What Is The Pattern Day Trade Rule?

The Pattern Day Trader (PDT) Rule requires any margin account identified as a “Pattern Day Trader” to maintain a minimum of $25,000 in account equity, in order to day trade. The Financial Industry Regulatory Authority (FINRA) defines a “Pattern Day Trader” as a brokerage customer that executes more than three round trip trades during a rolling five-business day period. Different brokerages may also implement additional requirements for customers.

Customers that are classified as a pattern day trader are required to maintain minimum of $25,000 in account equity in a margin account. PDT restrictions come into effect when the net liquidation value falls under the $25,000 requirement.

What Is the Rationale For PDT Rule?

Day trading became “mainstream” in the late 1990s and reached a fever pitch in 1999-2000. The technology heavy Nasdaq Index skyrocketed through 5,000 by March 2000 fueled by day traders, overvalued initial public offerings (IPOs) and short squeezes. The NASDAQ price/earnings (P/E) ratio grew to 200. Ultimately, the bubble burst in mid-2000, as the Nasdaq collapsed 78% from its highs. Retail traders with dreams of quitting their day jobs to become full-time traders for crushed in the bubble.

The extreme losses suffered by retail day traders prompted the Securities and Exchange Commission (SEC) to implement new rules in an attempt to “protect” unsophisticated retail traders from repeating the same mistakes. The SEC collaborated with the NYSE and NASD to determine a “Pattern Day Trader”, as one who executes four or more round trips in a rolling 5-business day period in a margin account.

The SEC implemented the mandatory $25,000 minimum account equity requirement for accounts that qualified as “Pattern Day Trader” under NASD Rule 2520 and NYSE Rule 431. The PDT Rule attempts to protect small account retail traders. capital (under $25,000) by limiting the trading activity. The assumption is that retail customers with over $25,000 in account equity are assumed to be familiar with the accepted the risks entailed with day trading.

While establishing a minimum watermark, they also increased the buying power for margin accounts above the $25,000 watermark from 2 to 1 up to 4-to-1 margin or 25% margin requirement. Therefore, a margin account with $25,000 cash allowed for up to $100,000 for intra-day buying power and 2 to 1 on overnight positions, or $50,000 in this example.

Monitor Margin Requirements For Volatile Stocks

Individual brokerages may adjust the day trading margin at their discretion, based on their risk assessment for specific stocks based on volatility and liquidity. Therefore, not every stock may be granted a 4 to 1 intra-day margin. It is imperative to check with your brokerage daily on thinly traded and or highly volatile stocks with limited short-able shares.

For example, stocks that are gapping over 20% on news with high short interest are susceptible to limited margin abilities. If a trader assumes 4 to 1 margin on a stock that has been adjusted to 2 to 1 margin by his broker, he may get a margin call or even a forced liquidation without even being aware of it. Stocks with low floats and/or hard to locate short-able shares are especially dangerous. This is how short squeezes are often triggered.

What Defines a Round Trip?

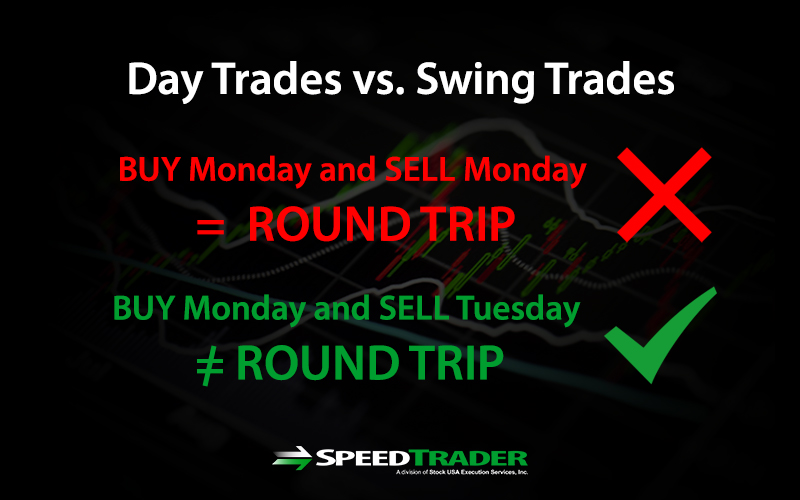

A round trip is defined as buying and selling the same stock or options position during the same day, which includes pre-market, regular market and post-market trading sessions. This means buying to open and selling to close the same stock or options contracts in a single day.

