What is Trade Management?

Trade management is the process of efficiently completing a trade sequence. This involves finding a set-up, determining allocation size and planning out the trade, then executing entry, monitoring and exits. Proper trade management results in minimizing losses and maximizing gains while integrating solid risk management techniques. Proper trade management can mean the difference between a profit and a loss, a minimal drawdown or an account blow out on the same stock pattern. Trade management requires discipline, knowledge of the underlying stock’s behavior and a solid trading methodology.

Common Struggles

The most common struggles with trade management revolve around entries and exits, which determines the outcome of the trade. Fear and greed are pivotal anchors that pull at the emotions of traders. In the absence of solid skill sets and experience, the emotions tend to dictate action at the worst possible times.

Mis-Timing Entries and Exits

The tangible outcomes of trade management can be measured with the quality of entries and exits. Late entries and exits are one of the most common problems. They are a result of a lack of confidence in the methodology and succumbing to emotions that finally compel the trader to take a hasty last-minute entry so they doesn’t miss out on any more potential profits. Unfortunately, lacking a momentum indicator like a stochastic, which gauges overbought and oversold conditions, a trader can easily chase an entry while it appears everyone wants in and then get stuck when the bids evaporate. Anticipating a shallow pullback, the trader will hold his position against the immediate price drops in anticipation of a strong reversal hoping for the resumption of upside momentum.

Unfortunately, without a momentum indicator that confirms the reversal, the trader is stuck like the proverbial “deer in the headlights” helplessly staring at his growing losses until the pain is too much and impusively panics out of his position, usually at the worst possible time. A few minutes later, the momentum indicator ‘bottoms’ out under the 20-band on peak volume indicating a capitulation. The trader is ‘worn out’ from the staggering loss and is in no condition to re-enter the trade when the stochastic bounces through the 20-band and finally reverses back up. In the meantime, the trader is overwhelmed in disbelief and doubt left with only the option to call it quits on the day or overleverage shares to try to make back losses, which likely results in deeper losses.

This illustration applies to late entries and late exits or early entries and late exits that result in losses. It also applies to early entries and early exits which result in minimal profits, that make the trader feel lousy for leaving the bulk of the profits on the table as the stock rockets much higher. The lack of knowledge, experience, capital and discipline are all factor contributing to the fallout from poor trade management.

Poor Share Size Allocations

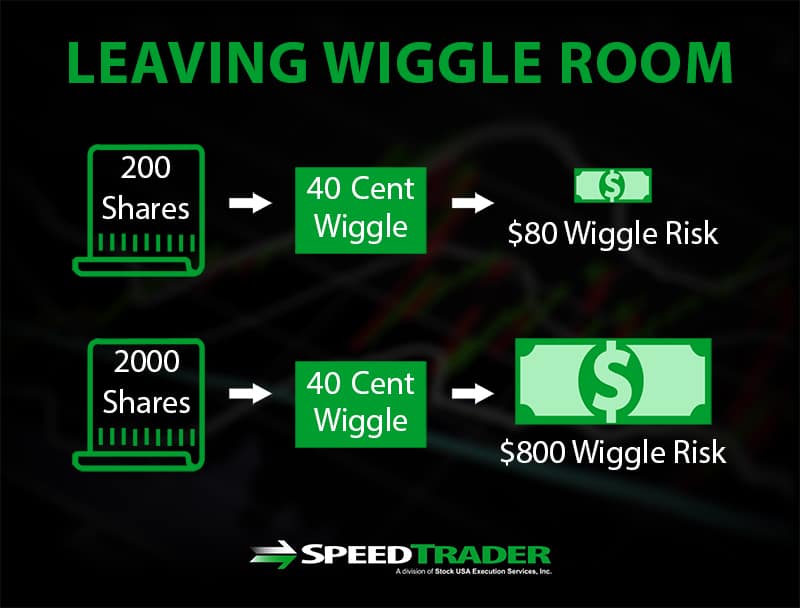

Another major struggle comes from over-leveraging position sizes. A 40-cent wiggle with 200 shares is much easier to stomach than 2,000 shares. Unfortunately, many traders only focus on the upside of heavier sized trades and then freeze when the same trade backfires on them.

