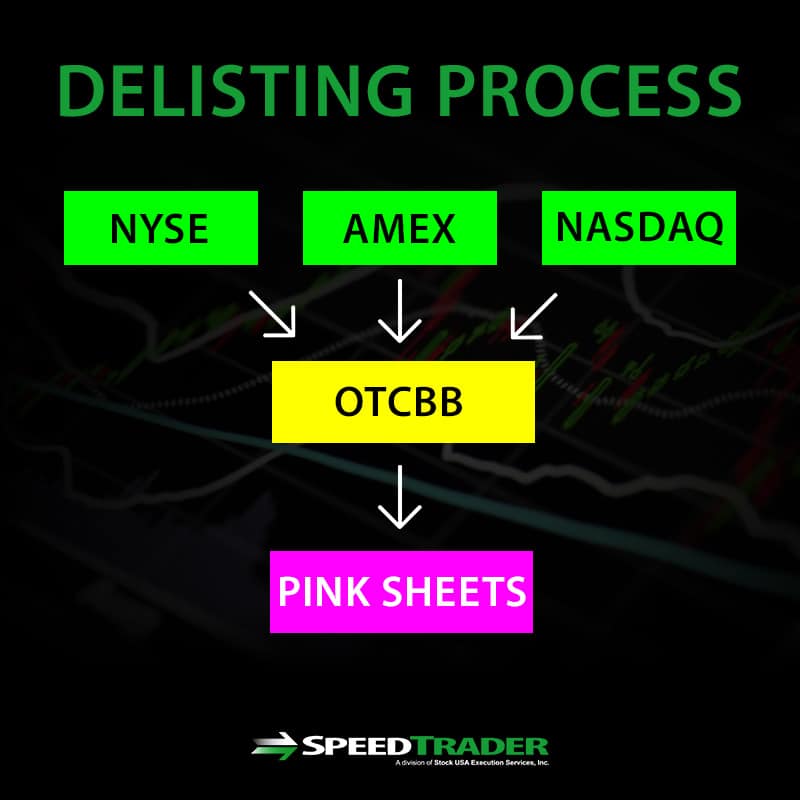

Stocks that are delisted from a major exchange (NYSE, NASDAQ, AMEX) can still trade on the Over-The-Counter Bulletin Board (OTCBB) market provided the financials are up-to-date and filed with the SEC. These types of stocks usually get delisted mainly due to failing to meet the minimal stock price requirement.

If a company is not current with its financial statements, then the last resort is to trade on the Pink Sheets where listing requirements are the loosest. These are the murkiest of publicly traded companies. Many companies are just publicly traded shell companies. Liquidity and volume is the thinnest of all markets here. This is a purgatory for stocks.

The worst case for a delisting is when the shares lose all value and no longer trade on any market. These companies go bankrupt or are shutdown due to fraud, sanctions or other fatal events. These shares are worthless and are write-offs at best for investors.