For example, if you buy 500 shares of AAPL and then sell the 500 shares the same day, that is considered a round trip. However, if you buy 500 shares of AAPL today and then sell 500 shares tomorrow, that does not qualify as a day trading round trip. Therefore, the 3 round trips per rolling 5 business days’ period remain in tact.

What Happens If You Break the PDT Rule?

If a margin account’s net liquidation value falls under $25,000 by the close, then the PDT restriction of maximum 3 round trips per 5 business days kicks in starting the next day. If the value rises back above $25,000, then the restrictions may be lifted. The account net liquidation value can be raised either by depositing more funds or the underlying securities rise in value. If the account holder trades more than the maximum 3 round trips within 5 business days, he is flagged for breaking the PDT Rule.

At the discretion of the brokerage, a first-time PDT Rule violation may only receive a warning. However, a second violation will result in the “freezing” of trading activity in the account for 90 days, as mandated by the NYSE regulation. Positions can only be closed during this time and no new open positions can be established. This can be remedied if more funds are deposited into the account to get it above the $25,000 minimum.

Tips for Traders Under the PDT Rule

The following are tips to help prevent violating the PDT Rule:

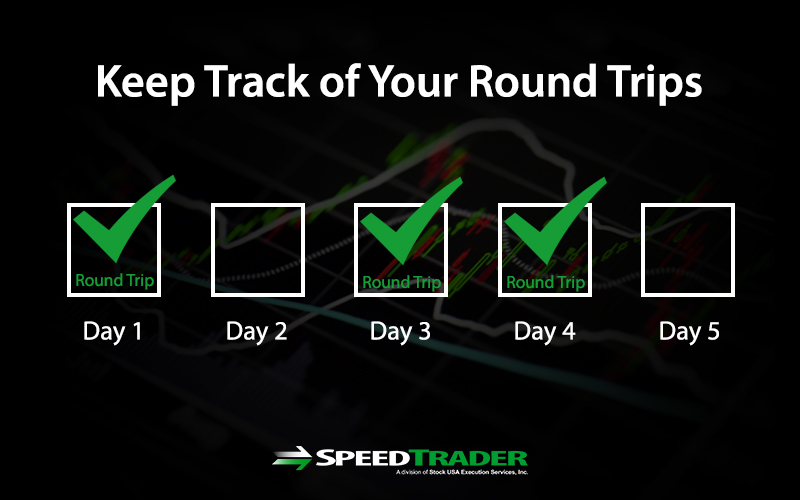

Keep Track of Your Round Trip Trades

This is pretty straightforward. Use a day timer or calendar to track the five-day period after a round trip trade is made. This will be when that specific round trip will reset. Be aware that you are only allowed a maximum of three round trip day trades within a rolling five-business day period.

Spare Your Remaining Round Trips

Consider each round trip as a bullet in an ammunition clip that only holds three bullets. The longer you go without making a round trip, the easier it is to avoid the PDT Rule violation. Each round trip resets after five business days. Be conscious of when a round trip was executed and mark the days on the calendar.

Avoid the Fourth Opening Trade Unless It is an Overnight Trade

Avoid the fourth opening trade within the 5-business day period, unless it is an overnight/swing trade. Some platforms will restrict the fourth opening trade as part of the safety mechanism in the platform algorithm.

Filter Tightly For The Best High-Probability Set-Ups

To avoid triggering the PDT Rule, be a sniper and meticulously plan your round trip trades carefully. In addition to monitoring support/resistance price levels with targets and triggers, you should also manage the allocation carefully in case some or part of the position might require an overnight hold. Prioritize which chart time frame is best suitable for the trade.

Scaling Into and or Out of Positions Separately

Rather than opening a position with one order, it may be more advantageous to consider scaling into the position with multiple orders on pullbacks. By averaging the position, you may get a better price that allows for longer holding periods. The PDT Rule applies only to round trips. Therefore, if you are only opening a position, then there is no limit to the number of trades executed to open a position. The same applies to closing a position. You can use multiple closing trades to average out the position closing price, as long as no shares were opened on the same day.

If you scale into a 900 share long position by executing three separate 300 share buy trade orders, this doesn’t qualify as a round trip. However, if you can close out the trade by selling 300 shares a piece with three separate sell orders, it would qualify as three round trip trades. In this situation, it would be best to close out all 900 shares in a single closing trade if executed on the same day. This would qualify as a single round trip, instead of three. As a rule of thumb, keep the scaling into a position separated by at least an overnight from scaling out of the position.

Swing Trading

Swing trading usually involves at least an overnight hold. Swing trade positions have smaller allocations than day trade positions due to the inherent risk associated with longer holding periods. Make sure you comfortable with this style, which requires more patience and temperament for larger trading price ranges.