As in the aforementioned example, while a trader may normally only trade 500 shares, but situations lead to desperation, the same trader may revenge trade with 5,000 shares to make back losses quickly. Unfortunately, these situations end up only compounding the losses quickly. Failing to recognize this malady in a timely manner can lead to account blow-ups quickly.

Trade Management Strategies

While having fluency with a solid trading methodology and the discipline to implement it is the top priority with trade management. Improving the execution factors can make an immediate material impact on trade results and improve trade management in the process. Here are some strategies that can augment your trade management implementation immediately.

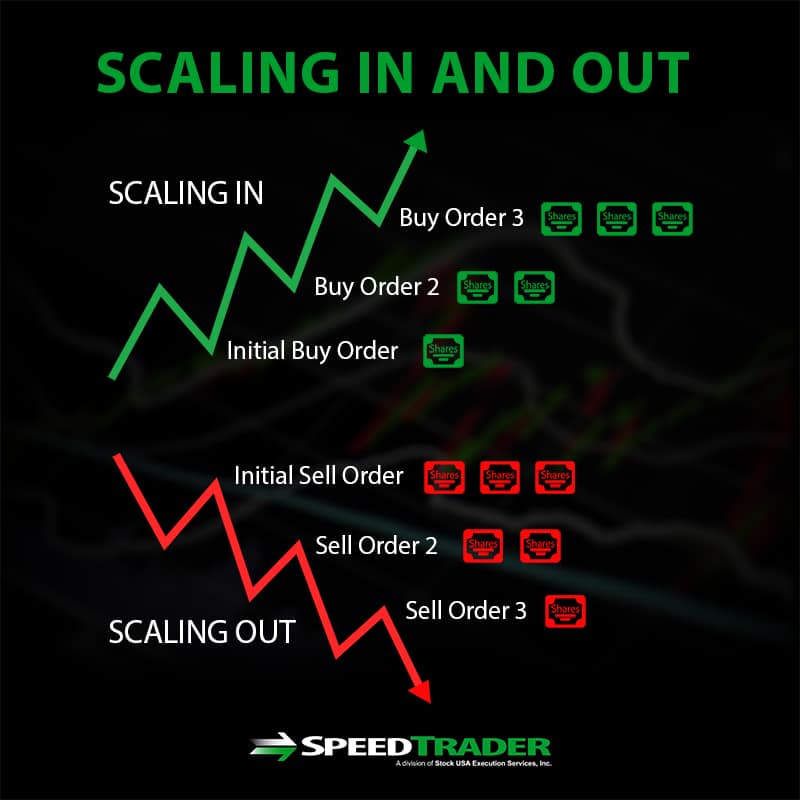

Scaling In and Out of Positions

Too often, traders tend to take their position in a single entry for fear of missing out on the full gains. This often backfires on late entries as the trader starts the position with a loss right off the bat. By integrating a scaling method for both entry and exit, the trader doesn’t have to rely solely on market timing and hoping for a decent entry.

Determine Total Position Size First

Scaling involves first determining the size of the position based on your conviction of the set-up, then breaking the size into several pieces that can help to improve your average price on the position. For example, if your goal is a 1,000-share position, then you may break up the size with limit orders or 400, 300 and 300 shares depending on how overbought the stock is at the momentum. This requires integrating a momentum indicator like a stochastic, MACD or RSI. By scaling into a trade, it buys you the time to also determine if the trade set-up is failing and allows for easier stop-losses and smaller drawdowns.

Scaling Provides Better Price, Fills and More Options

Scaling smaller pieces also results in quicker order fills without alerting the algorithms that may try to front-run larger orders. Scaling out of positions allows you to attain a higher average exit price (on long positions) as the position gets smaller, you may opt to ride the rest with the wider time frame trend.

Scaling shares requires a per-share pricing commission model from your online broker so that your commissions are not an influence and should never be an influence on how you manage the trade.

Integrate Trailing Stops

Traders naturally tend to focus soley on the potential upside of a trade while downplaying the possiblity of downside. This can result in getting blindsided when the set-up pattern fails or reverses sharply. Therefore, a trailing stop should always be integrated into the trade, preferrably manually but most platforms now also allow for automated trail stops. Trailing stops can be set for both profits and losses. The goal is to eliminate risk by eliminating the position, simple.

Price/Indicator-Based Stops

The size of the trailing stop should take into account the nominal wiggle room and the underlying support/resistance levels. For example, if a stock is uptrending with the 5-period simple moving average lagging 20-cents behind and tends to wiggle 10-cents, you could set a trailing stop at 15-cents below the 5-period moving average or if the 5-minute stochastic oscillation crosses back down. If you want to widen the trail stop to correlate with the 15-minute uptrend, then you could sell half of the position and extended the trail stop to 45-cents below the 5-period moving average. It pays to be familiar with the underlying stock and how much it tends to wiggle on different trending periods. Trailing stops must be strictly enforced and any delay can severely damage not only your account but also your psyche.

Offset Impulsive Actions with Patience to Game Liquidity

Markets are always trying to trigger either fear or greed. Patience is the antidote, but it must be administered carefully. Don’t always chase the offer price for entries and bids or exits when playing long positions. Practice placing limit orders on the bids to attain favorable pricing and ECN rebates. Practice selling positions on the offer into buyers. This exercise reinforces good execution habits and builds your intuition for gauging and managing liquidity. This is one of the most vital skill sets that seasoned traders attain. Liquidity is the most important factor that even overrides price.

Be Prudent on Sell Triggers

There are two reasons to exit a trade. It’s not based on profit or loss. It’s to eliminate risk because your management is faulty or the set-up is peaking/ or fizzling out. While this sounds negative, it’s actually a clinical way to describe stocks that are hitting maximum transparency or a paradigm shift in the trading climate. Whether the trade is profitable or not is not a sell trigger. While profit and loss may correlate with the two reasons, it shouldn’t be the sole reason. This is something that can be hard to understand, but the focus should always be on the process of the trade and not the outcome. Focusing on the process is what dictates the outcome, usually a foregone conclusion. When in doubt, get out.

Don’t Focus on P&L

The aforementioned can more easily be integrated by following the rule of not focusing on your Profit and Loss window. The focus should remain on the trade management of potential and current trades. This can be the hardest task because the usual goal of trading is to generate profits. It seems illogical not to focus on the end-goal, but that is the Catch-22. Traders who focus too much on profits, tend to make emotional decisions based on how their P&L will be affected rather than how apply tactical management to existing trades. For example, a P&L focused trader may freeze when a high probability pattern-set up reverses against him as he prays for his losses to be recovered on a recovery. A seasoned trader will spots the set-up eroding ahead of time and quickly exits the position and may even reverse the position in anticipation of the larger reversal move that forms from trapping complacent traders.

Accounting for Risk

This goes hand-on-hand with share size allocation. Quantify your dollar risk and be aware how much wiggle room you allot based on that initial risk value. The key is to avoid being blindsided emotionally and psychologically when the risk amount hits. Have an execution plan in mind should the risk amount trigger. Bottom line cut your losses quickly and don’t make excuses. If the set-up needs more time, then buy yourself the time by exiting the position and clearing your mind and exposure.

Take Smaller Position Sizes to Give You More Wiggle Room

This sounds obvious but your should be able to distinguish the difference between a smaller position trading range and larger position trading range. The range is identical but the impending value change needs to be understood. For example, a 200 share position can provide 50-cents of wiggle room for a $100 downside. This is equivalent to a 10-cent wiggle on 1,000 shares. It’s very common for traders to treat 200 shares as if it were 1,000 shares and kick themselves for taking a 10-cent profit for $20 rather than letting it run for a larger profit. This is the first step to scaling into and out of a position, bite-sized pieces.

Use Different Accounts for Different Types of Trades

Just like oil and water don’t mix, intra-day and swing trading don’t mix well when they are done through a single trading account. This is because it takes a different mindset and management for intra-day scalps, which require precision 1-minute chart integration for sharp concentrated scalps compared to multi-day swing trades which may use 60-minute charts for larger trend moves. It pays to have separate accounts for swing trades and intra-day trading. This is akin to simultaneously competing in a 40-yard dash and a 20-mile marathon. Most traders need the separation especially newbies to maintain the proper focus.

Limit The Number of Positions

It’s very tough to manage too many positions especially for intra-day trading. Try to limit the number of positions so that your attention is not diluted. Since stocks are correlated with benchmark indices, a sudden macro market move can simultaneously trigger sharp moves on all your positions. If you can’t simutaneously trade every position if the situation warrants it, then cut the number down.